How to cash out stocks on cash app – So, you’ve been dabbling in the stock market with Cash App and you’re ready to cash out some of your gains? It’s a great feeling to see your investments grow, and Cash App makes it pretty easy to turn those digital stocks into real-world cash. This guide will walk you through the process of selling your stocks, withdrawing your funds, and understanding the tax implications.

We’ll cover everything from placing your sell order to choosing your withdrawal method. We’ll also talk about the tax implications of selling stocks, including short-term and long-term capital gains. By the end of this guide, you’ll have a clear understanding of how to cash out your stocks on Cash App and navigate the process with confidence.

Tax Implications of Cashing Out Stocks: How To Cash Out Stocks On Cash App

When you sell your stocks on Cash App, you’ll need to be aware of the tax implications. The IRS considers any profit you make from selling stocks a capital gain, which is subject to taxation. However, the tax rate you pay depends on how long you held the stock before selling it.

Capital Gains Tax Rates

The tax rate you pay on your capital gains depends on whether the gain is considered short-term or long-term.

- Short-term capital gains are realized when you sell stocks you’ve held for less than a year. These gains are taxed at your ordinary income tax rate, which can range from 10% to 37% depending on your income level.

- Long-term capital gains are realized when you sell stocks you’ve held for a year or longer. These gains are taxed at a lower rate, typically 0%, 15%, or 20%, depending on your income level.

Here’s a table comparing the tax rates for different capital gains brackets:

| Income Level | Short-Term Capital Gains Tax Rate | Long-Term Capital Gains Tax Rate |

|---|---|---|

| $0 – $10,275 | 10% | 0% |

| $10,276 – $41,775 | 12% | 0% |

| $41,776 – $89,075 | 22% | 15% |

| $89,076 – $170,050 | 24% | 15% |

| $170,051 – $215,950 | 32% | 20% |

| $215,951 – $539,900 | 35% | 20% |

| $539,901+ | 37% | 20% |

For example, if you sell stocks you’ve held for less than a year and make a profit of $1,000, you’ll be taxed on that profit at your ordinary income tax rate. If your income level falls between $41,776 and $89,075, your short-term capital gains tax rate will be 22%. You’ll owe $220 in taxes on your $1,000 profit.

Security and Safety Considerations

Cash App is known for its user-friendly interface and convenience, but it’s crucial to prioritize the security of your account and financial information. Just like any online platform, Cash App has its own security measures in place to protect your data. Let’s dive into the details.

Security Measures Implemented by Cash App

Cash App utilizes various security features to protect user accounts and transactions. These include:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring you to enter a unique code sent to your phone or email, in addition to your password, when logging in. 2FA significantly reduces the risk of unauthorized access to your account, even if your password is compromised.

- Biometric Authentication: Cash App allows you to use fingerprint or facial recognition for login, further enhancing security. This feature makes it difficult for unauthorized individuals to access your account, even if they have your phone.

- Encryption: All data transmitted between your device and Cash App servers is encrypted using industry-standard protocols. This means your financial information is protected from eavesdropping and unauthorized access during transmission.

- Fraud Detection and Prevention: Cash App employs advanced algorithms and security protocols to detect and prevent fraudulent activities. These systems monitor transactions in real-time and flag suspicious activity, helping to protect users from unauthorized withdrawals and scams.

Safeguarding Your Cash App Account

While Cash App implements robust security measures, it’s essential to take proactive steps to protect your account. Here are some key tips:

- Strong Passwords: Use a strong and unique password for your Cash App account, combining uppercase and lowercase letters, numbers, and symbols. Avoid using common words or personal information. It’s also recommended to use a password manager to store and manage your passwords securely.

- Enable Two-Factor Authentication: Always enable 2FA for your Cash App account. This significantly reduces the risk of unauthorized access, even if your password is compromised. Be cautious about enabling 2FA on public Wi-Fi networks to prevent potential vulnerabilities.

- Regularly Review Transactions: Keep a close eye on your Cash App activity. Review your transaction history regularly for any suspicious or unauthorized transactions. If you notice anything unusual, report it to Cash App immediately.

- Be Cautious of Phishing Scams: Be wary of emails, texts, or phone calls that appear to be from Cash App but request your personal information or ask you to click on suspicious links. Never provide your login credentials or financial information through unsolicited communication channels. Cash App will never ask you for this information through email, text, or phone calls.

- Use a Secure Wi-Fi Connection: When using Cash App, ensure you are connected to a secure and trusted Wi-Fi network. Avoid using public Wi-Fi networks for sensitive transactions, as they may be vulnerable to security breaches. Use a VPN to encrypt your internet traffic and add an extra layer of security.

- Keep Your Software Updated: Regularly update your Cash App application and your mobile device’s operating system. Updates often include security patches that address potential vulnerabilities.

Cash App Customer Support, How to cash out stocks on cash app

Cash App offers various customer support options to assist users with account issues, security concerns, and general inquiries. These options include:

- In-App Support: The Cash App mobile application provides a built-in support feature. You can access it by navigating to the “Support” section within the app. Here, you can find answers to frequently asked questions (FAQs) and submit inquiries directly to Cash App’s customer support team.

- Help Center: Cash App maintains a comprehensive help center on its website. This resource provides detailed information about various aspects of the platform, including security, account management, and troubleshooting. You can find answers to common questions and access articles and tutorials on a wide range of topics.

- Social Media: Cash App is active on social media platforms like Twitter and Facebook. You can contact them through their official accounts for assistance or to report issues. They typically respond to inquiries and messages promptly.

