How to read stock graphs? It’s a question many ask, especially those entering the world of investing. Understanding the language of stock charts can be like learning a new language, but with practice, you can decipher the stories they tell about companies and market trends. From the simple lines and bars to the intricate candlestick patterns, stock graphs offer a visual roadmap of a company’s performance, revealing potential opportunities and risks.

This guide breaks down the basics of stock charts, showing you how to identify key components, analyze price movements, and interpret technical indicators. Whether you’re a seasoned trader or just starting your investing journey, this guide will equip you with the knowledge to navigate the world of stock charts with confidence.

Understanding Stock Chart Basics

Stock charts are visual representations of a stock’s price movements over time. They are essential tools for investors and traders as they provide insights into a stock’s historical performance, current trends, and potential future movements. Understanding the different types of charts, their components, and how to interpret them is crucial for making informed investment decisions.

Types of Stock Charts

Stock charts are available in various formats, each offering a unique perspective on price action. The three most common types are line charts, bar charts, and candlestick charts.

- Line Charts: Line charts are the simplest type of stock chart. They connect closing prices of a stock over time with a continuous line, highlighting the overall trend. They are ideal for visualizing long-term price movements and identifying major trends.

- Bar Charts: Bar charts display a stock’s price range for a specific period, typically a day or a week. Each bar represents a specific time period, with the top of the bar indicating the highest price (high), the bottom indicating the lowest price (low), and a horizontal line within the bar showing the closing price. Bar charts provide more information than line charts, including the high, low, and closing prices, which can be useful for identifying price reversals and support/resistance levels.

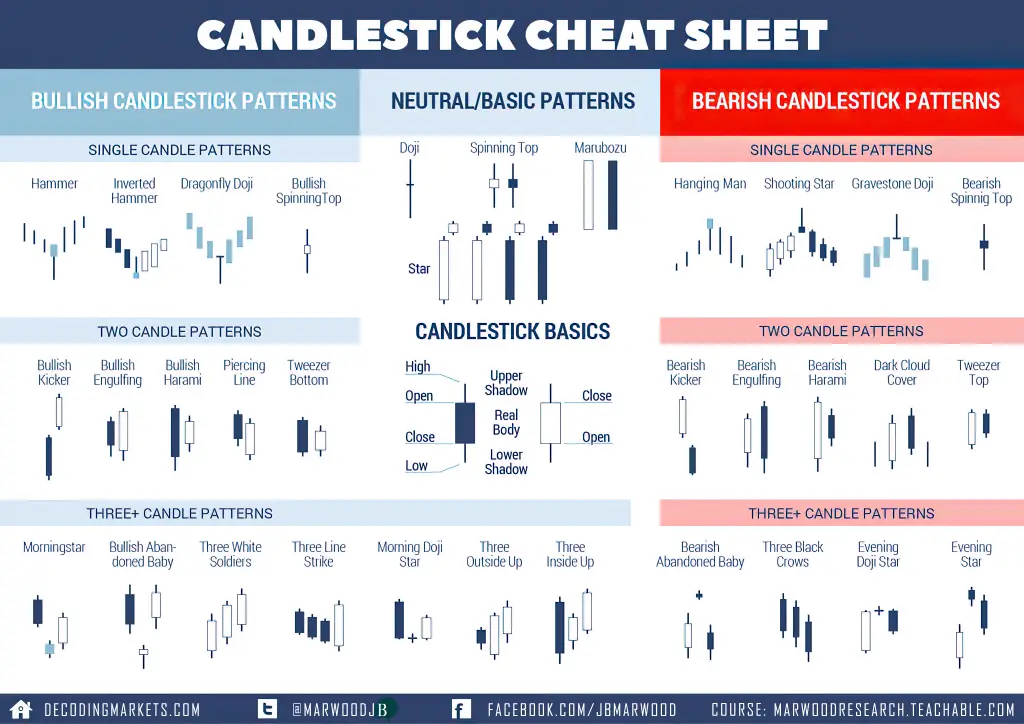

- Candlestick Charts: Candlestick charts are similar to bar charts but offer additional insights into price action. Each candlestick represents a specific time period and includes four key elements:

- Open: The price at which the stock opened for the period.

- Close: The price at which the stock closed for the period.

- High: The highest price the stock reached during the period.

