- Forex Traders Canada: A Comprehensive Guide

-

FAQ about Forex Traders Canada

- What is forex trading?

- Is forex trading legal in Canada?

- Do I need a license to trade Forex in Canada?

- What are the risks of forex trading?

- How much money do I need to start forex trading?

- What are the benefits of forex trading?

- What are the different types of forex trading strategies?

- How do I choose a forex broker in Canada?

- What is leverage in forex trading?

- Can I make a living as a forex trader in Canada?

Forex Traders Canada: A Comprehensive Guide

Introduction

Greetings, readers! Welcome to our in-depth guide on "Forex Traders Canada." Whether you’re an experienced trader or just starting your journey in the world of foreign exchange, this article will provide you with valuable insights and practical advice. So, sit back, relax, and let’s dive into the exciting world of forex trading in Canada.

In this guide, we will cover everything you need to know about forex traders Canada, including the basics of forex trading, the best brokers in Canada, and the regulatory landscape. We will also delve into the challenges and opportunities of forex trading in this dynamic market.

Understanding Forex Trading in Canada

Forex trading, short for foreign exchange trading, involves buying and selling currencies with the aim of making a profit from the exchange rate fluctuations. It is the largest and most liquid financial market in the world, with trillions of dollars traded ежедневно.

As a Canadian forex trader, you have access to a wide range of currency pairs, including the Canadian dollar (CAD), US dollar (USD), and euro (EUR). You can trade these pairs through a variety of channels, including online brokers, banks, and investment firms.

Choosing the Right Forex Broker in Canada

The choice of forex broker is crucial for your trading success. Here are some key factors to consider when selecting a broker:

Regulation and Safety

Ensure that the broker is regulated by a reputable financial authority in Canada, such as the Investment Industry Regulatory Organization of Canada (IIROC). This will provide protection and peace of mind.

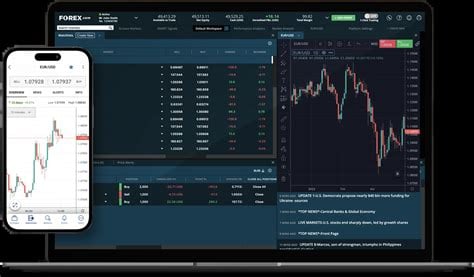

Trading Platform

The trading platform is the software you will use to execute trades. Look for a platform that is user-friendly, reliable, and offers the features you need.

Spreads and Commissions

Spreads and commissions are the fees charged by the broker for executing trades. Compare the spreads and commissions of different brokers to find the most competitive rates.

The Regulatory Landscape for Forex Traders Canada

The forex market in Canada is regulated by IIROC. IIROC sets the rules and regulations that forex brokers must follow to operate in the country. These regulations are designed to protect investors and ensure fair trading practices.

IIROC requires forex brokers to meet certain capital adequacy requirements, maintain client records, and report suspicious trading activity. This regulatory framework helps to maintain the integrity of the market and protects Canadian traders.

Challenges and Opportunities for Forex Traders Canada

Like any financial market, forex trading in Canada comes with its own set of challenges and opportunities.

Challenges

- High Leverage: Forex trading involves the use of leverage, which can amplify both profits and losses. It is important to use leverage wisely and avoid overtrading.

- Volatility: The forex market is known for its volatility, which can lead to sudden and unexpected price movements. This volatility can create both opportunities and risks for traders.

Opportunities

- High Liquidity: The forex market is highly liquid, which means that it is easy to buy and sell currencies quickly and efficiently. This liquidity allows traders to enter and exit positions with minimal slippage.

- 24/5 Trading: Forex is traded 24 hours a day, 5 days a week. This provides traders with ample opportunities to trade and capture market movements.

Table: Top Forex Brokers in Canada

| Broker | Regulation | Trading Platform | Spreads | Commissions |

|---|---|---|---|---|

| eToro | IIROC | Proprietary | 1 pip | None |

| XTB | IIROC | xStation 5 | 0.1 pips | None |

| CMC Markets | IIROC | Next Generation | 0.7 pips | Variable |

| IG | IIROC | MetaTrader 4/5 | 0.6 pips | Variable |

| Saxo Bank | IIROC | SaxoTraderGO | 1 pip | Variable |

Conclusion

Forex trading in Canada offers a wealth of opportunities for both experienced and novice traders. By understanding the basics of forex trading, selecting a reputable broker, and navigating the regulatory landscape, you can increase your chances of success.

To further your knowledge on forex trading and related topics, we invite you to explore our other articles. From beginner guides to advanced trading strategies, we have a wide range of resources available to help you become a successful forex trader.

Thank you for reading and happy trading!

FAQ about Forex Traders Canada

What is forex trading?

Forex (foreign exchange) trading involves buying and selling currencies on the global currency market to profit from fluctuations in their exchange rates.

Is forex trading legal in Canada?

Yes, forex trading is legal in Canada, regulated by the Investment Industry Regulatory Organization of Canada (IIROC).

Do I need a license to trade Forex in Canada?

No, a license is not required to trade forex in Canada, but it is recommended to work with a regulated broker for safety.

What are the risks of forex trading?

Forex trading involves significant risks, including potential loss of capital, high volatility, and the leverage effect.

How much money do I need to start forex trading?

The minimum capital required to start forex trading varies between brokers, but it is generally recommended to start with a few hundred dollars to minimize risk.

What are the benefits of forex trading?

Forex trading offers potential for high returns, 24/7 trading, and the ability to trade in a variety of currencies with leverage.

What are the different types of forex trading strategies?

Common forex trading strategies include trend trading, range trading, breakout trading, and scalping.

How do I choose a forex broker in Canada?

When choosing a forex broker in Canada, consider regulation, fees, trading platform, and customer support.

What is leverage in forex trading?

Leverage allows traders to borrow funds from their broker to amplify their trading positions, increasing potential returns but also risks.

Can I make a living as a forex trader in Canada?

While possible, it is challenging to make a full-time living as a forex trader in Canada. It requires significant knowledge, experience, and risk management.