- Introduction

- Understanding the Maritime Industry

- Legal Framework of Maritime Banking

- International Maritime Law Conventions

- Practical Considerations in Maritime Banking

- Table: Key Aspects of Maritime Banking Law

- Conclusion

-

FAQ about Maritime Banking Law

- What is maritime banking law?

- What are the main types of maritime banking transactions?

- How is maritime banking law regulated?

- What are the key legal issues in maritime banking?

- What are the risks of maritime banking transactions?

- How can maritime banking risks be mitigated?

- What are the advantages of using maritime banking law?

- What are the disadvantages of using maritime banking law?

- Who should seek advice from a maritime banking lawyer?

Introduction

Hey, readers! Welcome aboard our journey into the fascinating world of maritime banking law. As we set sail together, let’s dive into the depths of this complex yet essential topic and explore its intricacies, challenges, and opportunities.

What is Maritime Banking Law?

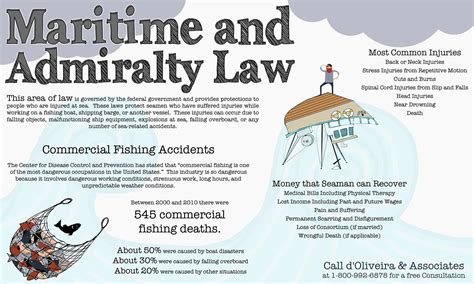

Maritime banking law refers to the legal framework governing financial transactions and services related to maritime industries, including shipping, shipbuilding, and offshore operations. It encompasses a broad range of legal issues, such as financing, maritime liens, mortgages, insurance, and regulatory compliance.

Understanding the Maritime Industry

The Evolution of Maritime Commerce

Since ancient times, maritime trade has played a pivotal role in global economic development. The rise of modern shipping and the globalized economy have further underscored the importance of maritime banking law to facilitate cross-border transactions and support the growth of the maritime sector.

Key Players in Maritime Banking

The maritime industry involves a diverse range of stakeholders, including ship owners, shipping companies, banks, insurance providers, ports, and legal professionals. Each player has specific roles and responsibilities within the maritime banking ecosystem.

Legal Framework of Maritime Banking

Financing Maritime Ventures

Maritime banking law provides various financing options for maritime projects, such as ship construction, vessel acquisition, and working capital. Traditional and innovative financing mechanisms, including loans, mortgages, and leasing, are commonly employed in maritime transactions.

Securing Maritime Loans

Maritime liens and mortgages act as essential security devices for lenders in maritime banking. These legal instruments grant creditors a preferred claim against a vessel or other maritime assets in case of default.

Insurance and Risk Management

Insurance is a critical aspect of maritime banking. Marine insurance policies cover potential risks and liabilities associated with maritime operations, including hull and machinery damage, cargo loss, and third-party injuries.

International Maritime Law Conventions

IMO and UNCLOS

International conventions, such as the International Maritime Organization (IMO) and the United Nations Convention on the Law of the Sea (UNCLOS), play a significant role in shaping maritime banking law. These agreements provide a common legal framework for maritime activities and ensure international cooperation and harmonization.

Conflict of Laws

Maritime banking transactions often involve parties from different jurisdictions, raising complex issues of conflict of laws. The choice of governing law and the enforcement of foreign judgments in maritime disputes are key considerations for legal professionals.

Practical Considerations in Maritime Banking

Due Diligence and Risk Assessment

Thorough due diligence and risk assessment are crucial before entering into maritime banking transactions. This involves examining the creditworthiness of borrowers, evaluating the collateral, and assessing potential legal and operational risks.

Legal Documentation and Compliance

Proper legal documentation is essential in maritime banking. Well-drafted loan agreements, mortgages, and insurance policies safeguard the interests of both lenders and borrowers. Compliance with regulatory requirements is also vital to avoid legal liability and reputational damage.

Table: Key Aspects of Maritime Banking Law

| Aspect | Description |

|---|---|

| Financing | Options and mechanisms for funding maritime ventures |

| Security | Maritime liens and mortgages as preferred claims on maritime assets |

| Insurance | Coverage for risks associated with maritime operations |

| Conventions | IMO and UNCLOS provide international legal framework |

| Conflict of Laws | Considerations in cross-border maritime transactions |

| Due Diligence | Importance of creditworthiness assessment and risk evaluation |

| Documentation | Well-drafted legal agreements and compliance with regulations |

Conclusion

Navigating the intricacies of maritime banking law requires a deep understanding of the legal and practical considerations involved. By embracing a comprehensive approach and seeking legal counsel when necessary, financial institutions and maritime industry stakeholders can effectively leverage maritime banking law to support their business goals and foster growth in this dynamic sector.