- Low: The lowest price the stock reached during the period.

Candlestick charts are particularly useful for identifying patterns and signals that can help predict future price movements.

Key Components of a Stock Chart

Stock charts consist of several key components that provide crucial information about a stock’s performance. These components include:

- Price Axis: The vertical axis of a stock chart represents the price of the stock. It is typically scaled logarithmically, which means that equal distances on the axis represent equal percentage changes in price. This helps to visualize price movements more accurately, especially when dealing with large price swings.

- Time Axis: The horizontal axis of a stock chart represents time. It can be scaled in various ways, such as daily, weekly, monthly, or yearly intervals. The time axis helps to track the stock’s performance over different time periods.

- Volume: The volume of a stock represents the number of shares traded during a specific period. It is typically displayed as a separate bar chart below the main price chart. High volume often indicates strong interest in the stock, which can be a sign of a trend continuation. Conversely, low volume can suggest a lack of interest, which may indicate a potential trend reversal.

- Indicators: Indicators are mathematical calculations that are applied to stock price data to generate signals and insights. They can be used to identify trends, overbought/oversold conditions, momentum, and other market dynamics. Popular indicators include moving averages, relative strength index (RSI), and MACD.

Example Stock Chart

[Image Description: A stock chart with clear labels for each component. The price axis is on the left side, showing the price of the stock. The time axis is at the bottom, showing the date and time. The volume bar chart is below the main price chart. The chart shows a candlestick chart with a clear open, close, high, and low for each candlestick. The chart also includes a moving average line and an RSI indicator.]

Understanding stock charts is essential for investors and traders. By analyzing the different types of charts, their components, and indicators, investors can gain valuable insights into market trends and make more informed investment decisions.

Analyzing Price Action

Price action is the movement of a stock’s price over time. It can be analyzed to identify trends, patterns, and potential support and resistance levels. By understanding how price action unfolds, traders can make more informed decisions about when to buy, sell, or hold a stock.

Common Price Patterns, How to read stock graphs

Price patterns are recurring formations in price charts that can signal potential price movements. Recognizing these patterns can help traders anticipate market behavior and make more informed trading decisions.

- Head and Shoulders: This pattern is characterized by three peaks, with the middle peak (the head) being the highest. The two outer peaks (the shoulders) are roughly the same height. This pattern suggests a potential reversal of an uptrend.

- Double Top/Bottom: These patterns are formed by two peaks or two troughs at roughly the same price level. A double top suggests a potential reversal of an uptrend, while a double bottom suggests a potential reversal of a downtrend.

- Triangles: These patterns are formed by converging price lines. They can be ascending, descending, or symmetrical. Triangles are often seen as consolidation patterns, suggesting a period of indecision in the market before a breakout in one direction or the other.

Support and Resistance Levels

Support and resistance levels are price points where the price of a stock has historically found difficulty breaking through. These levels can act as barriers to price movement, and traders often use them to identify potential entry and exit points.

- Support Levels: These are price levels where buying pressure is expected to be strong enough to prevent the price from falling further.

- Resistance Levels: These are price levels where selling pressure is expected to be strong enough to prevent the price from rising further.

Moving Averages

Moving averages are trend-following indicators that smooth out price fluctuations by averaging the price over a specified period. Traders use moving averages to identify trends and potential reversals.

- Simple Moving Average (SMA): This is the most basic type of moving average. It is calculated by averaging the closing prices of a stock over a specified period.

- Exponential Moving Average (EMA): This type of moving average gives more weight to recent prices, making it more responsive to price changes.

Using Moving Averages for Trend Identification: When the price of a stock is above its moving average, it is generally considered to be in an uptrend. When the price is below its moving average, it is generally considered to be in a downtrend.

Using Moving Averages for Reversal Identification: When the price of a stock crosses above a moving average from below, it can signal a potential bullish reversal. When the price crosses below a moving average from above, it can signal a potential bearish reversal.

Understanding Technical Indicators

Technical indicators are mathematical calculations based on historical price and volume data. They help traders identify trends, momentum, and potential buy or sell signals. By analyzing these indicators, traders can gain insights into market sentiment and make more informed trading decisions.

