- Forex List Brokers: A Comprehensive Guide for Traders

- Section 1: Navigating the Forex Landscape

- Section 2: Choosing the Right Forex List Broker

- Section 3: The Benefits of Using a Forex List Broker

- Section 4: A Comprehensive Comparison Table

- Conclusion

-

FAQ about Forex List Brokers

- What is a forex list broker?

- How does a forex list broker differ from a regular forex broker?

- What are the benefits of using a forex list broker?

- What are the risks of using a forex list broker?

- How can I choose a reputable forex list broker?

- What is the minimum deposit required to start trading with a forex list broker?

- What trading platforms are supported by forex list brokers?

- Can I trade both forex and CFDs with a forex list broker?

- Are there any fees associated with using a forex list broker?

- What is the best way to compare forex list brokers?

Forex List Brokers: A Comprehensive Guide for Traders

Introduction

Hey readers,

In the world of finance, foreign exchange (forex) trading has emerged as a lucrative and dynamic market. To navigate this complex terrain, it’s essential to find a reliable forex list broker that aligns with your trading needs. This article delves into the intricacies of forex list brokers, empowering you with the knowledge to make informed decisions and maximize your trading potential.

By providing a comprehensive overview, discussing key aspects to consider, and comparing different brokers, we aim to equip you with the tools to select the right forex list broker for your individual requirements. So, buckle up and let’s dive into the exciting realm of forex list brokers.

Section 1: Navigating the Forex Landscape

Understanding Forex Brokers

At the heart of forex trading lies the forex broker, acting as an intermediary between traders and the global foreign exchange market. They facilitate currency exchange, provide access to trading platforms, and offer a range of services to support traders. Choosing the most suitable forex list broker is paramount to success in this competitive market.

Types of Forex Brokers

To cater to diverse trading styles and preferences, different types of forex list brokers exist. Understanding these variations is crucial for selecting the right fit. From commission-based brokers, who charge a flat fee per trade, to spread-based brokers, who make a profit from the difference between bid and ask prices, choosing the most appropriate structure depends on your trading strategy and volume.

Section 2: Choosing the Right Forex List Broker

Key Considerations

When selecting a forex list broker, considering several key factors is vital. These include:

- Regulation and Licensing: Opt for brokers regulated and licensed by reputable authorities to ensure compliance and trustworthiness.

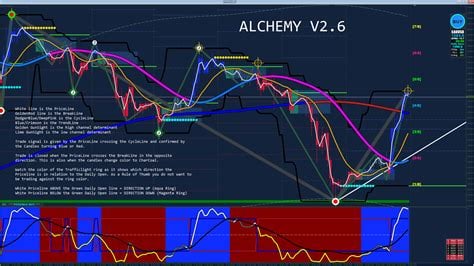

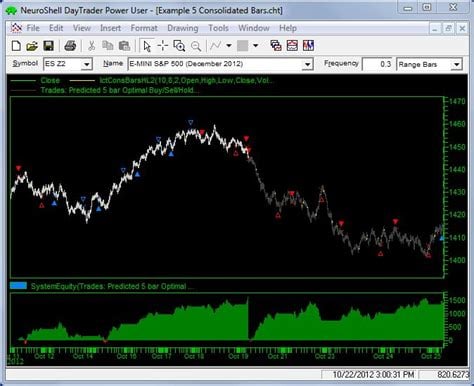

- Trading Platform: Explore different trading platforms offered by brokers and choose one that aligns with your trading style, ease of use, and desired features.

- Spreads and Commissions: Compare spreads and commission fees charged by brokers to determine the cost-effectiveness of their services.

- Customer Support: In the fast-paced forex market, reliable customer support is critical. Ensure your chosen broker offers prompt and knowledgeable support through multiple channels.

Comparing Forex Brokers

To make an informed decision, comparing different forex list brokers is essential. Evaluate their strengths and weaknesses based on the criteria mentioned above. Scrutinize their trading conditions, bonuses and promotions, and overall reputation among traders.

Section 3: The Benefits of Using a Forex List Broker

Enhanced Access to Markets

Forex list brokers provide traders with direct access to the global foreign exchange market, enabling them to trade currencies from around the world. This access to multiple currency pairs expands trading opportunities and allows traders to diversify their portfolios.

Reduced Risk and Leverage

Leverage, a feature offered by many forex list brokers, allows traders to control a larger position with a smaller amount of capital. While this can amplify profits, it also magnifies potential losses. Choosing a broker that offers appropriate leverage options is crucial for managing risk effectively.

Professional Support and Education

Reputable forex list brokers offer educational resources, market analysis, and personalized support to enhance their clients’ trading skills and knowledge. This guidance can empower traders to make informed decisions and navigate the complex forex market confidently.

Section 4: A Comprehensive Comparison Table

Forex Broker Comparison

| Broker | Regulation | Trading Platform | Spreads | Commissions | Customer Support |

|---|---|---|---|---|---|

| AvaTrade | FCA, ASIC | MetaTrader 4/5 | From 0.9 pips | From $0 per lot | 24/7 Support |

| XM | CySEC, FCA | MetaTrader 4/5 | From 1.0 pip | Zero | 24/7 Support |

| eToro | FCA, ASIC | Proprietary Platform | From 1.0 pip | Zero | 24/5 Support |

| IC Markets | ASIC, CySEC | MetaTrader 4/5, cTrader | From 0.0 pips | From $3.50 per lot | 24/5 Support |

| Pepperstone | ASIC, FCA | MetaTrader 4/5, cTrader | From 1.0 pip | From $7 per lot | 24/7 Support |

Conclusion

Choosing the right forex list broker is an integral part of successful forex trading. By understanding the different aspects discussed in this article, you can make an informed decision that aligns with your trading goals and requirements.

To delve deeper into the world of forex trading, feel free to explore our other articles on:

- Forex Trading Strategies

- Forex Market Analysis

- Forex Risk Management

We hope this comprehensive guide has empowered you with the knowledge and confidence to navigate the forex market with the support of a reputable forex list broker. Remember, the path to trading success lies in continuous learning, adaptability, and a strategic approach.

FAQ about Forex List Brokers

What is a forex list broker?

A forex list broker acts as an intermediary between traders and the various liquidity providers in the retail foreign exchange market.

How does a forex list broker differ from a regular forex broker?

Forex list brokers usually offer a wider selection of brokers and trading conditions than regular forex brokers.

What are the benefits of using a forex list broker?

Using a forex list broker can provide traders with access to better trading conditions, such as lower spreads and commissions, and a wider range of trading instruments.

What are the risks of using a forex list broker?

Forex list brokers may not be as regulated as regular forex brokers, and there is the risk of fraud or scams.

How can I choose a reputable forex list broker?

Always conduct thorough research on the broker’s reputation, regulatory status, and trading conditions before choosing one.

What is the minimum deposit required to start trading with a forex list broker?

The minimum deposit required will vary depending on the forex list broker, but it is typically between $100 and $500.

What trading platforms are supported by forex list brokers?

Forex list brokers usually support multiple trading platforms, such as MetaTrader 4, MetaTrader 5, and cTrader.

Can I trade both forex and CFDs with a forex list broker?

Yes, most forex list brokers offer trading on both forex and CFDs on various underlying assets.

Are there any fees associated with using a forex list broker?

Forex list brokers may charge fees for certain services, such as spreads, commissions, or inactivity fees.

What is the best way to compare forex list brokers?

Use a comparison tool or website that allows you to filter and compare different forex list brokers based on various criteria, such as trading conditions, fees, and customer support.