- Forex Trading Demo Account US: Ultimate Guide for 2023

-

FAQ about Forex Trading Demo Account US

- What is a forex demo account?

- How do I open a forex demo account?

- What are the benefits of using a forex demo account?

- How long can I use a forex demo account?

- Can I make real money with a forex demo account?

- What is the difference between a demo account and a live account?

- How do I withdraw money from a forex demo account?

- What is the best forex demo account?

- How do I get started with forex trading?

Forex Trading Demo Account US: Ultimate Guide for 2023

Hello, readers!

Welcome to your ultimate guide to forex trading demo accounts in the US. In this comprehensive article, we’ll delve into everything you need to know about these accounts, including their benefits, how to find the best ones, and how to use them effectively.

Whether you’re a seasoned trader or just starting out, this guide will provide you with valuable insights and practical advice to help you make the most of your forex trading journey.

Section 1: Understanding Forex Trading Demo Accounts

### What is a Forex Trading Demo Account?

A forex trading demo account is a simulated trading environment that allows you to practice trading foreign currencies without risking real money. These accounts are typically offered by brokers and provide traders with access to a virtual balance and real-time market data.

### Benefits of Using a Forex Trading Demo Account

Demo accounts offer numerous benefits for both novice and experienced traders, including:

- Risk-free practice: Allows you to test strategies, learn the platform, and gain experience without risking real money.

- Market familiarization: Provides exposure to real-time market conditions and helps you understand how currency pairs fluctuate.

- Strategy evaluation: Lets you experiment with different trading strategies and assess their performance in various market scenarios.

- Skill development: Enhances your trading skills and improves your decision-making abilities before entering live trading.

Section 2: Finding the Best Forex Trading Demo Account US

### Factors to Consider

When choosing a forex trading demo account in the US, several factors should be considered:

- Regulation: Ensure the broker is regulated by a reputable financial authority in the US, such as the National Futures Association (NFA).

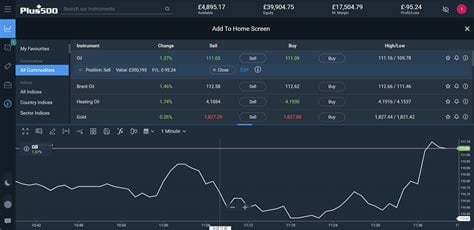

- Platform: Choose a platform that is user-friendly, offers advanced charting tools, and provides real-time data.

- Virtual balance: Select an account with a sufficient virtual balance to support your trading strategies and risk appetite.

- Market depth: Opt for an account that offers a wide range of currency pairs and provides deep liquidity for optimal trading conditions.

- Customer support: Ensure the broker provides reliable customer support in case you encounter any issues or have questions.

### Brokers with Top-Rated Demo Accounts

Based on the factors mentioned above, some of the recommended brokers with top-rated forex trading demo accounts in the US include:

- IG: Offers a demo account with a virtual balance of $20,000 and access to over 17,000 markets globally.

- OANDA: Provides a demo account with a virtual balance of $100,000 and real-time streaming market data.

- FXCM: Offers a demo account with a virtual balance of $50,000 and a proprietary Trading Station platform.

- TD Ameritrade: Provides a demo account with a virtual balance of $100,000 and access to the thinkorswim platform.

- Saxo Bank: Offers a demo account with a virtual balance of €100,000 and a wide range of trading instruments.

Section 3: Using Forex Trading Demo Accounts Effectively

### Setting Up Your Demo Account

To set up your forex trading demo account in the US, follow these steps:

- Visit the website of the chosen broker.

- Click on the "Open Demo Account" or "Try Demo" button.

- Provide your personal information, including name, email, and phone number.

- Choose a platform and select the desired virtual balance.

- Activate your account and start practicing.

### Tips for Effective Use

To make the most of your forex trading demo account, consider these tips:

- Set realistic goals: Determine your trading objectives and stick to them.

- Trade consistently: Practice regularly to develop a consistent trading routine.

- Analyze results: Track your trades and identify areas for improvement.

- Don’t chase losses: Avoid emotional trading and focus on long-term profitability.

- Seek feedback: Consider sharing your trades with experienced traders or mentors to gain valuable insights.

Forex Trading Demo Accounts in the US: A Summary Table

| Feature | IG | OANDA | FXCM | TD Ameritrade | Saxo Bank |

|---|---|---|---|---|---|

| Virtual Balance | $20,000 | $100,000 | $50,000 | $100,000 | €100,000 |

| Platform | MetaTrader 4 and 5 | OANDA JFX | Trading Station | thinkorswim | SaxoTraderGO |

| Currency Pairs | 17,000+ | 70+ | 40+ | 125+ | 180+ |

| Regulation | NFA | NFA, FCA | NFA | FINRA | FCA |

| Customer Support | 24/5 | 24/5 | 24/5 | 24/7 | 24/5 |

Conclusion

Forex trading demo accounts in the US offer a valuable tool for traders to enhance their skills and test strategies without risking real money. By understanding the benefits, finding the best brokers, and using these accounts effectively, traders can gain a competitive edge in the forex market.

As you progress on your forex trading journey, be sure to explore other educational resources, such as guides, tutorials, and webinars. By continuously learning and refining your skills, you can increase your chances of success in this dynamic and rewarding market.

We hope this comprehensive guide has provided you with the knowledge and insights you need to make the most of forex trading demo accounts in the US.

FAQ about Forex Trading Demo Account US

What is a forex demo account?

A forex demo account is a virtual trading account that allows you to practice forex trading without risking real money. You can use demo accounts to learn how to trade forex, test different strategies, and get comfortable with the trading platform.

How do I open a forex demo account?

Opening a forex demo account is quick and easy. Simply visit the website of a forex broker and follow the instructions to create an account. You will need to provide some basic personal information, such as your name, email address, and phone number.

What are the benefits of using a forex demo account?

There are many benefits to using a forex demo account, including:

- No risk: You can’t lose any real money when you trade on a demo account. This makes it a great way to learn how to trade without putting your capital at risk.

- Test different strategies: You can use a demo account to test different trading strategies and see how they perform before you trade with real money.

- Get comfortable with the trading platform: You can use a demo account to get comfortable with the trading platform and learn how to use the different tools and features.

How long can I use a forex demo account?

Most forex brokers allow you to use a demo account for as long as you need. However, some brokers may have a time limit on how long you can use a demo account.

Can I make real money with a forex demo account?

No, you cannot make real money with a forex demo account. Demo accounts are used for practice only. You cannot withdraw any profits that you make on a demo account.

What is the difference between a demo account and a live account?

A demo account is a virtual trading account that uses virtual money. A live account is a real trading account that uses real money.

How do I withdraw money from a forex demo account?

You cannot withdraw money from a forex demo account. Demo accounts are used for practice only.

What is the best forex demo account?

The best forex demo account for you will depend on your individual needs. Consider the following factors when choosing a demo account:

- The broker: Choose a reputable forex broker that offers a demo account with the features you need.

- The trading platform: Make sure the demo account uses a trading platform that you are comfortable with.

- The account balance: Choose a demo account with a balance that is large enough to allow you to trade realistically.

How do I get started with forex trading?

Once you have opened a demo account, you can start learning how to trade forex. There are many resources available to help you learn, including books, articles, and online courses. You can also find helpful information on the website of your forex broker.