Ending Remarks

Cashing out stocks on Cash App is a straightforward process, but it’s important to understand the steps involved and the tax implications. By following our guide, you can ensure a smooth and hassle-free experience. Remember to consider your investment goals and tax situation when deciding when and how to cash out your stocks. Happy investing!

FAQ Corner

Can I cash out only a portion of my stock holdings?

Yes, you can sell a portion of your stock holdings. You’ll just need to specify the number of shares you want to sell in your order.

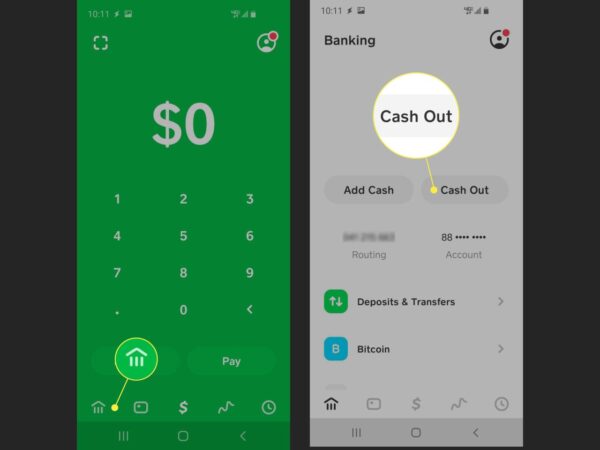

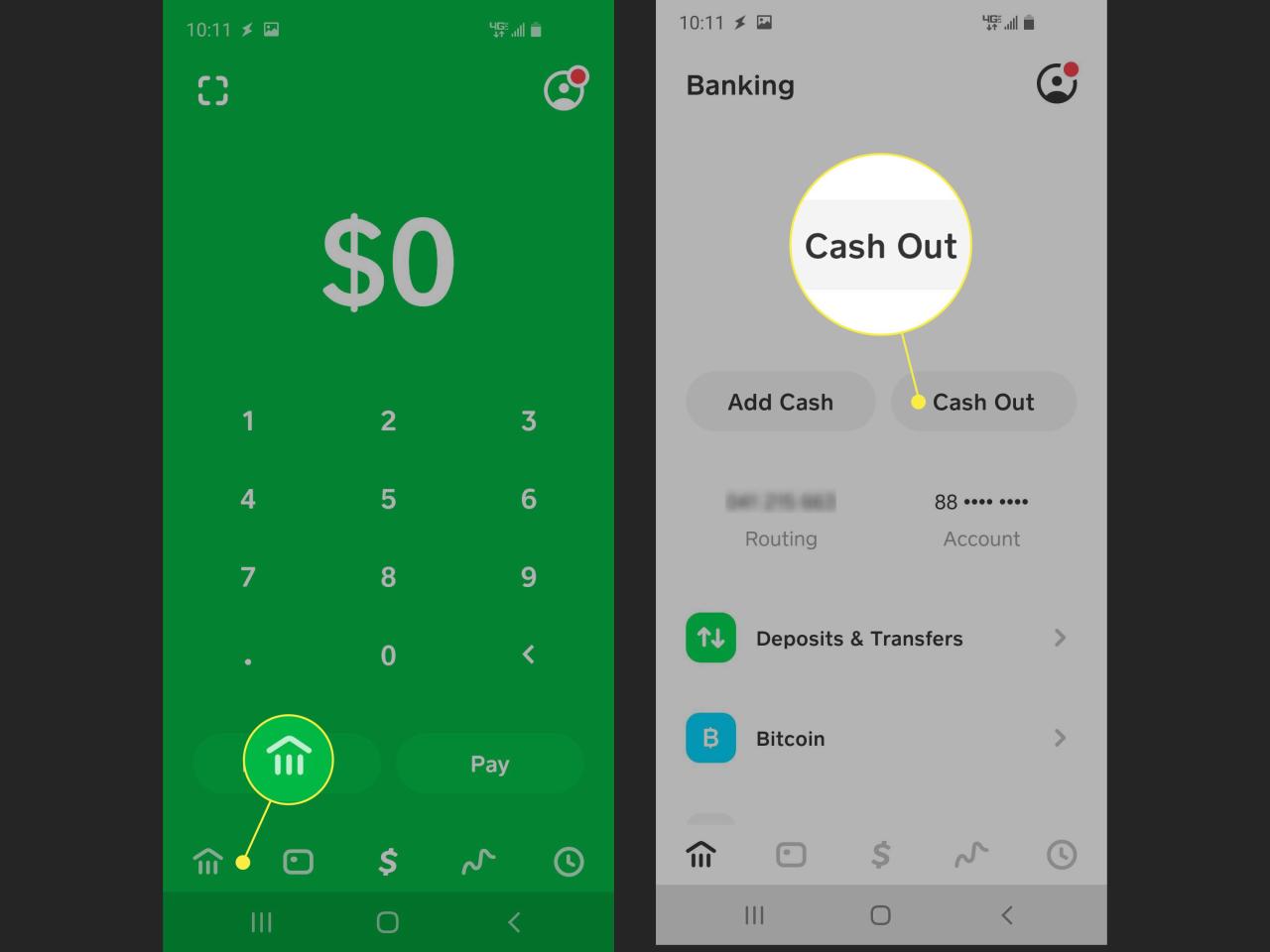

How long does it take to withdraw funds from Cash App?

The withdrawal time depends on the method you choose. Bank transfers usually take 1-3 business days, while debit card withdrawals are typically instant.

Are there any fees associated with withdrawing funds from Cash App?

Cash App typically doesn’t charge fees for withdrawals, but your bank may charge a fee for incoming transfers.

What happens if I forget my Cash App PIN?

If you forget your Cash App PIN, you can reset it through the app’s security settings. You’ll need to verify your identity to complete the reset.