- Forex Stocks Trading: A Comprehensive Guide for Beginners

- Introduction

- Understanding Forex Stocks Trading

- Types of Forex Stocks Trading

- Benefits of Forex Stocks Trading

- Risks of Forex Stocks Trading

- Forex Stocks Trading Strategies

- Table: Currencies Traded in Forex Markets

- Conclusion

-

FAQ about Forex Stocks Trading

- What is Forex stocks trading?

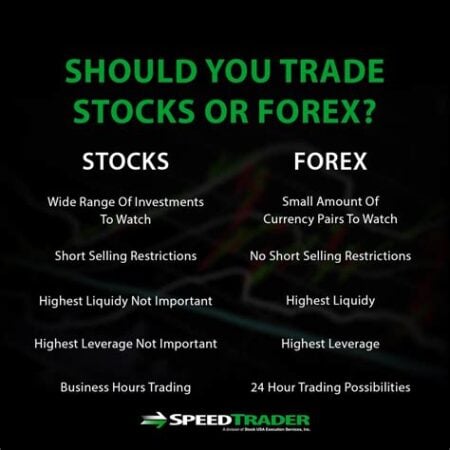

- How is Forex stocks trading different from traditional stock trading?

- What are the advantages of Forex stocks trading?

- What are the risks of Forex stocks trading?

- How do I get started with Forex stocks trading?

- What are some recommended Forex stocks to consider?

- How can I learn more about Forex stocks trading?

- What are the regulations surrounding Forex stocks trading?

- What are the tax implications of Forex stocks trading?

- Can I trade Forex stocks with a small account balance?

Forex Stocks Trading: A Comprehensive Guide for Beginners

Introduction

Greetings, readers! Are you looking to venture into the captivating world of forex stocks trading? If so, you’re in the right place. In this comprehensive guide, we’ll delve into everything you need to know about this exhilarating and potentially lucrative investment avenue.

Forex stocks trading, also known as currency trading or foreign exchange trading, involves speculating on the price movements of currencies from different countries. As the largest and most liquid financial market globally, forex stocks trading offers countless opportunities for profit, but it also comes with its risks.

Understanding Forex Stocks Trading

What is Forex?

Forex, short for foreign exchange, refers to the global market where currencies are traded. Unlike stocks or bonds, forex trading does not involve physical assets but rather pairs of currencies, such as EUR/USD (Euro versus US Dollar).

Currency Pairs

In forex trading, you buy and sell pairs of currencies, simultaneously buying one while selling another. The value of a currency pair is determined by the relative strength and weakness of the respective currencies.

Types of Forex Stocks Trading

Spot Trading

Spot trading involves buying or selling currency pairs for immediate delivery, usually within two business days. This is the most common type of forex trading and is typically executed through online platforms or brokers.

Forward Trading

Forward trading involves entering into a contract to buy or sell a specific amount of currency at a predetermined rate on a future date. This type of trading is often used for hedging against potential fluctuations in exchange rates.

Options Trading

Forex options give traders the right, but not the obligation, to buy or sell a certain amount of currency at a specified price on or before a particular date. Options trading provides additional flexibility and can be used to manage risk or speculate on price movements.

Benefits of Forex Stocks Trading

High Liquidity

Forex is the most liquid financial market, with trillions of dollars traded daily. This high liquidity ensures fast execution of trades and minimizes slippage.

24/5 Trading

Forex markets operate 24 hours a day, 5 days a week, providing traders with ample opportunities to enter or exit trades.

Leverage

Forex brokers often offer leverage, which allows traders to control larger positions with a smaller amount of capital. However, leverage also magnifies both profits and losses.

Risks of Forex Stocks Trading

Volatility

Forex markets can be highly volatile, with currency prices fluctuating rapidly. This volatility can lead to substantial gains or losses.

Economic Factors

Economic and political events can significantly impact currency prices. Traders need to stay abreast of global news and its potential impact on currency movements.

Counterparty Risk

When trading forex, you are essentially entering into a contract with your broker. Counterparty risk arises if your broker is unable or unwilling to fulfill its contractual obligations.

Forex Stocks Trading Strategies

Fundamental Analysis

This approach involves analyzing economic and political factors that influence currency prices, such as GDP growth, inflation, and interest rates.

Technical Analysis

Technical analysis focuses on studying historical price data to identify patterns and trends that may predict future price movements.

Scalping

Scalping involves making numerous small trades to capture small, short-term price fluctuations.

Table: Currencies Traded in Forex Markets

| Currency | Symbol | Country |

|---|---|---|

| US Dollar | USD | United States |

| Euro | EUR | European Union |

| Japanese Yen | JPY | Japan |

| British Pound | GBP | United Kingdom |

| Swiss Franc | CHF | Switzerland |

Conclusion

Forex stocks trading offers both opportunities and risks, making it a suitable investment vehicle for experienced traders. By understanding the concepts, types, and strategies involved, you can make informed decisions and pursue success in this dynamic financial market. To expand your knowledge, we invite you to explore our other articles on forex trading, where you’ll find valuable insights and tips to enhance your trading journey.

FAQ about Forex Stocks Trading

What is Forex stocks trading?

Forex (Foreign Exchange) stocks trading involves buying and selling shares of companies that are involved in the foreign exchange (Forex) market.

How is Forex stocks trading different from traditional stock trading?

In traditional stock trading, you buy and sell shares of companies whose primary business is not related to Forex. In Forex stocks trading, the companies you invest in are specifically engaged in Forex activities.

What are the advantages of Forex stocks trading?

- Diversify your portfolio with exposure to the Forex market.

- Potential for higher returns due to the volatility of Forex.

- Access to the global Forex market through a regulated exchange.

What are the risks of Forex stocks trading?

- High volatility and potential losses due to currency fluctuations.

- Currency risk if you invest in companies with operations in multiple countries.

- Economic and political factors can impact the value of Forex stocks.

How do I get started with Forex stocks trading?

- Open an account with a brokerage that offers Forex stocks trading.

- Research and select companies that you believe will perform well.

- Monitor market conditions and make informed trading decisions.

What are some recommended Forex stocks to consider?

- CME Group (CME)

- Intercontinental Exchange (ICE)

- Charles Schwab (SCHW)

- Interactive Brokers (IBKR)

How can I learn more about Forex stocks trading?

- Read books and articles on Forex trading.

- Attend webinars and workshops offered by brokers.

- Join online forums and communities dedicated to Forex stocks trading.

What are the regulations surrounding Forex stocks trading?

- Forex stocks trading is regulated by the Securities and Exchange Commission (SEC) in the United States and other regulatory bodies around the world.

- Brokers must adhere to strict rules to protect investors.

What are the tax implications of Forex stocks trading?

- Forex stocks trading is subject to capital gains tax rates.

- Short-term gains (less than one year) are taxed at ordinary income rates.

- Long-term gains (more than one year) are taxed at lower rates.

Can I trade Forex stocks with a small account balance?

- Most brokers require a minimum account balance to trade Forex stocks.

- Some brokers offer micro accounts that allow you to start with a smaller amount.