How do i purchase stocks – So you want to get in on the stock market, huh? That’s awesome! Buying stocks can be a great way to grow your money, but it can also be a little intimidating if you’re new to it. Don’t worry, though, it’s not as complicated as it seems. This guide will walk you through the whole process, from understanding the basics to actually placing your first order.

First things first, you need to understand what stocks actually are. They’re basically tiny pieces of ownership in a company. When you buy a stock, you’re basically becoming a part-owner of that company. And just like any other business, companies can do well or they can do poorly. If a company does well, the value of its stock goes up, and you make money. If it does poorly, the value of its stock goes down, and you lose money. It’s a bit of a gamble, but it can be a really rewarding one if you do your research and play your cards right.

Understanding Stock Basics: How Do I Purchase Stocks

Before diving into the exciting world of buying stocks, it’s crucial to understand the fundamentals. This section will cover the different types of stocks, the concept of ownership, and key metrics that investors use to evaluate stocks.

Types of Stocks

There are two main types of stocks: common stock and preferred stock.

- Common Stock: The most common type of stock, representing ownership in a company. Common stockholders have voting rights and can share in the company’s profits through dividends. However, they are also the last in line to receive assets if the company goes bankrupt.

- Preferred Stock: A type of stock that offers certain advantages over common stock. Preferred stockholders typically receive a fixed dividend payment and have priority over common stockholders in receiving assets if the company liquidates. However, they usually don’t have voting rights.

Stock Ownership and its Benefits

Owning stock means you have a piece of a company. This ownership comes with various benefits, including:

- Potential for Capital Appreciation: As the company grows and its stock price increases, your investment can appreciate in value.

- Dividend Payments: Some companies distribute a portion of their profits to shareholders in the form of dividends.

- Voting Rights: Common stockholders have the right to vote on important company decisions, such as electing the board of directors.

- Potential for Tax Advantages: Long-term capital gains from stock investments are typically taxed at a lower rate than ordinary income.

Key Stock Metrics

Investors use various metrics to evaluate stocks and make informed investment decisions. Some of the most common metrics include:

- Market Capitalization (Market Cap): The total value of a company’s outstanding shares. It’s calculated by multiplying the current share price by the number of outstanding shares.

Market Cap = Share Price x Number of Outstanding Shares

- Price-to-Earnings Ratio (P/E Ratio): A measure of a company’s valuation relative to its earnings. It’s calculated by dividing the current share price by the company’s earnings per share.

P/E Ratio = Share Price / Earnings Per Share

Choosing a Brokerage Account

Before you can start investing in stocks, you’ll need to choose a brokerage account. A brokerage account is like a bank account for your investments. It allows you to buy, sell, and hold stocks and other securities.

There are many different brokerage platforms available, and each one has its own features, fees, and benefits. So how do you choose the right one for you? Let’s explore the key differences and considerations.

Types of Brokerage Accounts

Choosing a brokerage account involves understanding the different types available. The two primary categories are online brokers and full-service brokers.

- Online brokers are typically digital platforms that offer a streamlined, self-directed approach to investing. They usually have lower fees and offer a wide range of investment options. Popular examples include Robinhood, TD Ameritrade, and Fidelity.

- Full-service brokers, on the other hand, provide a more personalized experience with access to financial advisors. They often cater to investors who require more guidance and hands-on support. These brokers usually have higher fees and might not offer as many investment options as online brokers.

Features and Fees, How do i purchase stocks

Once you’ve considered the type of brokerage, you’ll need to delve into specific features and associated fees.

- Trading platform: Online brokers often offer user-friendly platforms with advanced charting tools, research resources, and real-time market data. Some platforms may have mobile apps for on-the-go trading. Full-service brokers may have dedicated platforms or rely on traditional methods like phone calls and in-person meetings.

- Investment options: Different brokers offer varying investment options. Online brokers generally provide access to a wider range of stocks, ETFs, mutual funds, and even options trading. Full-service brokers might have more limited options, focusing on traditional investments.

- Fees: Fees can vary significantly depending on the brokerage and the type of account. Common fees include commission fees (charged per trade), account maintenance fees, inactivity fees, and fees for research and data. Online brokers generally have lower fees compared to full-service brokers.

- Minimum deposit: Some brokers may require a minimum deposit to open an account. This can range from zero to several thousand dollars, depending on the broker and account type.

- Research and education: Both online and full-service brokers may offer research tools, market analysis, and educational resources. The extent and quality of these resources can vary significantly.

Choosing the Right Brokerage

Choosing a brokerage that aligns with your investment goals and risk tolerance is crucial. Here are some tips to help you make the right decision:

- Define your investment goals: Are you looking for long-term growth, income generation, or short-term trading? Your goals will influence the type of brokerage and investment options you need.

- Assess your risk tolerance: How comfortable are you with market volatility? Your risk tolerance will help you choose a brokerage that offers appropriate investment options and research tools.

- Compare fees and features: Use online comparison tools to compare fees, investment options, and platform features across different brokerages. Make sure to consider the overall cost of investing, including trading commissions, account maintenance fees, and other charges.

- Read reviews and testimonials: Check online reviews and testimonials from other investors to get a sense of the customer experience with different brokerages. Look for reviews that address the specific features and services that are important to you.

- Consider your investment experience: If you’re a beginner, a full-service broker with financial advisors might be a good option. However, if you’re comfortable with self-directed investing, an online broker might be a better choice.

Placing a Stock Order

Now that you have a brokerage account and understand the basics of stocks, it’s time to learn how to actually buy and sell them. This is where placing an order comes in. Placing an order is essentially telling your brokerage how and when you want to buy or sell a specific stock.

