Life certificate for power of attorney in USA plays a crucial role in ensuring the validity and effectiveness of legal documents. It serves as a confirmation that the principal, the person granting the power of attorney, is alive and capable of making decisions. This certificate is often required by financial institutions, government agencies, and other entities when dealing with matters related to the principal’s assets and affairs. The need for a life certificate arises in various situations, such as when a principal is incapacitated or residing overseas. It helps safeguard the principal’s interests by verifying their continued existence and preventing fraudulent activities.

A power of attorney is a legal document that authorizes another person, known as the attorney-in-fact, to act on behalf of the principal. In the United States, there are different types of power of attorney, each with its own specific purpose and scope. For instance, a durable power of attorney remains in effect even if the principal becomes incapacitated, while a general power of attorney terminates upon the principal’s death or incapacity. The requirements for obtaining a life certificate for power of attorney vary from state to state, so it is essential to consult with legal professionals to ensure compliance with local regulations.

What is a Life Certificate?

A life certificate is a document that verifies the continued existence of an individual. It is often required for various purposes, including legal and financial transactions, and is particularly important in the context of power of attorney.

Purpose of a Life Certificate in Power of Attorney

A life certificate serves as proof that the principal, the individual granting the power of attorney, is still alive. This is crucial for ensuring that the attorney-in-fact, the person appointed to act on the principal’s behalf, is authorized to make decisions and manage the principal’s affairs.

Situations Where a Life Certificate Might Be Required for Power of Attorney

A life certificate might be required in various situations involving power of attorney, including:

- Financial Transactions: Banks, investment firms, and other financial institutions may require a life certificate to ensure the principal is alive before processing transactions or releasing funds.

- Real Estate Transactions: If the power of attorney includes the authority to sell or transfer real estate, a life certificate may be needed to verify the principal’s continued existence and consent.

- Legal Proceedings: Courts may require a life certificate to confirm the principal’s status in legal cases involving the power of attorney.

- Government Benefits: In some cases, government agencies may require a life certificate to continue providing benefits to the principal, especially if the attorney-in-fact is managing the principal’s affairs.

Importance of Ensuring the Life Certificate is Valid and Up-to-Date

It is crucial to ensure that the life certificate is valid and up-to-date to prevent any legal or financial complications. A life certificate typically has an expiration date, and it’s essential to obtain a new one before the existing one expires.

Failing to provide a valid life certificate could result in delays, disputes, or even the denial of transactions or services.

Power of Attorney and Life Certificates in the USA

A power of attorney (POA) is a legal document that allows one person (the principal) to grant another person (the agent) the authority to act on their behalf. This can be useful for a variety of reasons, such as when the principal is unable to manage their own affairs due to illness, travel, or other reasons.

Life certificates are often required in conjunction with power of attorney documents to ensure the principal is still alive and the POA is valid.

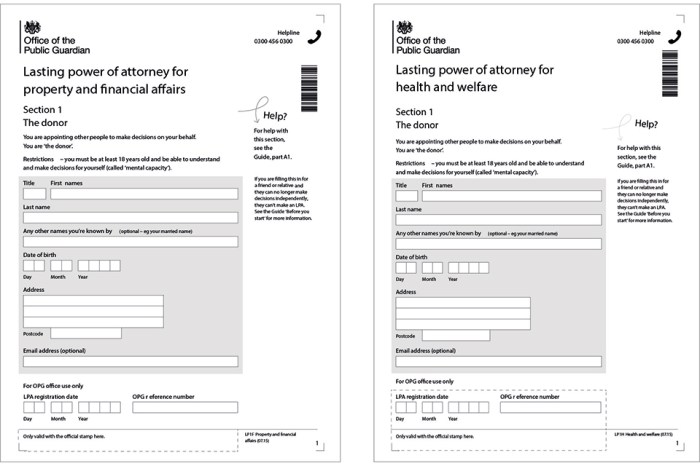

Types of Power of Attorney that May Require a Life Certificate

Life certificates are commonly required for durable power of attorney (DPOA) documents. A DPOA is a type of power of attorney that remains in effect even if the principal becomes incapacitated.

