- Introduction

- Understanding Forex Free Accounts

- Types of Forex Free Accounts

- Choosing the Right Forex Free Account

- Forex Free Account Trading Strategies

- Forex Free Account vs Funded Account

- Conclusion

-

FAQ about Forex Free Account

- What is a forex free account?

- What are the benefits of using a forex free account?

- What are the drawbacks of using a forex free account?

- Who is a forex free account suitable for?

- How do I open a forex free account?

- What are the terms and conditions of using a forex free account?

- Can I withdraw profits made from a forex free account?

- What happens if I lose money on a forex free account?

- How can I transition from a forex free account to a live trading account?

- What are some tips for using a forex free account?

Introduction

Hey readers,

Are you curious about the exciting world of forex trading but hesitant to take the plunge due to the potential risks involved? A forex free account can be the perfect solution for you. With this type of account, you can access the forex market without risking any of your own capital, allowing you to learn the ropes, develop strategies, and test out the waters before committing any real money.

In this comprehensive guide, we’ll delve into the world of forex free accounts, exploring their benefits, different types, and how to choose the best one for your needs. So, whether you’re a complete beginner or an experienced trader looking to test out a new strategy, read on to discover everything you need to know about forex free accounts.

Understanding Forex Free Accounts

What is a Forex Free Account?

A forex free account, also known as a demo account, is a simulated trading account that allows you to trade in real-time market conditions without risking any real money. Brokers provide these accounts to potential clients so they can get a feel for the trading platform, experiment with different strategies, and build their confidence before making real trades.

Benefits of Forex Free Accounts

- Risk-free environment: As mentioned earlier, the biggest advantage of a forex free account is that it allows you to trade without any financial risk. This means you can learn the ropes, make mistakes, and develop your skills without losing any real money.

- Practice and testing: Free accounts provide a safe and realistic environment where you can practice your trading skills, test out different strategies, and analyze the market before making real trades.

- Educational tool: Forex free accounts can be a valuable educational tool for beginners and experienced traders alike. They can provide access to educational resources, tutorials, and market analysis, helping you develop your knowledge and understanding of the forex market.

Types of Forex Free Accounts

Standard Demo Accounts

Standard demo accounts are the most common type of free account offered by brokers. They simulate live trading conditions, providing you with real-time market data, live quotes, and access to a variety of trading instruments. This type of account is ideal for beginners who want to learn the basics of forex trading or for experienced traders who want to test out new strategies.

Limited Time Demo Accounts

Limited time demo accounts are designed to provide a limited period of risk-free trading. Typically, these accounts expire within 30 or 90 days, after which you will need to open a funded account to continue trading. This type of account can be useful for short-term practice or experimenting with a specific strategy.

Contests and Promotions

Some brokers offer free demo accounts as part of contests or promotions. These contests often provide a larger virtual balance or special trading conditions for a limited period of time. Winning these contests can sometimes result in prizes or real money trading accounts.

Choosing the Right Forex Free Account

When choosing a forex free account, there are several factors to consider:

- Regulation and security: Ensure the broker you choose is regulated and licensed by a reputable financial authority, such as the FCA or SEC. This will provide you with peace of mind that your funds are safe and that the broker is conducting their operations in a transparent and fair manner.

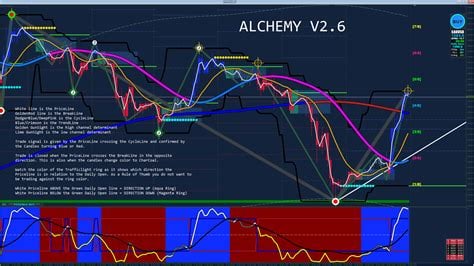

- Platform: Consider the trading platform offered by the broker. Is it user-friendly and easy to navigate? Does it provide the features and tools you need, such as charting tools, technical indicators, and order types?

- Customer support: Choose a broker that offers reliable and responsive customer support. You should be able to easily contact the broker with any questions or issues you may have.