Types of Stock Orders

The type of order you place determines how your trade is executed. Understanding the different types of orders is crucial for ensuring your trades are executed in a way that aligns with your investment goals.

- Market Order: A market order is the most common type of order. It instructs your brokerage to buy or sell a stock at the best available price at the moment the order is placed. This is a good option if you want to execute a trade quickly, but it doesn’t guarantee you’ll get the price you want. Market orders are best for when you want to buy or sell a stock as soon as possible and you’re not concerned about getting the best possible price.

- Limit Order: A limit order allows you to specify the maximum price you’re willing to pay for a stock (for a buy order) or the minimum price you’re willing to sell a stock for (for a sell order). If the stock price doesn’t reach your specified limit, your order won’t be executed. Limit orders are ideal for investors who want to buy or sell a stock at a specific price or better. This can help you avoid paying too much or selling too low, but it may also mean your order doesn’t get filled if the stock price doesn’t reach your limit.

- Stop-Loss Order: A stop-loss order is a type of limit order that automatically triggers a market order when the stock price falls below a certain level. This helps to limit your losses if the stock price drops significantly. It’s important to note that stop-loss orders are not foolproof, as the stock price may continue to fall below your stop-loss price before the order is filled.

Placing a Stock Order Through a Brokerage Platform

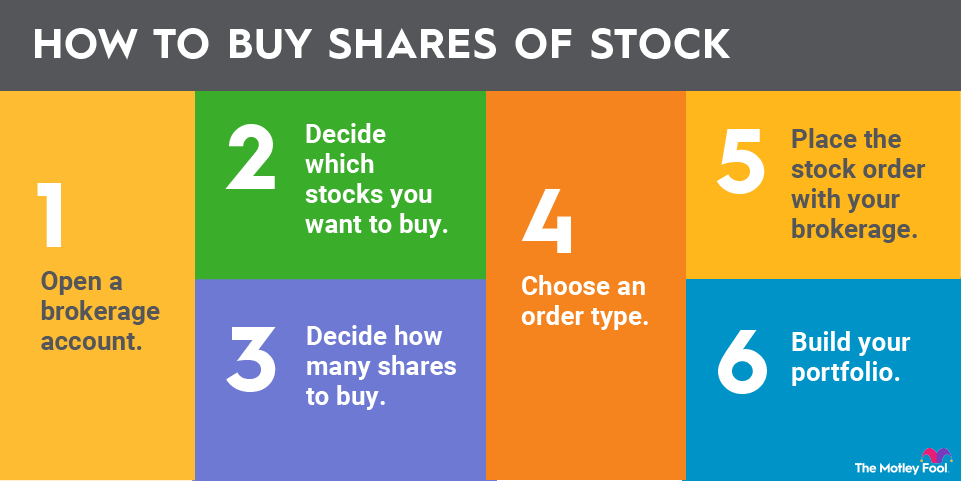

Placing a stock order is a straightforward process that can be done through your brokerage platform. Here’s a step-by-step guide:

- Log in to your brokerage account. This will take you to your brokerage platform’s dashboard, where you can manage your account, place trades, and view your portfolio.

- Search for the stock you want to trade. Most brokerage platforms have a search bar where you can enter the ticker symbol or company name of the stock you want to trade.

- Select the order type. This is where you’ll choose whether you want to place a market order, limit order, or stop-loss order.

- Enter the quantity of shares. This is the number of shares you want to buy or sell.

- Enter the limit price (if applicable). If you’re placing a limit order, you’ll need to enter the maximum price you’re willing to pay (for a buy order) or the minimum price you’re willing to sell for (for a sell order).

- Review your order details. Before you submit your order, make sure you’ve reviewed all the details carefully to ensure they’re correct.

- Submit your order. Once you’ve reviewed the order details, click the “Submit” or “Place Order” button to finalize your trade.

Conclusive Thoughts

So, there you have it. A quick and dirty guide to buying stocks. It’s definitely a good idea to do your research and get comfortable with the basics before you start investing, but it’s really not that complicated. Once you’ve got the hang of it, you’ll be buying stocks like a pro in no time. And remember, investing is a marathon, not a sprint. Don’t expect to get rich quick, but if you’re patient and play it smart, you can build a solid portfolio that will help you reach your financial goals.

Frequently Asked Questions

What are some of the risks associated with buying stocks?

The biggest risk is that the stock market can be volatile, and the value of your stocks can go down. There’s also the risk that the company you invest in might not do well, and you could lose some or all of your investment. It’s important to diversify your investments and not put all your eggs in one basket.

How much money do I need to start buying stocks?

You can start buying stocks with as little as a few hundred dollars. Many brokerages have no minimum investment requirements. Just remember, the more you invest, the more potential you have to earn.

What are some good resources for learning more about investing?

There are tons of resources out there for learning about investing. You can check out books, websites, and even online courses. A good place to start is the Securities and Exchange Commission (SEC) website. They have a lot of great information for beginners.

Is it better to buy stocks through an online broker or a full-service broker?

It depends on your needs and preferences. Online brokers are generally cheaper, but they don’t offer as much personalized advice as full-service brokers. If you’re new to investing, you might want to consider working with a full-service broker. But if you’re comfortable doing your own research, an online broker might be a better option for you.

How do I know which stocks to buy?

This is a tough question, and there’s no one-size-fits-all answer. You need to do your research and find stocks that you believe in. There are a lot of different factors to consider, such as the company’s financial health, its growth potential, and the overall market conditions. It’s also important to diversify your investments and not put all your eggs in one basket.