How can I start trading stocks? It’s a question many ask, dreaming of financial freedom and potential wealth. The world of stock trading can seem daunting, but it’s not as complicated as it may appear. This guide will walk you through the basics, from understanding stock markets to developing a trading strategy and managing your portfolio.

Think of it like learning any new skill – it takes time, effort, and the right tools. You’ll need to understand the fundamentals, develop a plan, and be prepared for the ups and downs of the market. But with the right approach, you can navigate the world of stocks and potentially achieve your financial goals.

Understanding the Basics of Stock Trading

Before you dive into the world of stock trading, it’s crucial to grasp the fundamentals. Understanding how stock markets operate, key terminology, and the roles of brokers and exchanges will equip you with the knowledge to make informed investment decisions.

Types of Stock Markets

The stock market is where buyers and sellers come together to trade shares of publicly listed companies. There are various stock markets worldwide, each with its own rules and regulations. Here are two prominent examples:

- New York Stock Exchange (NYSE): The NYSE is a physical exchange located in New York City. It is the largest stock exchange in the world by market capitalization, and it hosts some of the most well-known companies.

- NASDAQ (National Association of Securities Dealers Automated Quotations): NASDAQ is an electronic exchange, meaning trading happens electronically. It’s known for its focus on technology companies, including many of the biggest names in Silicon Valley.

Key Stock Market Terminology

Familiarizing yourself with key stock market terms is essential for understanding the language of trading:

- Stocks: Stocks represent ownership in a company. When you buy a stock, you’re essentially purchasing a small piece of that company.

- Shares: Shares are individual units of ownership in a company. One share represents a fraction of the company’s ownership.

- Dividends: Dividends are payments made by companies to their shareholders from their profits. They are typically paid quarterly or annually.

- Trading Volume: Trading volume refers to the number of shares of a particular stock that are traded during a specific period. High trading volume can indicate strong investor interest.

Brokers and Exchanges

Brokers and exchanges play critical roles in facilitating stock trading:

- Brokers: Brokers are intermediaries who connect buyers and sellers of stocks. They provide platforms for trading, research tools, and account management services.

- Exchanges: Exchanges are marketplaces where stocks are bought and sold. They provide a centralized platform for trading and ensure transparency and fairness.

Opening a Brokerage Account

To start trading stocks, you’ll need to open a brokerage account. Here’s a step-by-step guide:

- Choose a Broker: Research different brokers and compare their fees, trading platforms, and research tools.

- Provide Personal Information: You’ll need to provide personal details, such as your name, address, and Social Security number.

- Fund Your Account: Deposit money into your account to start trading.

- Start Trading: Once your account is funded, you can begin buying and selling stocks.

Developing a Trading Strategy

Before you jump into the exciting world of stock trading, you need a solid plan, a roadmap to guide your decisions and keep you on track. This is where a trading strategy comes in. It’s like a playbook, outlining your approach to the market, how you’ll choose stocks, and how you’ll manage your risk.

Types of Trading Strategies

Different trading strategies cater to different investment goals and risk appetites. Here are a few popular options:

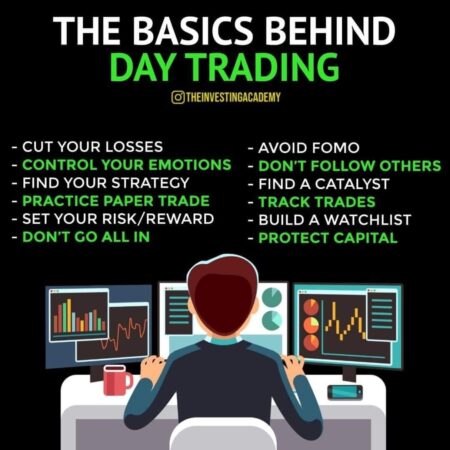

- Day Trading: This strategy involves buying and selling stocks within the same trading day. Day traders aim to capitalize on short-term price fluctuations, often using technical analysis to identify trends and patterns. This approach requires significant time commitment, close monitoring of market movements, and a high tolerance for risk.

- Swing Trading: Swing traders hold stocks for a few days to a few weeks, aiming to profit from price swings or corrections. They use a combination of technical and fundamental analysis to identify potential entry and exit points. Swing trading is less demanding than day trading, but it still requires active monitoring and a good understanding of market dynamics.

