- Introduction

- Understanding Forex Stocks Brokers

- Types of Forex Stocks Brokers

- Choosing a Forex Stocks Broker

- Benefits of Using a Forex Stocks Broker

- Forex Stocks Brokers Comparison Table

- Conclusion

-

FAQ about Forex Stocks Broker

- What is forex?

- What is a forex stock broker?

- How do I choose a forex stock broker?

- What are the risks of trading forex?

- How can I reduce the risks of trading forex?

- What are the benefits of trading forex?

- What are some tips for successful forex trading?

- What are the most common mistakes that forex traders make?

- How do I get started with forex trading?

Introduction

Greetings, readers! Welcome to our comprehensive guide to forex stocks brokers. In today’s fast-paced financial world, it’s crucial to have a deep understanding of the forex and stock markets. This article will provide you with all the necessary information to make informed decisions when choosing a forex stocks broker.

Our aim is not only to educate you but also to simplify the complex world of forex stocks trading. We’ll cover everything from the basics to advanced trading strategies, so you can gain confidence and success in your trading endeavors. So, grab a cup of coffee, sit back, and let’s dive into the world of forex stocks brokers.

Understanding Forex Stocks Brokers

Forex Brokers

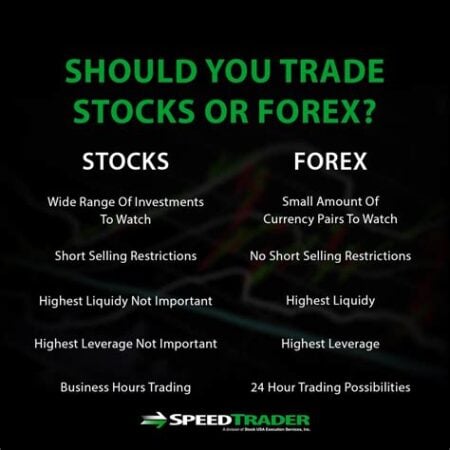

Forex brokers facilitate the trading of currencies by connecting buyers and sellers on the foreign exchange market. They provide a trading platform where traders can execute orders, manage risk, and access market analysis. Forex brokers typically charge commissions or spreads on each trade.

Stock Brokers

Stock brokers, on the other hand, assist investors in buying and selling stocks on various stock exchanges. They offer a wide range of services, including order execution, portfolio management, and investment advice. Stock brokers may charge fixed commissions or percentage-based fees on trades.

Types of Forex Stocks Brokers

Full-Service Brokers

Full-service brokers offer a comprehensive suite of services, including personalized investment advice, portfolio management, and access to research and analysis tools. These brokers typically charge higher fees but provide a tailored experience.

Discount Brokers

Discount brokers focus on providing low-cost trading platforms and basic services. They charge minimal commissions or fees and often cater to self-directed traders who manage their own portfolios.

Online Brokers

Online brokers offer user-friendly trading platforms that can be accessed from anywhere with an internet connection. They provide a range of services and fee structures, making them suitable for both beginners and experienced traders.

Choosing a Forex Stocks Broker

Consider Your Trading Style

Identify your trading style and risk tolerance before choosing a broker. If you prefer active trading with high leverage, a broker with low spreads and commissions is ideal. For long-term investors, a full-service broker with comprehensive research and advice may be more suitable.

Check Regulation and Reputation

Ensure that the broker you choose is regulated by a reputable financial authority, such as the FCA or SEC. This provides protection against fraud and misconduct. Also, research online reviews and testimonials to gauge the broker’s reputation.

Examine Trading Platform

The trading platform is your gateway to the markets. Choose a platform that is user-friendly, intuitive, and provides the features and tools you need for effective trading. Consider the platform’s charting capabilities, order execution speed, and mobile compatibility.

Fees and Commissions

Compare the fees and commissions charged by different brokers. These costs can impact your profitability, especially for active traders. Consider both the upfront costs and any ongoing fees.

Benefits of Using a Forex Stocks Broker

Access to Global Markets

Forex stocks brokers provide access to a vast range of markets, allowing you to trade stocks and currencies from around the world. This diversification can help you mitigate risk and enhance your returns.

