- Forex Lowest Spread Brokers: A Comprehensive Guide to Finding the Best Deals

- Types of Forex Spreads

- How to Compare Forex Brokers

- How to Find the Lowest Spread Broker

- Forex Lowest Spread Brokers Table

- Conclusion

-

FAQ About Forex Lowest Spread Broker

- What is a forex spread?

- What is a low spread broker?

- Why is it important to use a low spread broker?

- What are the benefits of using a low spread broker?

- How do I find a low spread broker?

- What should I look for when choosing a low spread broker?

- How can I take advantage of low spreads?

- What are the risks of using a low spread broker?

- What are some of the best low spread brokers?

Forex Lowest Spread Brokers: A Comprehensive Guide to Finding the Best Deals

Introduction

Hey readers,

Are you looking to venture into the world of forex trading? If so, one of the most important factors to consider is the spread offered by your broker. The spread is the difference between the bid and ask prices of a currency pair, and it can have a significant impact on your profitability.

In this guide, we’ll delve into everything you need to know about forex spreads. We’ll discuss the different types of spreads, how to compare brokers, and how to find the lowest spread broker for your needs.

Types of Forex Spreads

There are two main types of forex spreads: fixed spreads and variable spreads.

Fixed spreads are set by the broker and remain the same regardless of market conditions. This can provide peace of mind, as you know exactly how much you’ll be paying in spread costs. However, fixed spreads can be higher than variable spreads, especially during periods of high volatility.

Variable spreads fluctuate with market conditions. They are typically lower than fixed spreads, but they can be more unpredictable. This can make it difficult to budget for spread costs.

How to Compare Forex Brokers

When comparing forex brokers, it’s important to consider the following factors:

- Spread: As we mentioned before, this is one of the most important factors to consider. Be sure to compare the spreads offered by different brokers on the currency pairs you trade most frequently.

- Commission: Some brokers charge a commission on each trade. This can add to your trading costs, so be sure to factor it in when comparing brokers.

- Minimum deposit: This is the minimum amount of money you need to deposit into your account to start trading. Be sure to choose a broker with a minimum deposit that fits your budget.

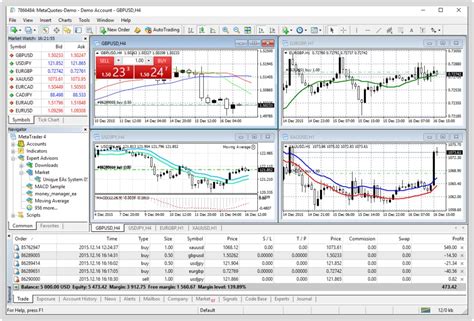

- Platform: The platform you use to trade forex can have a big impact on your trading experience. Be sure to choose a broker that offers a platform that is user-friendly and meets your needs.

- Customer support: It’s important to have access to reliable customer support in case you have any questions or problems. Be sure to choose a broker that offers 24/7 customer support.

How to Find the Lowest Spread Broker

Once you’ve considered the factors above, you can start shopping for the lowest spread broker. Here are a few tips:

- Use a forex broker comparison website. These websites allow you to compare the spreads offered by different brokers on a variety of currency pairs.

- Read online reviews. Other traders can provide valuable insights into the spreads and services offered by different brokers.

- Open a demo account. This will allow you to test out a broker’s platform and spreads without risking any real money.

Forex Lowest Spread Brokers Table

| Broker | Fixed Spread | Variable Spread | Commission |

|---|---|---|---|

| IC Markets | 0.0 pips | 0.1 pips | $7 per lot |

| FxPro | 0.1 pips | 0.2 pips | $6 per lot |

| Pepperstone | 0.1 pips | 0.2 pips | $5 per lot |

| Oanda | 0.1 pips | 0.2 pips | $4 per lot |

| XM | 0.1 pips | 0.2 pips | $3 per lot |

Conclusion

Finding the lowest spread broker can save you a significant amount of money in trading costs. By following the tips in this guide, you can find a broker that offers the spreads you need at a price you can afford.

Be sure to check out our other articles for more tips on forex trading.

FAQ About Forex Lowest Spread Broker

What is a forex spread?

The spread is the difference between the bid and ask prices of a currency pair. The bid price is the price at which you can sell the currency pair, while the ask price is the price at which you can buy it.

What is a low spread broker?

A low spread broker is a broker that offers tight spreads on its currency pairs. This means that you will pay less in trading costs when you trade with a low spread broker.

Why is it important to use a low spread broker?

Using a low spread broker can save you money on your trading costs. The tighter the spread, the less you will pay in trading fees.

What are the benefits of using a low spread broker?

There are several benefits to using a low spread broker, including:

- Lower trading costs

- Increased profitability

- Improved risk management

How do I find a low spread broker?

There are several ways to find a low spread broker, including:

- Comparing spreads between different brokers

- Reading broker reviews

- Checking out broker comparison websites

What should I look for when choosing a low spread broker?

When choosing a low spread broker, you should consider the following factors:

- The broker’s reputation

- The broker’s trading platform

- The broker’s customer service

- The broker’s fees

How can I take advantage of low spreads?

There are several ways to take advantage of low spreads, including:

- Trading during low-volatility periods

- Trading in high-liquidity currency pairs

- Using a scalping trading strategy

What are the risks of using a low spread broker?

There are some risks associated with using a low spread broker, including:

- The broker may not be regulated

- The broker may not be reliable

- The broker may charge hidden fees

What are some of the best low spread brokers?

Some of the best low spread brokers include:

- FxPro

- IC Markets

- Pepperstone

- Oanda

- XM