Popular Technical Indicators

Technical indicators can be broadly categorized into trend, momentum, and volatility indicators. Here are some popular indicators:

| Indicator | Function |

|---|---|

| Relative Strength Index (RSI) | Measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. |

| Moving Average Convergence Divergence (MACD) | Identifies trend changes by comparing two moving averages of prices. |

| Bollinger Bands | Show price volatility and potential price reversals. They consist of a moving average and two standard deviation bands above and below the moving average. |

| Stochastic Oscillator | Compares a stock’s closing price to its price range over a given period. |

| Average Directional Index (ADX) | Measures the strength of a trend. |

| On-Balance Volume (OBV) | Tracks the cumulative volume of buying and selling pressure. |

Benefits and Drawbacks of Technical Indicators

Different technical indicators have varying strengths and weaknesses.

| Indicator | Benefits | Drawbacks |

|---|---|---|

| RSI | Easy to understand and use. Provides insights into overbought or oversold conditions. | Can generate false signals. |

| MACD | Identifies trend changes and potential buy or sell signals. | Can be prone to whipsaws in choppy markets. |

| Bollinger Bands | Show price volatility and potential price reversals. | Can be difficult to interpret. |

| Stochastic Oscillator | Identifies overbought or oversold conditions. | Can generate false signals. |

| ADX | Measures the strength of a trend. | Can be slow to react to trend changes. |

| OBV | Tracks the cumulative volume of buying and selling pressure. | Can be difficult to interpret. |

Using Technical Indicators in Conjunction with Price Action Analysis

Technical indicators are most effective when used in conjunction with price action analysis. Price action refers to the movements of a stock’s price over time. By analyzing price action, traders can identify patterns, trends, and support and resistance levels. Technical indicators can then be used to confirm these patterns and signals.

For example, a trader might observe a bullish price action pattern, such as a breakout above resistance. They could then use the RSI indicator to confirm that the stock is not overbought. If the RSI is below 70, it could provide further evidence to support the bullish price action signal.

It’s important to note that technical indicators are not foolproof and should not be used as the sole basis for trading decisions.

Reading Volume: How To Read Stock Graphs

Volume is the number of shares traded in a specific period, usually a day. It’s an important factor in analyzing stock charts because it provides insights into market sentiment and the strength of price movements.

Volume can be used to confirm price trends, identify potential reversals, and gauge the overall interest in a particular stock.

Volume and Price Relationship

The relationship between price and volume can provide valuable insights into market sentiment. When the price of a stock is increasing, and volume is also increasing, it indicates strong buying pressure and a bullish trend. Conversely, when the price is decreasing, and volume is increasing, it suggests strong selling pressure and a bearish trend.

“High volume on a price increase is bullish, while high volume on a price decrease is bearish.”

However, it’s important to note that volume can be misleading. Sometimes, high volume can occur during a price correction, which is a temporary dip in the price of a stock. In such cases, the high volume might not necessarily indicate a change in the overall trend.

Identifying Volume Spikes

Volume spikes are periods of unusually high trading activity. They can signal significant market events, such as earnings announcements, news releases, or changes in investor sentiment.

Volume spikes can be identified on a stock chart by looking for bars with significantly higher volume than the surrounding bars.

- Bullish Volume Spike: When a volume spike occurs during an uptrend, it can indicate strong buying pressure and suggest that the uptrend is likely to continue.

- Bearish Volume Spike: When a volume spike occurs during a downtrend, it can indicate strong selling pressure and suggest that the downtrend is likely to continue.

It’s important to note that not all volume spikes are created equal. Some spikes may be short-lived and have little impact on the overall trend. Others may be more significant and signal a major shift in market sentiment.

Volume Patterns

Different stock charts exhibit unique volume patterns. Understanding these patterns can provide valuable insights into the market dynamics of a particular stock.

- Increasing Volume: A steady increase in volume during an uptrend suggests strong buying pressure and a healthy trend. Conversely, increasing volume during a downtrend indicates strong selling pressure and a weakening trend.

- Decreasing Volume: A decrease in volume during an uptrend may signal a lack of interest in the stock and a potential reversal. Conversely, decreasing volume during a downtrend may suggest that selling pressure is easing and a potential bottom is forming.

- Volume Divergence: Volume divergence occurs when the volume pattern does not confirm the price action. For example, if the price is making new highs, but volume is decreasing, it may suggest that the uptrend is losing momentum.

By analyzing volume patterns, traders can gain a better understanding of the market dynamics and make more informed trading decisions.

