- Forex Gain Capital: A Comprehensive Guide for Traders of All Levels

- The Essence of Forex Gain Capital

- Maximizing Forex Gain Capital

- Understanding Forex Gain Capital: A Breakdown

- Strategies for Enhancing Forex Gain Capital

- Conclusion

-

FAQ about Forex Gain Capital

- What is forex gain capital?

- What is the difference between spot and forward forex?

- What are pips and lots?

- What is leverage and how does it work?

- What is margin trading?

- What factors affect forex prices?

- What is technical analysis?

- What is fundamental analysis?

- What are the risks of forex trading?

- How do I get started with forex trading?

Forex Gain Capital: A Comprehensive Guide for Traders of All Levels

Introduction

Greetings, readers! Welcome to our in-depth exploration of forex gain capital, a crucial concept for traders in the ever-evolving foreign exchange market. In this article, we’ll delve into the intricacies of forex gain capital, covering its calculation, key factors affecting it, and the various strategies traders can employ to maximize their profits.

We understand that navigating the world of forex trading can be daunting, especially for beginners. That’s why we’ve crafted this article with a relaxed writing style, ensuring it’s accessible to traders of all experience levels. Let’s embark on this journey of financial enlightenment together!

The Essence of Forex Gain Capital

Forex gain capital, also known as profit, is the difference between the buying and selling price of a currency pair multiplied by the number of units traded. Traders may have short-term or long-term objectives, but at the heart of their trading pursuits lies the ultimate goal of generating positive forex gain capital.

Several factors influence forex gain capital, including market sentiment, economic indicators, political events, and supply and demand dynamics. Traders must remain vigilant in monitoring these factors and leveraging them to make informed trading decisions.

Maximizing Forex Gain Capital

While there is no foolproof recipe for success in forex trading, employing the right strategies can significantly improve your chances of reaping substantial forex gain capital. Here are a few effective approaches:

Technical Analysis

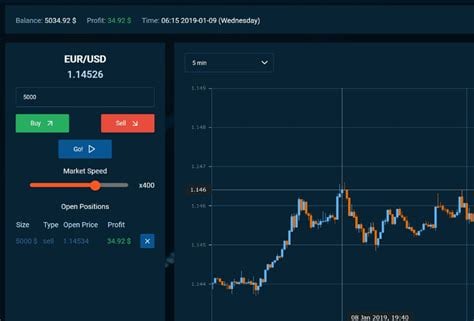

Technical analysis involves studying historical price charts and patterns to identify potential trading opportunities. Traders use indicators, such as moving averages, trendlines, and support and resistance levels, to forecast price movements and make informed entry and exit decisions.

Fundamental Analysis

Fundamental analysis focuses on the underlying economic and political factors that drive currency prices. Traders study macroeconomic data, such as GDP growth, interest rates, and inflation, to assess the overall health of an economy and its currency’s potential value.

Risk Management

Effective risk management is paramount in maintaining trading capital and securing future forex gain capital. Traders should determine their risk tolerance, use stop-loss orders to limit potential losses, and diversify their portfolio to mitigate risks.

Understanding Forex Gain Capital: A Breakdown

The following table provides a detailed breakdown of forex gain capital:

| Calculation | Description |

|---|---|

| Gain Capital | Buy Price – Sell Price x Number of Units |

| Profit | Positive Gain Capital |

| Loss | Negative Gain Capital |

| Pips | The smallest unit of price movement in a currency pair |

| Leverage | The use of borrowed capital to increase trading exposure |

| Currency Pairs | Forex trading involves the exchange of one currency for another, such as EUR/USD or GBP/JPY |

Strategies for Enhancing Forex Gain Capital

Beyond the fundamental principles, let’s explore some advanced strategies for enhancing forex gain capital:

Scalping

Scalping involves executing numerous small trades within a short period, aiming to profit from minor price fluctuations. Scalpers rely on technical analysis to identify quick trading opportunities and capitalize on market volatility.

News Trading

News trading involves taking advantage of market reactions to major news events. Traders monitor news releases and economic data to identify potential opportunities for short-term gains or losses.

Counter-Trend Trading

Counter-trend trading involves trading against the prevailing market trend, typically when the market is overextended or shows signs of reversal. Traders seek to profit by identifying potential trend reversals and entering into positions in anticipation of a market shift.

Conclusion

Forex gain capital is the lifeblood of any successful trader. By understanding the concepts, employing effective strategies, and implementing sound risk management practices, you can navigate the complexities of the forex market with confidence and maximize your potential for profit.

We invite you to explore our other articles for further insights into forex trading, technical analysis, and risk management. Together, let’s conquer the financial markets and achieve your trading goals.

FAQ about Forex Gain Capital

What is forex gain capital?

Forex gain capital refers to the profit or loss made when trading currencies in the foreign exchange market.

What is the difference between spot and forward forex?

Spot forex involves the immediate exchange of currencies, while forward forex involves an agreement to exchange currencies at a specified rate in the future.

What are pips and lots?

Pips (points in percentage) measure the change in the value of a currency pair. A lot represents a standard trading unit, typically 100,000 units of a base currency.

What is leverage and how does it work?

Leverage allows traders to control a larger amount of capital than they have on hand. It amplifies both potential profits and losses.

What is margin trading?

Margin trading is a form of leveraged trading where traders borrow money from their brokerage to amplify their trades.

What factors affect forex prices?

Economic data, political events, supply and demand, and interest rates can all impact forex prices.

What is technical analysis?

Technical analysis uses historical price data to identify potential trading opportunities and forecast future prices.

What is fundamental analysis?

Fundamental analysis examines economic and financial factors to determine the intrinsic value of currencies.

What are the risks of forex trading?

Forex trading involves high risk, including the potential for significant losses, volatility, and liquidity issues.

How do I get started with forex trading?

To start trading forex, you need to open an account with a forex broker, fund it, and develop a trading strategy.