- Introduction

- What is Forex Free System Trading?

- Benefits of Forex Free System Trading

- Types of Forex Free System Trading

- How to Choose a Forex Free System Trading?

- Other Aspects of Forex Free System Trading

- Conclusion

-

FAQ about Forex Free System Trading

- What is forex free system trading?

- How do forex free system trading work?

- Are forex free system trading profitable?

- What are the benefits of using forex free system trading?

- What are the risks of forex free system trading?

- How to choose a reliable forex free system trading?

- How to use forex free system trading effectively?

- What are the limitations of forex free system trading?

- What are the alternatives to forex free system trading?

- Are forex free system trading scams?

Introduction

Greetings, readers! Welcome to the definitive guide to forex free system trading. In this article, we’ll dive deep into the world of automated trading systems, exploring their benefits, risks, and how to find the right one for your needs. Whether you’re a seasoned trader or just starting your journey, this comprehensive guide will equip you with the knowledge and tools to navigate the exciting and potentially lucrative world of forex free system trading.

What is Forex Free System Trading?

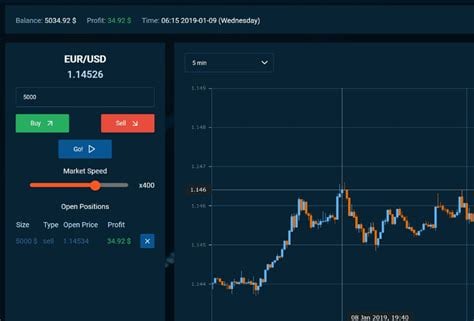

Forex free system trading involves using software or algorithms to automate your trading decisions. These systems are designed to analyze market data, identify trading opportunities, and execute trades without human intervention. By eliminating emotions and biases from the trading process, forex free system trading can potentially improve profitability and reduce risk.

Benefits of Forex Free System Trading

Enhanced Discipline and Consistency

Forex free system trading removes the human element from the trading decision-making process, ensuring discipline and consistency in execution. Automated systems follow pre-defined rules and strategies, reducing the risk of emotional trading and impulsive decisions.

Automated Risk Management

Forex free system trading allows you to set specific risk parameters, such as stop-loss and take-profit levels. This automation ensures that trades are closed at predetermined levels, limiting potential losses and protecting your capital.

Types of Forex Free System Trading

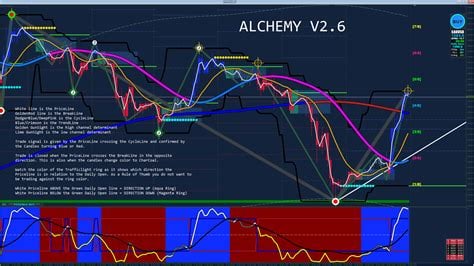

Indicator-Based Systems

Indicator-based systems use technical indicators to generate trading signals. These indicators are typically mathematical formulas that measure market trends, momentum, and volatility.

Rule-Based Systems

Rule-based systems rely on a set of predefined rules to determine trading decisions. These rules can be based on any combination of market data, such as price, volume, or time.

How to Choose a Forex Free System Trading?

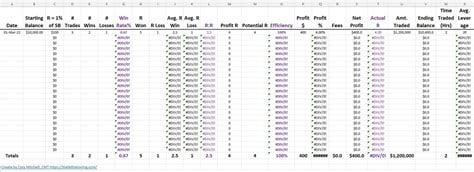

Evaluate Performance History

Before selecting a forex free system trading, it’s crucial to evaluate its historical performance. Look for systems with consistent profitability over a reasonable period of time.

Analyze Trading Parameters

Understand the trading parameters of the system, including its indicators or rules, risk management settings, and profit targets. Ensure that these parameters align with your trading strategy and risk tolerance.

Other Aspects of Forex Free System Trading

Backtesting and Optimization

Backtesting involves testing a trading system on historical data to assess its performance. Optimization involves refining the system’s parameters to improve its profitability.

Monitoring and Maintenance

Once you have selected a forex free system trading, it’s important to monitor its performance regularly and make necessary adjustments. This includes ensuring that the system is functioning properly and that its parameters remain relevant to market conditions.

Conclusion

Forex free system trading offers a unique opportunity to automate your trading decisions, enhance your discipline, and potentially improve your profitability. By carefully evaluating the benefits, risks, and different types of systems available, you can choose the right system for your needs. Remember to backtest, optimize, and monitor your system regularly to ensure its continued success.

We invite you to explore our other articles for more insights into forex free system trading and other topics related to successful trading.

FAQ about Forex Free System Trading

What is forex free system trading?

Forex free system trading refers to automated trading systems that are available at no cost.

How do forex free system trading work?

These systems use algorithms to analyze market data and generate trading signals.

Are forex free system trading profitable?

Profitability depends on factors such as the system’s accuracy, market conditions, and risk management.

What are the benefits of using forex free system trading?

They offer convenience, reduced emotional trading, and potential profit opportunities.

What are the risks of forex free system trading?

There are risks of losses, system failures, and the need for ongoing monitoring.

How to choose a reliable forex free system trading?

Look for systems with proven track records, positive user reviews, and clear trading rules.

How to use forex free system trading effectively?

Follow the system’s trading signals, manage risk, and monitor performance regularly.

What are the limitations of forex free system trading?

They may not be suitable for all traders, require discipline, and may have limited customization options.

What are the alternatives to forex free system trading?

Traders can consider manual trading, copy trading, or using paid forex trading systems.

Are forex free system trading scams?

While not all systems are scams, it’s important to research and be wary of unrealistic claims or high-pressure sales tactics.