- What is a Forex Trade Simulator?

- Benefits of Using a Forex Trade Simulator

- Types of Forex Trade Simulators

- Choosing the Right Forex Trade Simulator

- Forex Trade Simulator Free

- Simulated Trading Strategies

- Conclusion

-

FAQ about Forex Trade Simulator Free

- What is a Forex Trade Simulator Free?

- How does a Forex Trade Simulator Free work?

- What are the benefits of using a Forex Trade Simulator Free?

- How do I choose the right Forex Trade Simulator Free?

- Are there any drawbacks to using a Forex Trade Simulator Free?

- Can I use a Forex Trade Simulator Free to make money?

- What is the difference between a Forex Trade Simulator Free and a demo account?

- Are Forex Trade Simulators Free safe to use?

- How long should I use a Forex Trade Simulator Free before trading with real money?

- What are some tips for using a Forex Trade Simulator Free effectively?

Greetings, readers!

Welcome to the ultimate guide to Forex trade simulators. Are you a novice trader eager to test your strategies without risking real capital? Or perhaps you’re a seasoned pro looking to refine your techniques? Look no further, for in this comprehensive article, we’ll delve deep into the world of Forex trade simulators, empowering you to conquer the markets with confidence.

What is a Forex Trade Simulator?

A Forex trade simulator is a software tool that replicates real-world trading conditions, allowing you to practice and hone your skills without putting your hard-earned money on the line. These simulators provide access to historical or real-time market data, enabling you to test different strategies and make trading decisions without any financial repercussions.

Benefits of Using a Forex Trade Simulator

Harnessing the power of Forex trade simulators offers a wealth of advantages:

Risk-Free Learning:

With a simulator, you can experiment with different trading styles, indicators, and risk management techniques without risking a single cent. This allows you to gain invaluable experience and build confidence before venturing into live trading.

Market Analysis:

Simulators provide a platform to analyze market trends, identify patterns, and test your hypotheses without the pressure of real-time trading. You can backtest strategies over extended periods, optimizing them for maximum profitability.

Emotional Control:

Trading can evoke strong emotions. By practicing in a simulated environment, you can learn to manage your emotions and develop disciplined trading habits, reducing the likelihood of impulsive decisions.

Types of Forex Trade Simulators

There’s a plethora of Forex trade simulators available, each with its unique features:

Web-Based Simulators:

Accessible through a web browser, these simulators offer convenience and require no software installation. They may provide limited features compared to desktop simulators.

Desktop Simulators:

Offering a wider range of features and functionality, desktop simulators need to be installed on your computer. They often provide advanced tools for charting, analysis, and strategy optimization.

Mobile Simulators:

Catering to on-the-go traders, mobile simulators allow you to practice trading from anywhere via your smartphone or tablet. They may have fewer features than other types.

Choosing the Right Forex Trade Simulator

Selecting the ideal Forex trade simulator depends on your specific needs:

Experience Level:

Beginners may opt for web-based or mobile simulators with simplified interfaces. Advanced traders may prefer desktop simulators with comprehensive functionality.

Features:

Consider the features you require, such as historical or real-time data, customizable indicators, and charting tools. Some simulators offer advanced features like strategy backtesting and optimization.

Cost:

Some simulators are free to use, while others require a subscription. Determine the cost-benefit ratio and choose the one that aligns with your budget.

Forex Trade Simulator Free

Now, let’s explore some popular free Forex trade simulators that cater to different preferences:

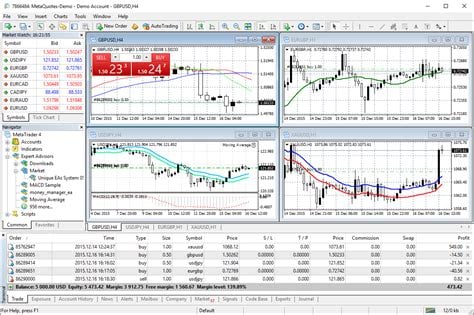

MetaTrader 4 & 5:

Renowned trading platforms, MetaTrader 4 and 5 offer built-in simulators with a vast range of features. They provide access to historical data, custom indicators, and automated trading capabilities.

