GECU Loan Overview

GECU offers a comprehensive suite of loan products tailored to meet diverse financial needs. Whether you’re looking to purchase a home, finance a vehicle, or consolidate debt, GECU has a loan solution designed to fit your circumstances.

Our loan offerings include:

- Mortgage loans: Fixed-rate and adjustable-rate mortgages for home purchases and refinances.

- Auto loans: New and used car loans with competitive interest rates and flexible terms.

- Personal loans: Unsecured loans for various purposes, including debt consolidation, home improvements, and unexpected expenses.

- Student loans: Private student loans to help cover the cost of education.

Loan Terms, Interest Rates, and Fees

Loan terms, interest rates, and fees vary depending on the loan type, your creditworthiness, and other factors. Our experienced loan officers will work with you to determine the most suitable loan options and provide personalized loan terms.

Eligibility Requirements and Application Process

To be eligible for a GECU loan, you must meet certain requirements, such as having a good credit score, stable income, and a positive payment history. The application process is straightforward and can be completed online or at any of our branch locations. Our team is dedicated to providing a seamless and efficient loan application experience.

GECU Loan Benefits

GECU offers a plethora of advantages that set its loans apart from competitors. These benefits are tailored to enhance the borrowing experience and provide financial flexibility.

One of the key advantages of GECU loans is their competitive interest rates. GECU understands the financial constraints faced by its members and strives to offer rates that are both competitive and affordable. This can result in significant savings over the life of the loan.

Flexible Repayment Options

GECU recognizes that every borrower has unique financial circumstances. To accommodate these diverse needs, GECU offers a range of flexible repayment options. Borrowers can choose from various loan terms and repayment schedules that align with their budget and cash flow. This flexibility allows borrowers to tailor their loan to their specific financial situation, ensuring a comfortable and manageable repayment process.

Special Perks and Rewards

GECU goes beyond competitive rates and flexible repayment options by offering special perks and rewards to its loan holders. These perks may include discounts on other GECU products and services, such as checking and savings accounts. Additionally, GECU may offer loyalty programs that reward long-standing members with exclusive benefits and incentives.

GECU Loan Application Process

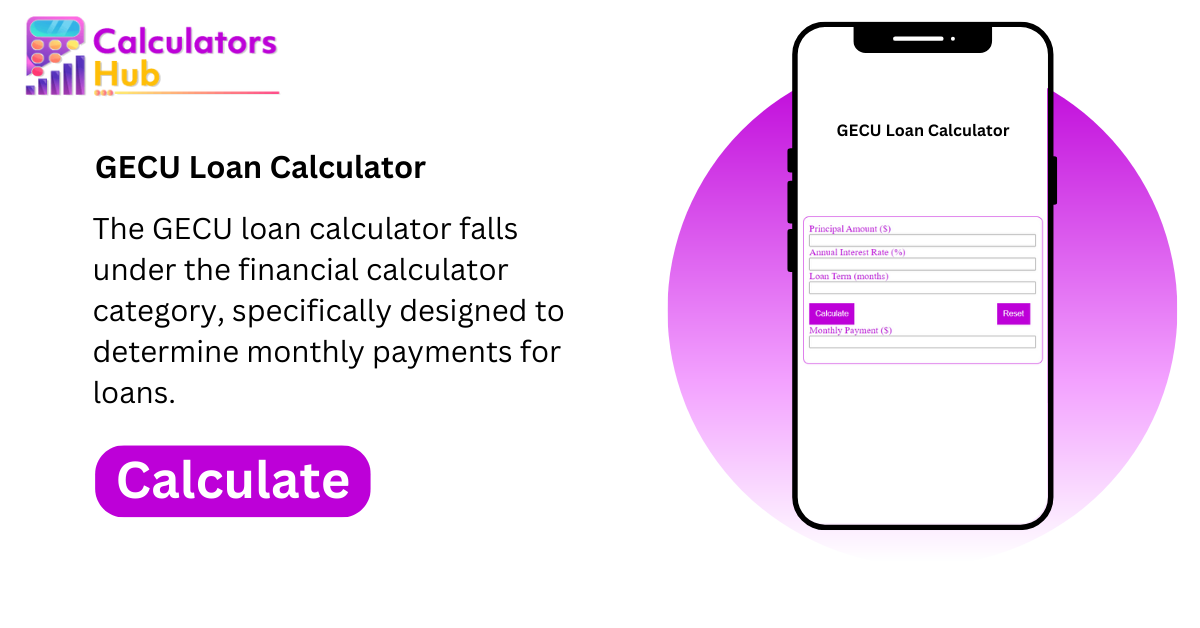

Applying for a GECU loan is a straightforward process that can be completed online or in person. Follow these steps to get started:

Step 1: Gather Required Documents and Information

Before you begin your application, gather the following documents and information:

| Document/Information | Description |

|---|---|

| Proof of Income | Pay stubs, tax returns, or bank statements |

| Proof of Identity | Driver’s license, passport, or state ID |

| Proof of Address | Utility bill, lease agreement, or mortgage statement |

| Loan Amount and Purpose | The amount you need to borrow and what you plan to use it for |

Step 2: Choose Your Loan Option

GECU offers a variety of loan options to meet your specific needs. Visit the GECU website or speak to a loan officer to learn more about the different options available.