- Educational resources: If you’re a beginner, look for brokers that provide educational resources, such as tutorials, webinars, and market analysis.

Forex Free Account Trading Strategies

Once you have chosen a forex free account, it’s time to start trading. Here are some strategies to consider:

Scalping

Scalping is a short-term trading strategy that involves entering and exiting trades within minutes or even seconds. Scalpers aim to profit from small price movements and capitalize on market volatility.

Day Trading

Day trading is a strategy that involves opening and closing trades within the same trading day. Day traders typically hold positions for a few hours or less and aim to profit from intraday price fluctuations.

Swing Trading

Swing trading is a medium-term strategy that involves holding positions for several days or even weeks. Swing traders aim to profit from market trends and take advantage of price swings.

Forex Free Account vs Funded Account

While forex free accounts provide a risk-free environment to practice and learn, it’s important to remember that they are not a substitute for funded accounts. Here are some key differences to keep in mind:

| Feature | Forex Free Account | Funded Account |

|---|---|---|

| Risk | No financial risk | Risk of losing real money |

| Capital | Virtual funds | Your own capital |

| Trading experience | Simulates live trading | Actual real-world trading |

| Psychology | Can foster overconfidence or reckless trading | Requires discipline and risk management |

| Education | Can be valuable for learning | Provides practical experience in real-time market conditions |

Conclusion

Forex free accounts are a valuable resource for anyone interested in trading forex. They provide a risk-free environment to learn, practice, and develop strategies before committing any real money. By carefully choosing a broker and selecting a trading strategy that suits your risk tolerance and trading style, you can maximize the benefits of forex free accounts and set yourself up for success when you eventually transition to live trading.

We hope this guide has provided you with the information you need to get started with forex free accounts. If you’re interested in learning more about forex trading or exploring other educational resources, be sure to check out our website for a wealth of articles, tutorials, and market analysis.

FAQ about Forex Free Account

What is a forex free account?

A forex free account is a type of account offered by some forex brokers that allows traders to trade forex without risking any of their own capital. These accounts are typically funded with virtual money, and any profits or losses made are not real.

What are the benefits of using a forex free account?

Using a forex free account can provide a number of benefits, including:

- The ability to learn how to trade forex without risking any real money.

- The opportunity to test out different trading strategies and see how they perform.

- A safe environment to practice trading without the pressure of losing real money.

What are the drawbacks of using a forex free account?

There are also some drawbacks to using a forex free account, including:

- The trades made on a free account are not real, so the profits or losses made are not real either.

- Free accounts often have limited functionality, and may not offer all of the same features as a real account.

- The trading conditions on a free account may be different than the conditions on a real account, which can make it difficult to transition to live trading.

Who is a forex free account suitable for?

Forex free accounts are suitable for a variety of traders, including:

- Beginners who want to learn how to trade forex without risking any real money.

- Experienced traders who want to test out new trading strategies.

- Traders who want to practice trading without the pressure of losing real money.

How do I open a forex free account?

Opening a forex free account is easy. Simply visit the website of a forex broker that offers free accounts and create an account. You will typically be required to provide some basic information, such as your name, email address, and phone number.

What are the terms and conditions of using a forex free account?

The terms and conditions of using a forex free account will vary depending on the broker. Be sure to read the terms and conditions carefully before opening an account.

Can I withdraw profits made from a forex free account?

No, you cannot withdraw profits made from a forex free account. The funds in a free account are not real, so any profits made are not real either.

What happens if I lose money on a forex free account?

If you lose money on a forex free account, the funds will simply be reset to the initial balance. You will not lose any real money.

How can I transition from a forex free account to a live trading account?

Once you have gained some experience trading on a free account, you can transition to a live trading account by making a deposit. Be sure to choose a broker that offers a live trading account that meets your needs.

What are some tips for using a forex free account?

Here are a few tips for using a forex free account:

- Use the free account to learn the basics of forex trading.

- Experiment with different trading strategies.

- Practice risk management.

- Set realistic expectations.