- Value Investing: This strategy focuses on finding undervalued stocks with strong fundamentals and holding them for the long term. Value investors believe that the market eventually recognizes the true value of these companies, leading to price appreciation. This approach emphasizes fundamental analysis, such as analyzing financial statements and assessing the company’s management, competitive landscape, and future growth prospects.

Risk Management and Stop-Loss Orders

Risk management is crucial in trading, as even the best strategies can encounter unexpected market fluctuations. Setting stop-loss orders is a key risk management tool. A stop-loss order automatically sells your stock if it reaches a predetermined price, limiting your potential losses.

“Stop-loss orders are like safety nets, preventing you from falling too far.”

Choosing Stocks to Invest In

Selecting the right stocks is essential for successful trading. Consider these key factors:

- Company Fundamentals: Analyze the company’s financial statements, revenue growth, profitability, debt levels, and cash flow. Look for companies with strong fundamentals and a sustainable business model.

- Market Trends: Understand the broader market conditions, including economic indicators, interest rates, and investor sentiment. Consider whether the stock is aligned with the overall market direction.

- Industry Analysis: Research the industry in which the company operates, its competitive landscape, and growth potential. Look for industries with favorable long-term prospects.

Technical and Fundamental Analysis

Two primary methods of stock analysis are technical and fundamental analysis.

- Technical Analysis: This method uses historical price data and trading volume to identify patterns and trends. Technical analysts believe that past price movements can predict future price behavior. Common technical indicators include moving averages, relative strength index (RSI), and MACD.

- Fundamental Analysis: This method focuses on analyzing the company’s financial statements, management, competitive landscape, and industry outlook. Fundamental analysts believe that a company’s intrinsic value drives its stock price in the long run.

Choosing the Right Tools and Resources

Now that you have a basic understanding of the stock market and have developed a trading strategy, it’s time to choose the right tools and resources to execute your plan. This section will explore different online brokerage platforms, financial news sources, market data providers, and stock trading simulators to help you make informed decisions.

Online Brokerage Platforms

Online brokerage platforms are essential for buying and selling stocks. They provide the interface and tools needed to execute trades, manage your portfolio, and access market data. Here’s a comparison of popular platforms:

| Platform | Pros | Cons |

|---|---|---|

| Robinhood |

|

|

| TD Ameritrade |

|

|

| Fidelity |

|

|

Financial News Sources and Market Data Providers

Staying informed about market trends and company news is crucial for successful stock trading. Here are some essential resources:

- Financial News Websites:

- Bloomberg

- Reuters

- Wall Street Journal

- CNBC

- MarketWatch

- Market Data Providers:

- FactSet

- S&P Global Market Intelligence

- Bloomberg Terminal

- Refinitiv Eikon

Stock Trading Simulators and Educational Resources

Before risking real money, it’s essential to practice your trading skills in a risk-free environment. Stock trading simulators and educational resources can help you develop your strategies and gain confidence.

| Resource | Description |

|---|---|

| Investopedia Stock Simulator | Offers a virtual portfolio with $100,000 in virtual cash to practice trading stocks, options, and ETFs. |

| TD Ameritrade Thinkorswim Platform | Provides a robust platform with advanced charting tools, paper trading, and educational resources. |

| Wall Street Prep | Offers online courses and study materials for financial modeling, valuation, and investment banking. |

| Coursera Financial Markets Specialization | Provides a comprehensive curriculum on financial markets, investment strategies, and risk management. |

Managing Your Portfolio

Congratulations! You’ve taken the leap into the world of stock trading and learned the basics. Now, it’s time to talk about how to manage your hard-earned investments. This involves more than just buying and selling stocks – it’s about building a portfolio that aligns with your goals and risk tolerance, and then actively managing it over time.

Portfolio Diversification

Diversification is the cornerstone of sound investment strategy. It’s like spreading your bets across different horses in a race. By investing in a variety of assets, you reduce the risk of losing everything if one investment goes south. Here’s how diversification works in practice:

- Sector Diversification: Investing in companies from different industries (e.g., technology, healthcare, energy) helps you mitigate the impact of sector-specific downturns. If the tech sector takes a hit, your healthcare investments might still be performing well.

- Asset Class Diversification: Don’t put all your eggs in one basket. Invest in a mix of stocks, bonds, real estate, and even commodities. Stocks offer growth potential, bonds provide stability, real estate can generate rental income, and commodities like gold can act as a hedge against inflation.