Feel free to embark on further legal explorations by visiting our blog for additional insights into specialized areas of maritime law. Stay tuned for more captivating content that will guide you through the uncharted waters of maritime legal landscapes!

FAQ about Maritime Banking Law

What is maritime banking law?

Maritime banking law is a specialized area of law that deals with the financing of maritime ventures. It includes the regulation of loans, mortgages, and other financial instruments used to finance the construction, purchase, and operation of ships and other maritime assets.

What are the main types of maritime banking transactions?

The main types of maritime banking transactions include:

- Ship financing: Loans used to finance the construction or purchase of ships.

- Ship mortgages: Loans secured by a mortgage on a ship.

- Maritime liens: Claims against a ship that arise from maritime activities, such as unpaid wages or repair bills.

- Charterparty financing: Loans used to finance the chartering of ships.

- Marine insurance: Insurance policies that cover maritime risks, such as damage to ships or cargo.

How is maritime banking law regulated?

Maritime banking law is regulated by a variety of international and domestic laws and conventions. The most important international conventions include the International Convention on Maritime Liens and Mortgages, the Geneva Maritime Conventions, and the United Nations Convention on the Law of the Sea. Domestic laws and regulations vary from country to country, but they generally follow the principles of international law.

What are the key legal issues in maritime banking?

The key legal issues in maritime banking include:

- The priority of maritime liens and mortgages: Maritime liens and mortgages have priority over other claims against a ship, but the priority of different liens and mortgages can be complex.

- The enforcement of maritime liens and mortgages: Maritime liens and mortgages can be enforced through a variety of legal proceedings, including foreclosure and arrest of the ship.

- The regulation of charterparty financing: Charterparty financing is a complex area of law that involves a variety of legal issues, such as the rights and obligations of the charterer and the shipowner.

- The regulation of marine insurance: Marine insurance is a vital part of the maritime industry, and it is heavily regulated to ensure that policyholders are protected.

What are the risks of maritime banking transactions?

Maritime banking transactions involve a number of unique risks, including:

- The risks of maritime perils: Ships and other maritime assets are exposed to a variety of maritime perils, such as storms, collisions, and piracy.

- The risks of insolvency: Shipowners and other maritime businesses can become insolvent, which can lead to the loss of the asset that is financed.

- The risks of fraud: Maritime banking transactions can be complex, and there is a risk of fraud by the parties involved.

How can maritime banking risks be mitigated?

Maritime banking risks can be mitigated through a variety of measures, including:

- Careful due diligence: Before entering into a maritime banking transaction, it is important to conduct careful due diligence on the parties involved and the asset that is financed.

- Proper documentation: It is important to have a properly drafted and executed loan agreement, mortgage, or other financing document.

- Adequate insurance: It is important to have adequate insurance coverage for the asset that is financed.

- Careful monitoring: It is important to monitor the performance of the loan and the asset that is financed regularly.

What are the advantages of using maritime banking law?

Maritime banking law provides a number of advantages for parties that are involved in maritime ventures, including:

- Access to capital: Maritime banking law provides access to capital for the construction, purchase, and operation of ships and other maritime assets.

- Risk mitigation: Maritime banking law can help to mitigate the risks of maritime ventures by providing a legal framework for the financing of these ventures.

- Enforcement of rights: Maritime banking law provides a legal framework for the enforcement of the rights of parties that are involved in maritime ventures.

What are the disadvantages of using maritime banking law?

Maritime banking law can also have some disadvantages, including:

- Complexity: Maritime banking law is a complex area of law, and it can be difficult to understand and comply with the regulations.

- Costs: Maritime banking transactions can be expensive, due to the legal and administrative costs involved.

- Delays: Maritime banking transactions can be time-consuming, due to the need to obtain regulatory approvals and other documents.

Who should seek advice from a maritime banking lawyer?

Anyone who is considering entering into a maritime banking transaction should seek advice from a maritime banking lawyer. A maritime banking lawyer can help to explain the legal issues involved, draft and negotiate the necessary documents, and represent you in any legal proceedings that may arise.