TradingView:

A popular web-based simulator, TradingView offers a user-friendly interface and a wide selection of charting tools. It allows you to trade simulated stocks, bonds, and Forex currencies.

Oanda Practice Account:

Oanda, a reputable Forex broker, provides a free practice account with access to real-time market data. It offers advanced charting and analysis tools, fostering a realistic trading experience.

Simulated Trading Strategies

Once you’ve chosen a simulator, it’s time to put your trading skills to the test. Here are some strategies to consider:

Trend Following:

Identify market trends and trade in the direction of the prevailing trend, aiming to capture large price movements.

Scalping:

Execute multiple small trades throughout the day, profiting from small price fluctuations. This strategy requires quick reflexes and a deep understanding of market psychology.

Swing Trading:

Hold positions for a few days or weeks, aiming to profit from larger market swings. Swing traders seek to identify potential reversals and capitalize on price momentum.

Table: Forex Trade Simulator Free Comparison

| Simulator | Type | Features | Cost |

|---|---|---|---|

| MetaTrader 4/5 | Desktop | Built-in simulator, custom indicators, automated trading | Free |

| TradingView | Web-Based | User-friendly interface, extensive charting tools | Free for basic plan |

| Oanda Practice Account | Broker-Provided | Real-time market data, advanced charting tools | Free |

Conclusion

Embracing the power of Forex trade simulators is a game-changer for aspiring and seasoned traders alike. These tools provide a risk-free environment to develop, refine, and master your trading strategies. Whether you’re a beginner seeking to build a solid foundation or an experienced trader seeking to enhance your skills, Forex trade simulators free the door to success in the dynamic world of Forex trading.

Explore More Articles:

- Forex Trading for Beginners: A Comprehensive Guide

- The Ultimate Guide to Forex Trading Psychology

- Top 10 Forex Trading Mistakes and How to Avoid Them

FAQ about Forex Trade Simulator Free

What is a Forex Trade Simulator Free?

A Forex Trade Simulator Free is a software tool that simulates real-world forex trading without the risk of losing real money. It allows traders to test strategies, learn the market, and build confidence before trading with real funds.

How does a Forex Trade Simulator Free work?

Forex Trade Simulators Free mimic the real-world trading environment, including market fluctuations, bid/ask prices, and order execution. They allow traders to make trades, see their profits and losses, and track their performance.

What are the benefits of using a Forex Trade Simulator Free?

Forex Trade Simulators Free offer several benefits, including risk-free practice, the ability to test strategies, market learning, and confidence building.

How do I choose the right Forex Trade Simulator Free?

When choosing a Forex Trade Simulator Free, consider factors such as realism, features, ease of use, and availability of support.

Are there any drawbacks to using a Forex Trade Simulator Free?

While Forex Trade Simulators Free offer many benefits, they can also have limitations, such as not fully replicating the emotional aspect of real trading and potential discrepancies in market simulation.

Can I use a Forex Trade Simulator Free to make money?

Forex Trade Simulators Free are not designed for profit-making. They are intended for educational and practice purposes. Trading virtual currency does not guarantee success in real-world trading.

What is the difference between a Forex Trade Simulator Free and a demo account?

Forex Trade Simulators Free are typically standalone software programs, while demo accounts are provided by brokers and use real-time market data. Demo accounts allow traders to practice with virtual funds, but they are limited in features and functionality compared to Forex Trade Simulators Free.

Are Forex Trade Simulators Free safe to use?

Reputable Forex Trade Simulators Free are safe to use. They do not require personal or financial information and operate independently of live trading platforms.

How long should I use a Forex Trade Simulator Free before trading with real money?

The duration of using a Forex Trade Simulator Free depends on individual needs and learning pace. It is recommended to use a simulator until you consistently achieve positive results and feel confident in your trading strategies.

What are some tips for using a Forex Trade Simulator Free effectively?

To maximize the benefits of a Forex Trade Simulator Free, set realistic goals, practice regularly, track your progress, and seek guidance from experienced traders if needed.