Applying Knowledge to Real-World Scenarios

Okay, so you’ve got the basics of reading stock charts down. Now let’s get practical! We’ll dive into some real-world scenarios and how to use stock charts to make informed trading decisions. We’ll also explore how to spot potential entry and exit points based on chart patterns and indicators.

Identifying Potential Entry and Exit Points

Identifying potential entry and exit points is a key skill in stock trading. This is where your knowledge of chart patterns and technical indicators really comes into play. Here’s a breakdown of how to use them:

Chart Patterns:

Chart patterns are visual representations of price movements that often repeat over time. They can help you predict future price action and identify potential entry and exit points. Here are some common chart patterns:

* Head and Shoulders: This pattern suggests a potential reversal of an uptrend. It’s formed by three peaks, with the middle peak (the head) being the highest.

* Double Top/Double Bottom: This pattern indicates a potential reversal of the current trend. A double top is formed by two peaks at the same price level, followed by a decline. A double bottom is formed by two lows at the same price level, followed by an increase.

* Triangles: Triangles are consolidation patterns that suggest a breakout in the direction of the trend. There are various types of triangles, such as ascending, descending, and symmetrical.

Technical Indicators:

Technical indicators are mathematical calculations that are plotted on a chart to help you identify trends, momentum, and overbought/oversold conditions.

* Moving Averages: These indicators smooth out price fluctuations to help you identify trends. Common moving averages include the 50-day and 200-day moving averages. When the price crosses above a moving average, it can signal a potential buy signal. Conversely, a cross below can indicate a potential sell signal.

* Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI reading above 70 is generally considered overbought, while a reading below 30 is considered oversold.

* MACD: The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It can help you identify trend changes and potential buy or sell signals.

Example:

Let’s say you’re looking at the stock chart for Apple (AAPL). You notice a head and shoulders pattern forming on the chart, with the neckline at $150. You also see that the RSI is above 70, indicating that the stock is overbought. Based on these observations, you might decide to sell your AAPL shares, anticipating a potential decline in the stock price.

Step-by-Step Guide to Reading Stock Charts

Here’s a step-by-step guide on how to read stock charts, whether you’re a beginner or an experienced trader:

Step 1: Choose a Chart Type:

There are different chart types available, such as line charts, candlestick charts, and bar charts. Each type has its own advantages and disadvantages. For beginners, line charts are a good place to start as they are the simplest to understand.

Step 2: Identify the Key Components:

Make sure you understand the basic components of a stock chart, including the price axis, the time axis, and the volume indicator.

Step 3: Analyze the Trend:

Determine the overall trend of the stock price by identifying the highs and lows. Is the stock in an uptrend, a downtrend, or a sideways trend?

Step 4: Look for Chart Patterns:

Once you have identified the trend, look for chart patterns that could indicate a change in the trend.

Step 5: Use Technical Indicators:

Technical indicators can help you confirm your analysis and identify potential buy or sell signals.

Step 6: Consider the Volume:

High volume can indicate strong buying or selling pressure, while low volume can indicate weak interest in the stock.

Step 7: Practice, Practice, Practice:

The best way to learn how to read stock charts is to practice. You can start by analyzing historical charts and then move on to real-time charts.

Outcome Summary

Mastering the art of reading stock graphs unlocks a world of insights into market dynamics. By understanding the language of charts, you can identify trends, spot potential turning points, and make informed trading decisions. Remember, practice makes perfect, so keep analyzing charts and honing your skills. As you become more comfortable interpreting the visual stories of stock charts, you’ll gain a deeper understanding of the market and be better equipped to make strategic investment choices.

FAQs

What is the best type of stock chart to use?

The best type of chart depends on your individual preferences and trading style. Line charts are good for visualizing long-term trends, bar charts offer more detail on price fluctuations, and candlestick charts are popular for identifying patterns and market sentiment.

How do I find reliable stock chart data?

You can access real-time stock chart data from reputable financial platforms like TradingView, Yahoo Finance, or Google Finance. These platforms offer a range of charting tools and indicators.

What are some common mistakes beginners make when reading stock charts?

Common mistakes include over-reliance on a single indicator, chasing trends too aggressively, and not understanding the context of chart patterns. It’s important to approach chart analysis with a balanced and disciplined approach.