- Introduction

- Choosing the Right Forex Trade Site for You

- Exploring the Features of Forex Trade Sites

- Forex Trade Site Comparison Table

- Conclusion

-

FAQ about Forex Trading Sites

- What is a forex trading site?

- How is forex trading done?

- What is the minimum amount of money I need to start forex trading?

- How do I choose a reputable forex trading site?

- What are the risks of forex trading?

- What is leverage and how does it work?

- What is a spread?

- What is a pip?

- What are the different types of forex trading orders?

- How much can I earn from forex trading?

Introduction

Greetings, fellow readers! Are you ready to embark on a thrilling journey into the world of forex trading? Today, we present you with an in-depth guide to navigating the landscape of forex trade sites, ensuring you have all the knowledge and insights to succeed in the dynamic forex market.

Choosing the Right Forex Trade Site for You

Factors to Consider

Selecting the ideal forex trade site is paramount to your trading success. Consider these crucial factors before making a decision:

-

Regulation and Trustworthiness: Look for sites regulated by reputable authorities like the FCA, ASIC, or CySEC, indicating that they adhere to industry standards and protect your funds.

-

Fees and Commissions: Compare the fees and commissions charged by different sites to minimize the impact on your profits.

-

Trading Platform: Choose a site with an intuitive and user-friendly trading platform that meets your specific trading style and preferences.

Popular Forex Trade Sites

-

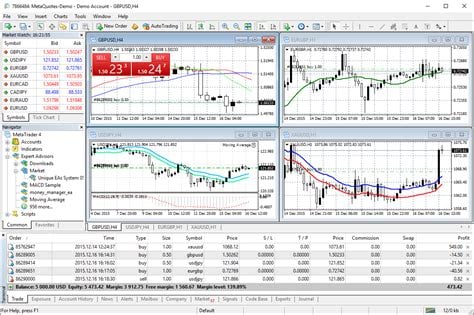

MetaTrader 4: An industry-leading platform offering advanced charting tools, expert advisors, and a vast selection of technical indicators.

-

cTrader: Known for its lightning-fast order execution, customizable interface, and copy trading features.

-

NinjaTrader: A comprehensive platform with real-time market data, backtesting capabilities, and support for multiple order types.

Exploring the Features of Forex Trade Sites

Market Analysis and Research Tools

-

Economic Calendar: Stay updated on key economic events that impact currency prices.

-

Technical Analysis Tools: Utilize charts, indicators, and patterns to identify trading opportunities.

-

Fundamental Analysis Tools: Access news, articles, and market commentary to assess the underlying factors driving currency movements.

Account Types and Trading Options

-

Demo Account: Practice trading without risking real money, ideal for beginners or testing strategies.

-

Standard Account: A basic account type suitable for both novice and experienced traders.

-

Premium Account: Offers advanced features and personalized services for high-volume traders.

Customer Support and Resources

-

24/7 Live Chat: Get immediate assistance with any questions or issues.

-

Educational Materials: Access webinars, articles, and videos to enhance your trading knowledge.

-

Community Forum: Engage with other traders, share insights, and learn from their experiences.

Forex Trade Site Comparison Table

| Feature | MetaTrader 4 | cTrader | NinjaTrader |

|---|---|---|---|

| Regulation | FCA, ASIC, CySEC | FCA, ASIC, CySEC | SEC, CFTC |

| Fees and Commissions | Low | Competitive | Moderate |

| Trading Platform | Advanced | User-friendly | Customizable |

| Market Analysis Tools | Comprehensive | Real-time | Extensive |

| Account Types | Demo, Standard, Premium | Demo, Standard, ECN | Demo, Basic, Advanced |

| Customer Support | 24/7 Live Chat | 24/7 Email and Phone | Phone Support |

Conclusion

Choosing the right forex trade site is essential for successful trading. By carefully considering the factors outlined in this guide, you can make an informed decision that aligns with your individual needs and goals. Remember to research thoroughly and explore different sites until you find the perfect match for your trading journey.

Thank you for reading! Explore our blog for more insightful articles on forex trading and other financial markets.

FAQ about Forex Trading Sites

What is a forex trading site?

A forex trading site is a platform that allows individuals to buy and sell foreign currencies online. It provides access to real-time currency quotes, trading tools, and interfaces for executing trades.

How is forex trading done?

Forex trading involves buying and selling currency pairs, such as EUR/USD or GBP/JPY. When you buy a currency pair, you are essentially buying the first currency and selling the second. Your profit or loss depends on whether the value of the first currency rises or falls relative to the second.

What is the minimum amount of money I need to start forex trading?

The minimum amount required varies depending on the platform and broker. Typically, you can start trading with as little as $100-$500. However, it’s recommended to have a larger capital base to manage risk effectively.

How do I choose a reputable forex trading site?

Look for platforms that are regulated by reputable financial authorities, offer transparent pricing, have a strong track record, and provide excellent customer support.

What are the risks of forex trading?

Forex trading carries inherent risks, including market volatility, leverage, and the potential for losses. Always trade responsibly and with a risk management strategy in place.

What is leverage and how does it work?

Leverage allows traders to trade larger amounts of currency than their account balance permits. While leverage can increase potential profits, it can also amplify losses. Leverage should be used with caution and should not exceed a trader’s risk tolerance.

What is a spread?

A spread is the difference between the bid price and the ask price of a currency pair. The spread is how brokers make their profit on forex trades.

What is a pip?

Pip stands for "point in percentage." It is the smallest possible increment of change in a currency pair’s value. Pips are used to measure profits and losses in forex trading.

What are the different types of forex trading orders?

Common forex trading orders include market orders (executed immediately at the current market price), limit orders (executed when the price reaches a specified level), and stop-loss orders (used to protect against large losses).

How much can I earn from forex trading?

Your potential earnings depend on several factors, including market conditions, trading strategy, risk tolerance, and account size. It’s important to have realistic expectations and to avoid chasing unrealistic profits.