- Geographic Diversification: Expanding your investments beyond your home country can help you capitalize on global growth opportunities and mitigate risks associated with a single economy.

Portfolio Rebalancing

Your portfolio isn’t a set-it-and-forget-it proposition. As your investments grow and market conditions change, the balance between your asset classes can shift. Rebalancing ensures that your portfolio remains aligned with your original investment goals and risk tolerance.

- Regularly Review Your Asset Allocation: Aim to rebalance your portfolio at least once a year, or more frequently if there are significant market fluctuations.

- Sell Overperforming Assets: If a particular asset class has grown significantly, consider selling some of it to bring your portfolio back to its desired balance.

- Buy Underperforming Assets: Use the proceeds from selling overperforming assets to buy more of the underperforming ones. This helps you maintain a balanced and diversified portfolio.

Managing Risk

Risk management is crucial for long-term investment success. It’s about understanding the potential downsides of your investments and taking steps to mitigate them. Here are some key strategies:

- Know Your Risk Tolerance: Are you comfortable with volatility, or do you prefer a more conservative approach? Your risk tolerance will influence your investment choices.

- Set Stop-Loss Orders: Stop-loss orders automatically sell your stock if it falls below a predetermined price, limiting your potential losses.

- Diversify Your Investments: As mentioned earlier, diversification helps spread your risk across different assets and sectors.

- Avoid Overtrading: Frequent buying and selling can lead to higher trading costs and emotional decisions. Stick to your investment strategy and avoid impulsive trades.

Common Mistakes New Traders Make, How can i start trading stocks

Learning from the mistakes of others is a valuable way to improve your trading skills. Here are some common pitfalls new traders often fall into:

- Chasing Returns: Don’t get caught up in the hype of hot stocks. Focus on investing in companies with strong fundamentals and long-term growth potential.

- Ignoring Risk: Every investment carries some level of risk. Don’t underestimate the potential for losses, and always have a plan for managing risk.

- Emotional Trading: Letting emotions like fear and greed drive your investment decisions can lead to poor results. Stick to your strategy and avoid impulsive trades.

- Lack of Research: Before investing in any company, thoroughly research its financials, management team, and industry outlook.

Tracking Your Portfolio Performance

Monitoring your portfolio’s performance is essential for making informed decisions. There are several ways to track your progress:

- Use a Portfolio Tracking App: Numerous apps and online platforms offer tools to monitor your investments, track returns, and analyze performance.

- Create a Spreadsheet: A simple spreadsheet can be used to manually track your investments, transactions, and returns.

- Review Your Statements Regularly: Your brokerage statements provide a detailed overview of your investment activity and performance.

Regularly reviewing your portfolio’s performance allows you to identify areas for improvement, adjust your investment strategy, and make informed decisions to achieve your financial goals.

Understanding the Risks of Stock Trading: How Can I Start Trading Stocks

Trading stocks can be a thrilling way to potentially grow your wealth, but it’s crucial to understand that it also comes with inherent risks. Like any investment, there’s no guarantee of profits, and you could lose some or all of your initial investment.

Market Volatility

The stock market is constantly fluctuating, influenced by various factors like economic news, company performance, and investor sentiment. This volatility can lead to sudden and unpredictable price swings, both upward and downward. A stock that was profitable one day could plummet the next, leading to significant losses if you’re not prepared.

Loss of Capital

The most significant risk in stock trading is the potential to lose your invested capital. While you can potentially make substantial profits, you also risk losing money if the stock price goes down. The amount you could lose depends on the price of the stock, the number of shares you own, and the extent of the price decline.

Other Risks

- Counterparty Risk: This refers to the risk that the broker or other financial institution you’re dealing with might default on their obligations, potentially leading to the loss of your funds.

- Operational Risk: This involves the risk of errors or failures in the trading process, such as misplacing orders or experiencing technical glitches, which can result in financial losses.

- Liquidity Risk: Some stocks are less actively traded, making it difficult to buy or sell them quickly at a desired price. This can lead to losses if you need to sell a stock urgently.

Mitigating Risks

While risks are inherent in stock trading, you can take steps to mitigate them.

- Diversification: Investing in a variety of different stocks across different industries can help spread out your risk. If one stock performs poorly, others might offset the losses.

- Stop-Loss Orders: These orders automatically sell your stock if it falls below a certain price, limiting your potential losses. It’s important to set stop-loss orders at a level that makes sense for your investment strategy and risk tolerance.