Leverage and Margin Trading

Brokers may offer leverage, which allows you to trade with more capital than you have in your account. This can amplify your potential profits but also increase your risk. Margin trading involves borrowing funds from the broker and using them to trade.

Education and Resources

Many forex stocks brokers offer educational resources, webinars, and trading tools to help you improve your knowledge and skills. These resources can empower you to make informed decisions and improve your trading performance.

Forex Stocks Brokers Comparison Table

| Feature | Full-Service Brokers | Discount Brokers | Online Brokers |

|---|---|---|---|

| Services | Personalized advice, portfolio management, research | Low-cost trading, basic services | User-friendly platforms, range of services |

| Fees | Higher fees, commissions | Low commissions, fixed fees | Variable fees, low-cost options |

| Platform | Comprehensive trading platforms | Basic platforms, limited tools | Advanced platforms with mobile access |

| Suitability | Active traders, long-term investors | Self-directed traders | Beginners, experienced traders |

Conclusion

Choosing the right forex stocks broker is crucial for your trading success. By understanding the different types of brokers, considering your trading style, and examining the various aspects we have covered, you can make an informed decision that meets your individual needs.

Remember to stay up-to-date with market trends and continue to educate yourself on trading strategies. Don’t forget to explore our other articles for additional insights into forex and stock markets. Happy trading!

FAQ about Forex Stocks Broker

What is forex?

Forex (foreign exchange) is the market where currencies are traded. It is the largest financial market in the world, with a daily trading volume of over $5 trillion.

What is a forex stock broker?

A forex stock broker is a company that provides traders with access to the forex market. Forex stock brokers offer a variety of services, including:

- Execution of trades

- Providing quotes

- Offering leverage

- Providing research and analysis

How do I choose a forex stock broker?

When choosing a forex stock broker, you should consider the following factors:

- Reputation: The broker should have a good reputation for reliability and customer service.

- Fees: The broker should charge reasonable fees for its services.

- Platform: The broker should offer a user-friendly trading platform.

- Customer service: The broker should provide good customer service.

What are the risks of trading forex?

Forex trading is a high-risk activity. The value of currencies can fluctuate rapidly, and you could lose money on your trades. You should only trade forex if you are prepared to lose money.

How can I reduce the risks of trading forex?

There are a number of things you can do to reduce the risks of trading forex, including:

- Educate yourself: Learn about forex trading before you start trading.

- Start with a small account: Don’t risk more money than you can afford to lose.

- Use a stop-loss order: A stop-loss order will automatically close your trade if the price of the currency moves against you.

- Don’t overlever your trades: Leveraging your trades can increase your profits, but it can also increase your losses.

What are the benefits of trading forex?

Forex trading offers a number of benefits, including:

- 24-hour trading: The forex market is open 24 hours a day, 5 days a week.

- High liquidity: The forex market is the most liquid market in the world, which means that you can easily buy and sell currencies.

- Leverage: You can use leverage to trade forex, which means that you can control a larger position with a smaller amount of capital.

What are some tips for successful forex trading?

There are a number of things you can do to increase your chances of success in forex trading, including:

- Develop a trading plan: A trading plan will help you to stay disciplined and to make rational trading decisions.

- Manage your risk: Always be aware of the risks involved in forex trading and take steps to manage your risk.

- Be patient: Forex trading is a marathon, not a sprint. Don’t expect to get rich quick.

What are the most common mistakes that forex traders make?

Some of the most common mistakes that forex traders make include:

- Trading with too much leverage: Leveraging your trades can increase your profits, but it can also increase your losses.

- Not using a stop-loss order: A stop-loss order will automatically close your trade if the price of the currency moves against you.

- Trading emotionally: Don’t let your emotions get in the way of your trading decisions.

- Not educating yourself: Learn about forex trading before you start trading.

How do I get started with forex trading?

To get started with forex trading, you will need to open an account with a forex stock broker. Once you have opened an account, you can start trading forex by placing buy and sell orders.