- Forex Trading with Interactive Brokers: The Ultimate Guide for Beginners and Pros

- Section 1: Understanding Forex Trading with Interactive Brokers

- Section 2: Getting Started with Forex Trading

- Section 3: Trading Strategies and Risk Management

- Section 4: Advanced Features for Forex Traders

- Section 5: Educational Resources and Support

- Section 6: Conclusion

- Table: Summary of Interactive Brokers Forex Trading Features

-

FAQ about Forex Trading with Interactive Brokers

- What is Forex Trading?

- Why Trade Forex with Interactive Brokers?

- How do I Open a Forex Trading Account with IB?

- What Currencies Can I Trade with IB?

- What Leverage Options are Available?

- What Trading Platform Does IB Use?

- How Do I Deposit and Withdraw Funds?

- What Fees and Commissions are Involved?

- Is Forex Trading Right for Me?

- Where Can I Get Help with Forex Trading?

Forex Trading with Interactive Brokers: The Ultimate Guide for Beginners and Pros

Introduction

Greetings, readers! Welcome to our comprehensive guide on forex trading with Interactive Brokers. Whether you’re a seasoned veteran or a budding enthusiast, this article will equip you with invaluable insights and practical tips to navigate the thrilling world of forex trading with Interactive Brokers.

Before diving into the specifics, let’s briefly introduce our trading partner. Interactive Brokers is a global brokerage firm renowned for its robust platform, low trading fees, and extensive educational resources. Through its advanced trading tools and analytical capabilities, Interactive Brokers empowers traders of all levels to make informed decisions and execute trades strategically.

Section 1: Understanding Forex Trading with Interactive Brokers

Market Overview

Forex, or foreign exchange, refers to the exchange of currencies between two nations. Forex trading involves speculating on currency price movements, either to profit from short-term fluctuations or longer-term trends. Forex is the most traded market globally, offering vast liquidity and 24/7 trading opportunities.

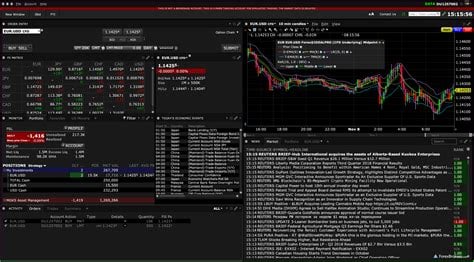

Interactive Brokers’ Platform

Interactive Brokers offers a sophisticated trading platform tailored to forex traders. Its Trader Workstation (TWS) provides real-time data streaming, advanced charting capabilities, and a wide range of order types. Additionally, Interactive Brokers’ mobile app offers seamless on-the-go trading, allowing you to monitor markets and execute trades from anywhere.

Section 2: Getting Started with Forex Trading

Opening an Account

To embark on your forex trading journey with Interactive Brokers, you’ll need to open an account. The process is straightforward, requiring personal information, financial details, and a funded account. Once your account is set up, you can access the TWS platform and begin trading.

Forex Trading Instruments

Interactive Brokers offers a diverse range of forex trading instruments, including major currency pairs (e.g., EUR/USD, USD/JPY), minor currency pairs, and exotic currency pairs. Major pairs are the most popular and liquid, while minors and exotics offer higher volatility and potential for greater profits.

Section 3: Trading Strategies and Risk Management

Trading Strategies

There are numerous forex trading strategies to choose from, each with its risk and reward characteristics. Some popular strategies include trend following, scalping, range trading, and news trading. The best strategy for you will depend on your trading style, risk tolerance, and market conditions.

Risk Management

Risk management is paramount in forex trading. Interactive Brokers provides a robust suite of risk management tools, including stop-loss orders, take-profit orders, and position sizing tools. These tools help you limit potential losses and protect your trading capital.

Section 4: Advanced Features for Forex Traders

Market Depth and Liquidity

Interactive Brokers offers exceptional market depth and liquidity for all forex instruments. You’ll have access to real-time bid and ask prices, ensuring efficient order execution and minimal slippage.

Commission and Fees

Interactive Brokers’ commission structure is highly competitive. You’ll only pay a flat commission per million traded, regardless of the trading volume or account size. This transparency and low costs allow you to maximize your trading profits.

Section 5: Educational Resources and Support

Interactive Brokers understands the importance of education and support for traders. They offer a comprehensive library of articles, videos, and webinars covering all aspects of forex trading. Additionally, their dedicated customer support team is available 24/7 to assist you with any queries or issues.

Section 6: Conclusion

Forex trading with Interactive Brokers offers a world of opportunities for both novice and experienced traders. With its advanced platform, diverse trading instruments, risk management tools, and educational resources, Interactive Brokers empowers traders to navigate the forex market with confidence.

If you’re eager to delve deeper into the world of forex trading, we encourage you to explore our other articles on related topics. Our team of experts are passionate about sharing knowledge and helping traders succeed in this dynamic and rewarding field.

Table: Summary of Interactive Brokers Forex Trading Features

| Feature | Description |

|---|---|

| Platform | Trader Workstation (TWS) and mobile app |

| Trading Instruments | Major, minor, and exotic currency pairs |

| Trading Strategies | Trend following, scalping, range trading, news trading |

| Risk Management | Stop-loss orders, take-profit orders, position sizing |

| Market Depth and Liquidity | Real-time bid and ask prices |

| Commission and Fees | Flat commission per million traded |

| Educational Resources | Articles, videos, webinars, customer support |

FAQ about Forex Trading with Interactive Brokers

What is Forex Trading?

Forex trading, also known as currency trading, involves buying and selling different currencies with the aim of profiting from exchange rate fluctuations.

Why Trade Forex with Interactive Brokers?

Interactive Brokers (IB) is a renowned brokerage firm that offers low trading fees, a wide range of currency pairs, and advanced trading tools for forex traders.

How do I Open a Forex Trading Account with IB?

You can open an account on the IB website by providing personal information, trading experience, and funding the account.

What Currencies Can I Trade with IB?

IB allows trading in over 100 currency pairs, including major pairs (e.g., EUR/USD), minor pairs, and exotic pairs (e.g., USD/ZAR).

What Leverage Options are Available?

IB offers leverage options ranging from 1:1 (no leverage) to 100:1, allowing traders to amplify their potential returns but also their potential risks.

What Trading Platform Does IB Use?

IB provides the Trader Workstation (TWS) platform, which offers advanced charting tools, technical analysis indicators, and risk management features.

How Do I Deposit and Withdraw Funds?

IB accepts various payment methods, including bank wire transfers, credit/debit cards, and e-wallets. Withdrawal requests are typically processed within 1-2 business days.

What Fees and Commissions are Involved?

IB charges competitive trading fees based on the currency pair and volume traded. Non-trading fees may also apply, such as account maintenance fees and regulatory fees.

Is Forex Trading Right for Me?

Forex trading involves significant risks and requires careful consideration of your financial situation and risk tolerance. It’s recommended to seek professional advice before starting to trade.

Where Can I Get Help with Forex Trading?

IB provides educational resources, FAQs, and live customer support to assist clients with their forex trading endeavors.