- Thorough Research: Before investing in any stock, conduct thorough research on the company’s financial performance, industry trends, and competitive landscape. This can help you make informed decisions and avoid investing in companies with high risks.

- Invest Only What You Can Afford to Lose: One of the most important principles of investing is to never invest more than you can afford to lose. This helps you avoid financial distress if your investments don’t perform as expected.

Understanding Trading Risks

| Risk Type | Potential Consequences |

|---|---|

| Market Volatility | Sudden and unpredictable price swings, leading to potential losses. |

| Loss of Capital | The possibility of losing some or all of your invested capital. |

| Counterparty Risk | Loss of funds due to the default of your broker or financial institution. |

| Operational Risk | Financial losses due to errors or failures in the trading process. |

| Liquidity Risk | Difficulty selling stocks quickly at a desired price, potentially leading to losses. |

Seeking Professional Advice

While learning the ropes of stock trading is empowering, sometimes seeking guidance from a financial advisor can be a smart move. Financial advisors can provide valuable insights and help you navigate the complexities of the market.

Benefits of Seeking Professional Advice

A financial advisor can offer several benefits:

- Objective Perspective: They provide an unbiased viewpoint on your investment decisions, helping you avoid emotional biases that can lead to poor choices.

- Expertise and Knowledge: They possess in-depth knowledge of the financial markets, investment strategies, and economic trends.

- Personalized Guidance: They tailor their advice to your specific financial goals, risk tolerance, and time horizon.

- Portfolio Management: They can manage your portfolio, rebalancing it as needed and adjusting your investment strategy based on market changes.

- Financial Planning: They can assist with broader financial planning, including retirement planning, estate planning, and tax optimization.

Finding Reputable Financial Professionals

Finding a trustworthy financial advisor is crucial. Consider these resources:

- Professional Organizations: The Financial Planning Association (FPA), the Certified Financial Planner Board of Standards (CFP Board), and the National Association of Personal Financial Advisors (NAPFA) are reputable organizations that offer directories of certified financial planners.

- Referrals: Ask friends, family, and colleagues for recommendations.

- Online Resources: Websites like Investopedia and NerdWallet provide resources and guides for finding financial advisors.

Types of Financial Advice

Financial advisors offer a range of services:

- Investment Planning: They help you develop an investment plan aligned with your goals and risk tolerance.

- Portfolio Management: They actively manage your investment portfolio, making buy and sell decisions based on market conditions and your investment objectives.

- Retirement Planning: They assist in planning for your retirement, ensuring you have enough savings to meet your needs.

- Estate Planning: They help you create a plan for the distribution of your assets after your death.

- Tax Optimization: They advise on tax strategies to minimize your tax liability.

Understanding Your Investment Goals and Risk Tolerance

Before seeking professional advice, it’s essential to have a clear understanding of your investment goals and risk tolerance:

- Investment Goals: What are your financial objectives? Are you saving for retirement, a down payment on a house, or your child’s education?

- Risk Tolerance: How comfortable are you with the possibility of losing money? Are you a conservative investor who prefers low-risk investments, or are you more aggressive and willing to take on higher risk for the potential of greater returns?

“It’s important to remember that financial advisors are not miracle workers. They can provide guidance and expertise, but ultimately, you are responsible for your own financial decisions.”

Closing Summary

The journey of learning how to trade stocks is an ongoing one. It requires patience, discipline, and a willingness to learn. Remember, there’s no magic formula, but with the right knowledge, resources, and a solid plan, you can build a strong foundation for successful stock trading.

Popular Questions

What is the minimum amount I need to start trading stocks?

There’s no set minimum amount. Many brokerage platforms allow you to start with as little as a few dollars. However, it’s important to invest only what you can afford to lose.

How do I choose the right brokerage account for me?

Consider factors like fees, trading tools, research options, and customer support. It’s also helpful to compare different platforms and read reviews.

What are some common mistakes new traders make?

Overtrading, chasing trends, not diversifying, and not managing risk effectively are common mistakes. It’s essential to learn from others’ experiences and avoid these pitfalls.

Is it better to invest in individual stocks or ETFs?

It depends on your investment goals and risk tolerance. ETFs offer diversification and lower fees, while individual stocks can provide higher potential returns.

How can I stay up-to-date on market news and trends?

Follow reputable financial news sources, subscribe to market analysis newsletters, and use online tools to track market data and trends.