Step 3: Submit Your Application

Once you have gathered the required documents and information, you can submit your application online or in person.

Online Application:

- Visit the GECU website and click on the “Loans” tab.

- Select the loan option that you are interested in.

- Complete the online application form and submit it.

In-Person Application:

- Visit a GECU branch and speak to a loan officer.

- Provide the loan officer with the required documents and information.

- Complete the loan application form with the assistance of the loan officer.

Step 4: Loan Approval

Once you have submitted your application, GECU will review your information and make a decision on your loan request. You will be notified of the decision within a few business days.

GECU Loan Repayment

GECU offers multiple convenient methods to repay your loan, ensuring a seamless and timely repayment process.

Automatic Payment Options

Automate your loan payments to avoid missed due dates and potential late fees. You can set up automatic payments through:

– Online Banking: Log in to your GECU online banking account and schedule recurring payments.

– Phone Banking: Call GECU’s automated phone banking system and set up automatic payments over the phone.

Online Banking Services

GECU’s online banking platform provides secure and efficient ways to manage your loan payments:

– View Loan Details: Access your loan account information, including balance, due date, and payment history.

– Make One-Time Payments: Initiate manual payments whenever convenient.

– Set Payment Reminders: Receive email or text message notifications prior to your due date.

Late Payment Penalties and Consequences

Timely loan payments are crucial to maintain a good credit score and avoid penalties. Late payments may result in:

– Late Payment Fees: GECU charges a late payment fee for missed or overdue payments.

– Impact on Credit Score: Late payments can negatively affect your credit score, making it harder to secure loans or favorable interest rates in the future.

– Default Status: Persistent late payments can lead to loan default, which can have severe consequences, including repossession or foreclosure.

GECU Loan Customer Service

GECU is committed to providing exceptional customer service to its loan borrowers. With a dedicated team of loan specialists, GECU ensures that you receive prompt and efficient assistance with your loan inquiries and concerns.

Whether you have questions about your loan application, account balance, or repayment options, GECU offers multiple channels for you to connect with its customer support team.

Contact Information

- Phone: (800) 693-4328

- Email: loansupport@gecu.org

- Live Chat: Available on the GECU website during business hours

Self-Service Options

In addition to direct contact with customer support, GECU provides a range of self-service options for your convenience:

- Online Banking: Access your loan account, view statements, and make payments securely online.

- Mobile Banking: Manage your loan on the go with the GECU mobile app.

- FAQs: Find answers to common loan-related questions on the GECU website.

GECU Loan Comparison

Comparing GECU loans to similar products offered by other financial institutions can provide valuable insights into the advantages and disadvantages of choosing GECU. This comparison highlights key differences in interest rates, fees, and features, empowering you to make informed decisions about your financial needs.

To provide a comprehensive comparison, we have compiled a table outlining the key aspects of GECU loans alongside similar products from reputable financial institutions. By analyzing this table, you can identify the most suitable option for your specific circumstances.

Interest Rates and Fees

Interest rates and fees are crucial factors to consider when comparing loans. GECU offers competitive interest rates that are generally lower than those charged by other financial institutions. Additionally, GECU may offer discounts or reduced rates to members who meet certain criteria, such as maintaining a high credit score or having a long-standing relationship with the credit union.

In terms of fees, GECU typically charges lower origination fees and annual fees compared to other lenders. These fees can add up over time, so it’s important to factor them into your decision-making process.

Loan Features and Flexibility

GECU loans come with a range of features that enhance their flexibility and convenience. These features include:

- Flexible loan terms: GECU offers a variety of loan terms to suit different needs, allowing you to choose the repayment period that best aligns with your financial situation.

- Multiple loan options: GECU provides a diverse portfolio of loan products, including personal loans, auto loans, home loans, and student loans. This allows you to consolidate your debts or access funds for various purposes under one roof.

- Online loan management: GECU’s online platform and mobile app offer convenient access to your loan account, enabling you to make payments, track your balance, and manage your loan details at your fingertips.

Customer Service and Support

GECU is renowned for its exceptional customer service. The credit union’s dedicated team of loan specialists is available to assist you throughout the loan process, from application to repayment. GECU also provides comprehensive online resources and FAQs to empower you with the information you need to make informed decisions.