- Introduction

- Understanding Forex Trading Demos

- Choosing the Right Forex Trading Demo

- Making the Most of Your Forex Trading Demo

- Forex Trading Demo Free: Comparison Table

- Conclusion

-

FAQ about Forex Trading Demo Free

- What is a forex trading demo account?

- Why use a forex trading demo account?

- How to open a forex trading demo account?

- What are the benefits of using a forex trading demo account?

- What are the limitations of forex trading demo accounts?

- How long can I use a forex trading demo account for?

- How do I switch from a forex trading demo account to a live account?

- Is it possible to make money with a forex trading demo account?

- What is the best forex trading demo account?

- What should I look for when choosing a forex trading demo account?

Introduction

Hey Readers,

Welcome to our in-depth guide to forex trading demos, where we’ll immerse you in the world of risk-free practice trading. As you embark on this journey, we’ll guide you through the nuances of forex trading demos, empowering you with the knowledge and skills necessary to master the markets.

Understanding Forex Trading Demos

What Is a Forex Trading Demo?

A forex trading demo is an invaluable tool that allows you to simulate real-world forex trading without risking any capital. It provides a secure environment where you can practice your trading strategies, test out different platforms, and build your confidence before venturing into live trading.

Benefits of Using a Forex Trading Demo

- Risk-Free Trading: Eliminate the financial risk associated with live trading and experiment with different strategies without losing money.

- Practice and Learn: Gain valuable experience and hone your trading skills before putting your real capital on the line.

- Experiment with Strategies: Test out various trading methods, adjust your parameters, and optimize your approach without consequences.

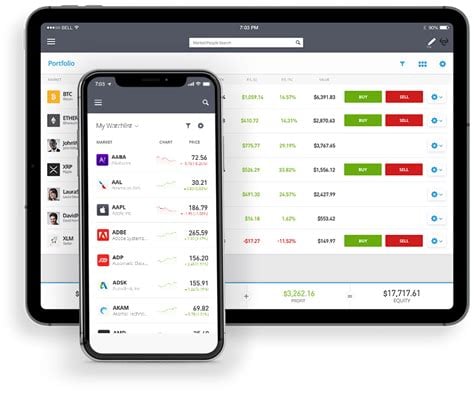

- Platform Evaluation: Assess different forex trading platforms, compare their features, and choose the one that best suits your needs.

Choosing the Right Forex Trading Demo

Factors to Consider

- Market Data Quality: Ensure the demo platform provides accurate and real-time market data to replicate live trading conditions.

- Trading Tools and Features: Look for platforms that offer a comprehensive suite of trading tools, such as charts, indicators, and risk management features.

- Account Size and Leverage: Select a demo account with sufficient virtual funds and leverage to simulate real-world trading scenarios.

- Customer Support: Choose a broker that provides responsive and reliable customer support to assist you if you encounter any issues.

Choosing a Reputable Broker

- Regulation and Security: Opt for brokers that are regulated by reputable financial authorities to ensure the safety of your funds.

- Demo Expiration: Consider the expiration period of the demo account to avoid disruptions in your practice sessions.

- Fees and Commissions: Check for any fees or commissions associated with the demo account, as some brokers may charge for extended use.

Making the Most of Your Forex Trading Demo

Setting Realistic Goals

- Define Your Objectives: Clearly outline what you want to achieve with your demo trading, whether it’s practicing a specific strategy or improving your overall trading performance.

- Set Realistic Expectations: Remember that demo trading is not a guarantee of success in live trading, but rather a valuable learning tool.

- Track Your Progress: Monitor your trades, analyze your results, and identify areas for improvement.

Developing a Trading Plan

- Define Your Strategy: Outline your entry and exit points, risk management parameters, and position sizing.

- Test Your Strategy: Use the demo platform to validate your strategy, make adjustments as needed, and refine your approach.

- Manage Your Risk: Set stop-loss orders and position limits to protect your virtual capital from potential losses.

Tips for Success

- Practice Consistently: Regular trading sessions are crucial for developing your skills and building confidence.

- Analyze Your Results: Evaluate your trades, identify your mistakes, and adjust your strategy accordingly.

- Seek Education: Supplement your demo trading with educational resources, such as articles, webinars, and online courses.

- Transition to Live Trading Gradually: Once you feel confident in your abilities, consider transitioning to live trading with a small initial investment.

Forex Trading Demo Free: Comparison Table

| Broker | Market Data | Trading Tools | Account Size | Leverage | Customer Support | Open a Demo |

|---|---|---|---|---|---|---|

| MetaTrader | Real-time quotes | Comprehensive suite | Up to $1 million | Up to 1:1000 | 24/7 live chat | [Open Now](https://www.broker.com/demo) |

| cTrader | High precision data | Advanced charting | Up to $10 million | Up to 1:500 | Email and ticket system | [Open Now](https://www.broker.com/demo) |

| NinjaTrader | Institutional-grade platform | Customizable interface | Up to $2 million | Up to 1:200 | Phone and email | [Open Now](https://www.broker.com/demo) |

Conclusion

Forex trading demos are an indispensable tool for aspiring and experienced traders alike. By following the insights shared in this guide, you can harness the power of forex trading demos and embark on a journey of growth and mastery. Remember, patience, practice, and continuous learning are the keys to unlocking your trading potential.

If you’re eager to delve deeper into the world of forex trading, we invite you to explore our other comprehensive guides and articles designed to empower you on your financial endeavors. Keep trading, keep learning, and seize the opportunities that the forex market has to offer.

FAQ about Forex Trading Demo Free

What is a forex trading demo account?

A forex trading demo account is a simulation of a real trading account, which allows you to trade with virtual money in a risk-free environment.

Why use a forex trading demo account?

Using a forex trading demo account allows you to practice trading without risking real money, learn about different trading strategies, and test the performance of trading systems.

How to open a forex trading demo account?

Opening a forex trading demo account is usually free and easy. You can typically open an account by visiting the website of a forex broker and filling out a simple form.

What are the benefits of using a forex trading demo account?

Forex trading demo accounts offer several benefits, including:

- No risk of losing real money

- Opportunity to practice trading in a realistic environment

- Ability to test different trading strategies

- Evaluation of trading systems

What are the limitations of forex trading demo accounts?

Forex trading demo accounts have some limitations, such as:

- Simulated trading conditions may not fully reflect real-world conditions

- Emotional factors that affect real trading may not be present in demo accounts

- Withdrawal of funds is not possible

How long can I use a forex trading demo account for?

The duration of forex trading demo accounts varies depending on the broker. Some brokers offer unlimited access, while others may limit the usage period.

How do I switch from a forex trading demo account to a live account?

Switching from a forex trading demo account to a live account typically involves opening a new account with the broker and funding it with real money.

Is it possible to make money with a forex trading demo account?

No, it is not possible to make money with a forex trading demo account, as the funds used are virtual.

What is the best forex trading demo account?

The best forex trading demo account depends on your individual needs and preferences. Consider factors such as the duration of the demo period, trading platform, and customer support.

What should I look for when choosing a forex trading demo account?

When choosing a forex trading demo account, consider the following factors:

- Demo period duration

- Trading platform features

- Customer support availability

- Reputation of the broker