- Forex Leverage Brokers: A Guide for the Savvy Trader

- What is a Forex Leverage Broker?

- Choosing the Right Forex Leverage Broker

- Leveraging Forex Effectively

- Forex Leverage Broker Comparison Table

- Conclusion

-

FAQ about Forex Leverage Brokers

- What is forex leverage?

- How does forex leverage work?

- What are the benefits of using leverage?

- What are the risks of using leverage?

- What is margin call?

- How to choose the right leverage for you?

- Is forex leverage legal?

- What is the difference between fixed and floating leverage?

- How to calculate leverage?

- What is the minimum leverage offered by forex brokers?

Forex Leverage Brokers: A Guide for the Savvy Trader

Introduction: Hello, Readers!

Welcome, readers, to our comprehensive guide to forex leverage brokers. In the dynamic world of forex trading, selecting the right broker with the appropriate leverage options can significantly amplify your profit potential. Throughout this article, we’ll delve into the intricacies of forex leverage brokers, highlighting key aspects to consider and empowering you to make informed decisions.

Leverage is a double-edged sword. While it can magnify your gains, it also augments potential losses. Therefore, understanding leverage and its implications is crucial for successful trading.

What is a Forex Leverage Broker?

Definition

Forex leverage brokers are brokerage firms that grant traders access to borrowed capital to enhance their trading power. This borrowed capital, known as leverage, enables traders to control a larger position than their account balance would normally allow.

Advantages

- Magnified profits: Leverage multiplies both profits and losses, potentially boosting returns.

- Increased trading flexibility: Traders can allocate a smaller portion of their capital to each trade, allowing them to diversify their portfolio and capitalize on multiple opportunities.

- Reduced transaction costs: By trading with larger positions, traders can spread their transaction costs over a broader base, potentially lowering their overall expenses.

Choosing the Right Forex Leverage Broker

Factors to Consider

- Regulation: Ensure your broker is regulated by reputable authorities such as the FCA, CySEC, or ASIC.

- Leverage options: Assess the leverage ratios offered by the broker and select one that suits your risk tolerance and trading style.

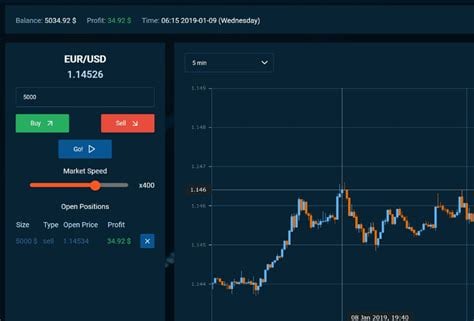

- Trading platform: Evaluate the trading platform’s functionality, user-friendliness, and availability of trading tools.

- Customer support: Reliable and responsive customer support is essential for resolving queries and ensuring a smooth trading experience.

Leveraging Forex Effectively

Managing Risk

Leverage is a powerful tool, but it must be handled responsibly. To mitigate risks:

- Set appropriate leverage ratios: Determine and adhere to a leverage level that aligns with your risk tolerance and trading strategy.

- Use stop-loss orders: Establish pre-determined exit points to limit potential losses.

- Monitor market conditions: Stay abreast of economic news, geopolitical events, and market volatility to make informed decisions.

Advanced Techniques

- Position sizing: Calculate the optimal position size based on your account balance, leverage ratio, and risk tolerance.

- Scalping: Execute numerous small-profit trades over short timeframes, leveraging the power of compound interest.

- Hedging: Create offsetting positions to mitigate the risks associated with market fluctuations.

Forex Leverage Broker Comparison Table

| Broker | Leverage Ratio | Trading Platform | Regulation |

|---|---|---|---|

| AxiTrader | Up to 1:400 | MetaTrader 4/5 | FCA |

| XM | Up to 1:888 | MetaTrader 4/5 | CySEC |

| IC Markets | Up to 1:500 | MetaTrader 4/5, cTrader | ASIC |

| Pepperstone | Up to 1:500 | MetaTrader 4/5, cTrader | FCA |

| Oanda | Up to 1:50 | Proprietary platform | FCA |

Conclusion

Understanding forex leverage brokers is paramount for successful trading in the currency markets. By carefully selecting the right broker, implementing effective risk management strategies, and leveraging advanced techniques, traders can harness the power of leverage to amplify their profits while mitigating potential losses.

We encourage you to explore our other articles for further insights into forex trading and financial matters. Stay informed, trade wisely, and unlock the full potential of forex leveraging.

FAQ about Forex Leverage Brokers

What is forex leverage?

Forex leverage allows traders to control a larger position size than their account balance. It’s expressed as a ratio, e.g., 100:1 or 500:1.

How does forex leverage work?

Leverage multiplies your account balance. For example, with 100:1 leverage, a $1,000 balance lets you trade up to $100,000 worth of currency.

What are the benefits of using leverage?

Leverage can magnify profits and reduce the need for large capital. It allows traders to enter larger positions and potentially earn higher returns.

What are the risks of using leverage?

Leverage can also magnify losses. If the market moves against you, you could lose more than your initial investment.

What is margin call?

A margin call occurs when your account balance falls below a certain level, triggering the need to add more funds or close positions.

How to choose the right leverage for you?

Consider your risk tolerance, trading experience, and account balance. Higher leverage increases risk but also potential profits.

Is forex leverage legal?

Yes, leverage is legal in most countries but regulated to protect traders. Some jurisdictions may have restrictions on the maximum leverage allowed.

What is the difference between fixed and floating leverage?

Fixed leverage remains constant, while floating leverage changes based on factors such as market volatility and account balance.

How to calculate leverage?

Divide the position size by the account balance. For instance, if you trade $100,000 with a $1,000 balance, your leverage is 100:1.

What is the minimum leverage offered by forex brokers?

The minimum leverage offered can vary depending on the broker. It’s typically in the range of 10:1 to 50:1 for retail traders.