This is because a DPOA can be used to make important decisions about the principal’s finances, healthcare, and other personal matters. Therefore, it is essential to ensure the principal is still alive and capable of granting the power of attorney.

Legal Requirements for Obtaining a Life Certificate for Power of Attorney

The specific requirements for obtaining a life certificate for power of attorney vary by state. Generally, a life certificate will need to be signed by the principal in front of a notary public.

The notary public will verify the principal’s identity and witness their signature. The life certificate may also need to be accompanied by other documentation, such as a copy of the principal’s driver’s license or passport.

- Some states may have specific forms that must be used for life certificates.

- Others may allow the use of a generic form, as long as it includes the required information.

It is important to consult with an attorney to determine the specific requirements in your state.

For example, in California, a life certificate is not required for a durable power of attorney. However, the agent may be required to provide proof of the principal’s death if they need to access the principal’s assets.

Obtaining a Life Certificate

A life certificate is a document that verifies the existence of an individual. It is typically required by financial institutions, insurance companies, and government agencies to ensure that beneficiaries or policyholders are still alive.

Process of Obtaining a Life Certificate

The process of obtaining a life certificate can vary depending on the issuing organization or institution. Generally, the following steps are involved:

- Contact the issuing organization. This could be a bank, insurance company, government agency, or other institution that requires a life certificate.

- Request a life certificate form. Most organizations have a specific form that needs to be filled out.

- Provide the necessary information. This typically includes your name, date of birth, address, and other identifying information.

- Submit the completed form. This can be done in person, by mail, or online.

- Pay any applicable fees. Some organizations may charge a fee for issuing a life certificate.

- Receive the life certificate. The certificate will be sent to you by mail or email.

Documents Required for Obtaining a Life Certificate

The specific documents required may vary depending on the organization. However, common documents include:

- Photo identification. This could be a driver’s license, passport, or other government-issued ID.

- Proof of address. This could be a utility bill, bank statement, or other document that shows your current address.

- Social Security card. This is required for verifying your identity.

- Other relevant documents. The organization may require additional documents depending on the specific situation.

Organizations or Institutions that Issue Life Certificates

Various organizations and institutions issue life certificates. Here are a few examples:

- Banks. Many banks require life certificates for beneficiaries of accounts or insurance policies.

- Insurance companies. Life insurance companies require life certificates to ensure that the policyholder is still alive.

- Government agencies. Some government agencies, such as the Social Security Administration, may require life certificates for certain benefits.

- Employers. Some employers may require life certificates for employees who are participating in retirement or other benefit plans.

Challenges in Obtaining a Life Certificate, Life certificate for power of attorney in usa

Obtaining a life certificate can be challenging in certain situations. Here are some potential difficulties:

- Inability to reach the issuing organization. It can be difficult to contact the issuing organization, especially if it is located in a different country.

- Missing documents. If you do not have the necessary documents, you may not be able to obtain a life certificate.

- Language barriers. If you are not fluent in the language of the issuing organization, you may have difficulty communicating with them.

- Long processing times. It can take several weeks or even months to obtain a life certificate.

Importance of a Life Certificate for Power of Attorney

A Life Certificate is a crucial document that serves as proof of the principal’s continued existence, especially in the context of a Power of Attorney. It ensures that the attorney-in-fact is acting on behalf of a living person, preventing potential legal complications and safeguarding the interests of both parties involved.

Legal Implications of a Missing or Outdated Life Certificate

The absence or invalidity of a Life Certificate can lead to various legal issues, potentially jeopardizing the entire Power of Attorney arrangement.

- Challenge to the Power of Attorney: If a Life Certificate is not provided or is outdated, the validity of the Power of Attorney can be challenged. This means that the attorney-in-fact might not be able to act on behalf of the principal, even if the principal has granted them the authority to do so. This can result in delays, disputes, and legal battles.

