Introduction

Greetings, readers! Are you searching for an in-depth understanding of the enigmatic term "spread" in the realm of forex trading? Well, you’ve come to the right place. In this comprehensive guide, we will delve into the intricacies of forex spreads, empowering you with the knowledge to navigate the trading landscape with confidence and precision.

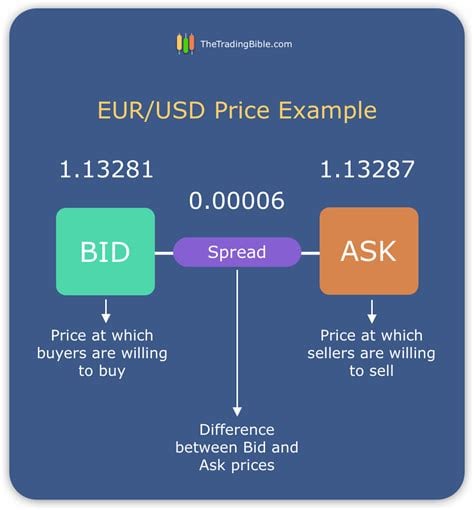

So, what exactly is a spread? It’s a fee, a commission, that is charged by your forex broker for executing your trades. It’s the difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy). Spreads are how forex brokers make money, and they can vary significantly depending on the broker, currency pair, and market conditions.

Spreads in Forex Trading

Fixed vs. Variable Spreads

There are two main types of spreads in forex trading: fixed and variable. Fixed spreads remain constant, regardless of market conditions, while variable spreads fluctuate with the market. Fixed spreads are typically offered by market makers, while variable spreads are offered by ECN (Electronic Communication Network) brokers.

Raw vs. Marked-up Spreads

Raw spreads are the spreads that are actually charged by the liquidity providers or market makers. Marked-up spreads are raw spreads that have been increased by the broker. The markup is how some brokers make money, so it’s important to be aware of this before choosing a broker.

Factors Affecting Spreads

Currency Pair

The currency pair you’re trading can have a big impact on the spread. Major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, typically have tighter spreads than minor currency pairs or exotic currency pairs. This is because major currency pairs are more heavily traded, which creates more liquidity and tighter spreads.

Market Conditions

Market conditions can also affect spreads. During volatile market conditions, spreads can widen significantly. This is because liquidity can dry up, making it more difficult for brokers to find counterparties to fill your trades.

Broker

The broker you choose can also have a big impact on the spreads you pay. Some brokers offer lower spreads than others, so it’s important to compare spreads before choosing a broker.

Forex Spreads Table

The following table provides a breakdown of spreads for different currency pairs and broker types:

| Currency Pair | Market Maker Spread | ECN Spread |

|---|---|---|

| EUR/USD | 1-2 pips | 0.5-1 pips |

| GBP/USD | 1-3 pips | 0.8-2 pips |

| USD/JPY | 1-4 pips | 0.7-3 pips |

| AUD/USD | 1-5 pips | 0.9-4 pips |

| NZD/USD | 1-6 pips | 1-5 pips |

Conclusion

Understanding forex spreads is essential for successful trading. By choosing the right broker and currency pair, and by being aware of the factors that affect spreads, you can minimize the impact of spreads on your trading profitability.

If you’re interested in learning more about forex trading, check out our other articles on forex basics, trading strategies, and risk management. We’ve got everything you need to get started with forex trading and achieve your financial goals.

FAQ about Forex Spread

What is forex spread?

Forex spread is the difference between the bid price and the ask price of a currency pair. It represents the cost of executing a trade.

How is forex spread calculated?

Forex spread is usually expressed in pips, which are the smallest unit of measurement for currency pairs. The spread is typically a fixed amount, but it can vary depending on market conditions.

Why does forex spread matter?

Forex spread is important because it affects the profitability of your trades. A higher spread means a higher cost of trading, which can reduce your profits.

What is the average forex spread?

The average forex spread for a major currency pair is typically around 1-2 pips. However, it can be higher or lower depending on the currency pair and market conditions.

How can I reduce forex spread?

There are a few ways to reduce forex spread. One way is to trade with a broker that offers tight spreads. Another way is to trade during market hours when liquidity is high.

What is the difference between fixed and variable forex spread?

Fixed spreads are set by the broker and do not change. Variable spreads fluctuate based on market conditions.

What is a pip?

A pip (point in percentage) is the smallest unit of measurement for currency pairs. It represents a change of 0.01% in the value of a currency pair.

What is a stop loss order?

A stop loss order is an order to sell or buy a currency pair when it reaches a certain price. This order is used to limit losses in case the market moves against you.

What is a take profit order?

A take profit order is an order to sell or buy a currency pair when it reaches a certain price. This order is used to lock in profits in case the market moves in your favor.

What is a swap?

A swap is a fee that is charged when you hold a position overnight. This fee is typically charged by the broker and is based on the interest rate differential between the two currencies in the pair.