- Introduction

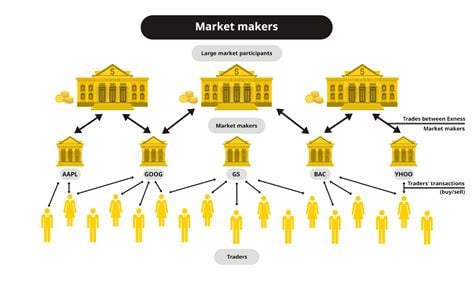

- The Role of Market Makers in Forex

- Types of Market Makers in Forex

- Benefits of Trading with Market Makers

- Drawbacks of Trading with Market Makers

- Conclusion

-

FAQ about Forex Market Makers

- What is a Forex Market Maker?

- How do Market Makers Make Money?

- What are the Advantages of Trading with a Market Maker?

- What are the Disadvantages of Trading with a Market Maker?

- How Can You Identify a Forex Market Maker?

- What are the Risks of Trading with a Market Maker?

- How Can You Avoid Risks When Trading with a Market Maker?

- What are Some Examples of Forex Market Makers?

- How do Market Makers Differ from ECNs?

- Are Market Makers Regulated?

Introduction

Hey there, readers! Forex, the vast and ever-evolving financial realm, often steers our focus towards popular players like retail traders and large institutional investors. But amidst this dynamic ecosystem, a crucial entity often operates silently yet plays a profound role in shaping market dynamics – the market maker in forex.

Market makers are the unsung heroes of forex. They provide liquidity, ensure price discovery, and stabilize markets during volatility. Without their tireless efforts, currency trading would be a disjointed and chaotic landscape. So, let’s lift the veil and delve deeper into the world of market makers in forex.

The Role of Market Makers in Forex

Providing Liquidity

Market makers are the backbone of liquidity in the forex market. They continuously quote both bid and ask prices for currency pairs, allowing traders to execute trades instantly without having to wait for a counterparty. This liquidity is essential for ensuring smooth market operations, preventing excessive price spreads, and facilitating large trade volumes.

Price Discovery

Market makers play a pivotal role in price discovery within the forex market. They continuously analyze market conditions, news events, and economic data to adjust their bid and ask prices. This process helps establish fair market prices and provides valuable information to traders in making informed trading decisions.

Market Stabilization

During periods of market volatility or uncertainty, market makers step up to stabilize prices. They absorb excess supply or demand by adjusting their quotes, preventing excessive price swings and maintaining market order. Their intervention acts as a buffer against drastic price movements, protecting market participants from potential losses.

Types of Market Makers in Forex

Dealer Market Makers

Dealer market makers maintain their own inventory of currencies and trade directly with retail clients. They use their resources to provide liquidity and manage risk, often quoting wider spreads to cover their trading costs.

Non-Dealer Market Makers

Non-dealer market makers, also known as liquidity providers, do not hold their own inventory but connect traders to other market participants. They facilitate trades by matching orders and earn a commission for each transaction.

Electronic Market Makers

Electronic market makers utilize algorithms and automated systems to quote prices and execute trades. They offer extremely tight spreads and lightning-fast execution but may lack the personal touch of human market makers.

Benefits of Trading with Market Makers

Reduced Market Impact

Market makers’ ability to provide liquidity helps minimize market impact. Traders can execute large trades without significantly affecting prices, allowing them to maintain their trading strategies without incurring substantial slippage.

Improved Execution Speed

Market makers’ quotes are typically available 24/7, enabling traders to execute trades almost instantaneously during market hours. This speed is particularly advantageous for scalpers and high-frequency traders.

Access to a Wide Range of Currency Pairs

Market makers often offer a comprehensive list of currency pairs, including both major and exotic pairs. This diversity provides traders with ample opportunities to capitalize on market movements across various currency markets.

Drawbacks of Trading with Market Makers

Potential Conflicts of Interest

Dealer market makers have the potential for conflicts of interest as they trade for their own profit. This may lead them to quote unfavorable prices or trade against their clients’ positions.

Limited Transparency

Market makers’ pricing models and profit margins are often not transparent. This lack of transparency can make it difficult for traders to assess the fairness of quotes and the true cost of trading with market makers.

Required Minimum Account Size

Some market makers may impose minimum account balance requirements to trade with them. This can be a barrier to entry for beginner traders with limited capital.

Conclusion

Market makers in forex are the unsung heroes who ensure liquidity, facilitate price discovery, and stabilize markets. They make it possible for traders to execute trades efficiently and access a wide range of currency pairs. While there are potential drawbacks to consider, the benefits of trading with market makers often outweigh the risks. If you’re serious about forex trading, understanding the role and advantages of market makers can give you a competitive edge in the financial markets.

So, the next time you place a forex trade, remember the vital role played by market makers in making your trading experience seamless and efficient.

Do you have any other questions about market makers in forex? Check out our other articles for more in-depth insights and trading tips:

- [The Ultimate Guide to Forex Trading for Beginners](link to article 1)

- [5 Tips for Choosing the Right Forex Broker](link to article 2)

- [10 Common Forex Trading Mistakes to Avoid](link to article 3)

FAQ about Forex Market Makers

What is a Forex Market Maker?

Market makers (MMs) are financial institutions that provide liquidity to Forex markets by simultaneously posting both bid and ask prices for currencies.

How do Market Makers Make Money?

MMs profit from the spread between the bid and ask prices. If a client buys a currency at the ask price and sells it back immediately at the bid price, the MM makes the difference.

What are the Advantages of Trading with a Market Maker?

- Guaranteed liquidity and fixed spreads

- Fast execution and no requotes

- Reduced slippage and price manipulation

What are the Disadvantages of Trading with a Market Maker?

- Potential conflict of interest

- Wider spreads than ECNs or other liquidity providers

How Can You Identify a Forex Market Maker?

MMs typically have proprietary trading desks and low-latency trading systems. They are often regulated by financial authorities and provide competitive prices.

What are the Risks of Trading with a Market Maker?

The main risk is potential price manipulation, which can occur if the MM has a large enough market share to influence prices.

How Can You Avoid Risks When Trading with a Market Maker?

- Choose a reputable MM with a good track record.

- Be aware of the MM’s spreads and fees.

- Use stop-loss orders to limit potential losses.

What are Some Examples of Forex Market Makers?

Popular MMs include XTX Markets, Citadel Securities, Goldman Sachs, and JPMorgan.

How do Market Makers Differ from ECNs?

MMs post their own prices and provide guaranteed liquidity, while ECNs (electronic communication networks) connect buyers and sellers directly, resulting in wider price ranges but reduced intervention.

Are Market Makers Regulated?

Yes, MMs are typically regulated by financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US.