- Potential for Fraud: A missing Life Certificate can create opportunities for fraud. If the principal is deceased or incapacitated, a fraudulent party could claim to be the attorney-in-fact and attempt to misappropriate the principal’s assets.

- Financial and Legal Liability: The attorney-in-fact could be held financially and legally liable if they act on behalf of a deceased or incapacitated principal without a valid Life Certificate.

How a Life Certificate Protects the Interests of the Principal and the Attorney-in-Fact

A Life Certificate provides a layer of protection for both the principal and the attorney-in-fact.

- Protects the Principal’s Assets: A valid Life Certificate ensures that the principal’s assets are managed according to their wishes and that the attorney-in-fact is acting within the scope of the Power of Attorney.

- Provides Legal Protection for the Attorney-in-Fact: By providing proof of the principal’s continued existence, a Life Certificate safeguards the attorney-in-fact from potential legal challenges and liability.

- Ensures Smooth Transactions: A Life Certificate simplifies transactions and prevents unnecessary delays or disputes.

Common Questions and Concerns: Life Certificate For Power Of Attorney In Usa

It’s natural to have questions about life certificates and power of attorney. This section addresses some common concerns, providing clarity and guidance on these important legal documents.

Common Questions About Life Certificates and Power of Attorney

Understanding the nuances of life certificates and power of attorney can be challenging. This table addresses common questions, offering answers, additional information, and relevant resources.

| Question | Answer | Additional Information | Relevant Resources |

|---|---|---|---|

| What is a life certificate, and why is it needed for power of attorney? | A life certificate is a document that confirms an individual is still alive. It’s often required to ensure the validity of a power of attorney, particularly when the principal (the person granting the power) resides outside the US or is unable to personally sign documents. | Life certificates help prevent fraud and ensure that the power of attorney is being used appropriately. |

|

| Who needs to obtain a life certificate? | The individual granting the power of attorney (the principal) is typically the one who needs to obtain a life certificate. This is often required by financial institutions, government agencies, or other organizations that handle the principal’s affairs. | The specific requirements for life certificates can vary depending on the institution or organization involved. |

|

| How often should a life certificate be updated? | The frequency of life certificate updates depends on the specific requirements of the institution or organization. Some may require annual updates, while others may have different timelines. | It’s best to check with the relevant institution or organization to determine their specific requirements. |

|

| What happens if a life certificate is not provided? | Failure to provide a life certificate when required can lead to delays in processing transactions, potential complications with financial accounts, and even the suspension of power of attorney. | The consequences of not providing a life certificate can vary depending on the specific situation and the institution or organization involved. |

|

| Can I create my own life certificate? | It’s generally not advisable to create your own life certificate. Official life certificates are typically obtained through designated authorities like U.S. embassies or consulates. | Using an unofficial life certificate may not be accepted by institutions or organizations. |

|

Final Thoughts

In conclusion, obtaining a life certificate for power of attorney in the USA is a crucial step in ensuring the legal validity and effectiveness of the document. It provides peace of mind by verifying the principal’s continued existence and preventing potential fraudulent activities. By understanding the purpose, requirements, and procedures involved, individuals can navigate this process efficiently and protect their interests. It is highly recommended to seek guidance from legal professionals to ensure compliance with all applicable laws and regulations.

Query Resolution

What happens if I don’t provide a life certificate?

Without a valid life certificate, the power of attorney may be deemed invalid or unenforceable. This could result in delays or complications when attempting to manage the principal’s assets or affairs.

How long is a life certificate valid for?

The validity period of a life certificate varies depending on the issuing organization or institution. It’s important to check the specific guidelines for the certificate you are obtaining.

Can I obtain a life certificate online?

Some organizations may offer online options for obtaining life certificates. However, it is recommended to consult with legal professionals or relevant authorities to determine the acceptable methods for your specific situation.