- Micro Lot Forex Brokers: A Beginner’s Guide to Trading Small

- Introduction

- Understanding Micro Lots

- Choosing a Micro Lot Forex Broker

- Features of Micro Lot Forex Brokers

- Table: Comparison of Micro Lot Forex Brokers

- Conclusion

-

FAQ about Micro Lot Forex Brokers

- 1. What is a micro lot forex broker?

- 2. What are the benefits of trading with a micro lot forex broker?

- 3. What are the disadvantages of trading with a micro lot forex broker?

- 4. How do I choose a micro lot forex broker?

- 5. What are some of the best micro lot forex brokers?

- 6. How do I open an account with a micro lot forex broker?

- 7. How do I fund my micro lot forex account?

- 8. How do I place a trade with a micro lot forex broker?

- 9. How do I close a trade with a micro lot forex broker?

- 10. What are some tips for trading with a micro lot forex broker?

Micro Lot Forex Brokers: A Beginner’s Guide to Trading Small

Introduction

Hi readers,

Are you ready to dive into the exciting world of currency trading? If you’re just starting out or seeking more flexibility, micro lot forex brokers might be the perfect option for you. As a beginner-friendly platform, micro lot brokers allow you to trade with smaller amounts of money, minimizing your financial risk.

In this comprehensive guide, we’ll explore the ins and outs of micro lot forex brokers, helping you make an informed decision on whether they’re the right choice for your trading journey.

Understanding Micro Lots

What are Micro Lots?

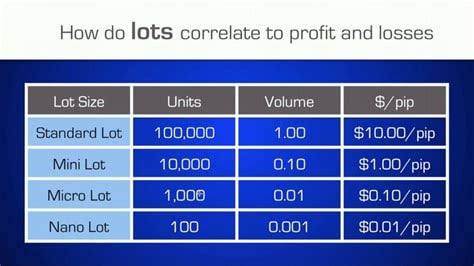

In forex trading, a lot represents a standardized unit of currency. Traditionally, a standard lot consists of 100,000 units of a base currency, which can be overwhelming for those with limited capital. Micro lots, on the other hand, represent a mere 1,000 units, providing a more accessible entry point.

Advantages of Trading Micro Lots

- Reduced financial risk: With a smaller lot size, you trade with less money, mitigating potential losses.

- Enhanced flexibility: Micro lots allow for smaller position sizes, enabling you to diversify your portfolio and test different strategies.

- Lower margin requirements: Micro brokers typically require lower margin, making it easier to enter the market.

Choosing a Micro Lot Forex Broker

Key Factors to Consider

- Regulation and reputation: Ensure the broker is licensed by a reputable regulatory body, such as the FCA or ASIC.

- Trading platform: Assess the user-friendliness, available trading tools, and execution speed of the platform.

- Fees and commissions: Compare the spread, commissions, and other charges levied by different brokers.

- Customer support: Look for brokers that provide reliable and prompt customer assistance.

Top Micro Lot Forex Brokers

- XM: A regulated broker with low spreads and a user-friendly platform.

- eToro: A popular choice for beginners, offering social trading and copy trading features.

- Pepperstone: Known for its low commissions and fast execution times.

Features of Micro Lot Forex Brokers

Small Minimum Deposits

Micro lot brokers typically require minimal initial deposits, ranging from $10 to $500. This makes forex trading accessible to individuals with limited capital.

Flexible Lot Sizes

Micro brokers allow you to trade in increments of 0.01 micro lots, providing unparalleled flexibility and precision in your trading.

Educational Resources

Many micro lot brokers offer educational materials, webinars, and seminars to help beginners navigate the forex market.

Table: Comparison of Micro Lot Forex Brokers

| Broker | Minimum Deposit | Spread | Commission | Platform |

|---|---|---|---|---|

| XM | $10 | 1 pip | $0 | MetaTrader 4/5 |

| eToro | $200 | Variable | N/A | Proprietary |

| Pepperstone | $200 | 1 pip | $7 per side | cTrader |

Conclusion

Micro lot forex brokers are an ideal option for beginner traders or individuals with limited capital. They offer reduced financial risk, enhanced flexibility, and access to valuable educational resources. By carefully selecting a broker that meets your specific needs, you can maximize your trading potential and embark on a successful forex trading journey.

If you’re eager to explore more educational content related to forex trading, be sure to check out our other articles on topics such as technical analysis, risk management, and trading strategies.

FAQ about Micro Lot Forex Brokers

1. What is a micro lot forex broker?

A micro lot forex broker allows traders to trade with very small amounts of currency, typically 1,000 units of currency or less. This is in contrast to standard lot brokers, who require traders to trade with minimum lot sizes of 100,000 units.

2. What are the benefits of trading with a micro lot forex broker?

Micro lot forex brokers offer a number of benefits, including:

- Lower risk: Trading with micro lots allows traders to risk less money on each trade, which can help them to manage their risk more effectively.

- Greater flexibility: Micro lot brokers allow traders to trade with smaller amounts of money, which gives them greater flexibility in how they manage their trading accounts.

- More trading opportunities: Micro lot brokers allow traders to take advantage of more trading opportunities, as they can trade with smaller lot sizes and enter and exit trades more quickly.

3. What are the disadvantages of trading with a micro lot forex broker?

There are a few potential disadvantages to trading with a micro lot forex broker, including:

- Higher spreads: Micro lot brokers typically have higher spreads than standard lot brokers, which can eat into profits.

- Limited liquidity: Micro lot brokers may not have as much liquidity as standard lot brokers, which can make it more difficult to get filled at the desired price.

- Less leverage: Micro lot brokers may offer less leverage than standard lot brokers, which can limit trading potential.

4. How do I choose a micro lot forex broker?

When choosing a micro lot forex broker, there are a few factors to consider, including:

- Regulation: Make sure the broker is regulated by a reputable financial authority.

- Spreads: Compare the spreads offered by different brokers to find the one with the lowest costs.

- Liquidity: Ensure the broker has ample liquidity to meet your trading needs.

- Leverage: Consider the amount of leverage offered by the broker to determine if it meets your trading style.

5. What are some of the best micro lot forex brokers?

Some of the best micro lot forex brokers include:

- IC Markets: IC Markets is a well-regulated broker that offers low spreads and high liquidity.

- Pepperstone: Pepperstone is another reputable broker that offers competitive spreads and fast execution.

- FXTM: FXTM is a popular choice for micro lot traders due to its low minimum deposit and wide range of trading instruments.

6. How do I open an account with a micro lot forex broker?

Opening an account with a micro lot forex broker is a simple process. Typically, you will need to provide the broker with your personal information, such as your name, address, and date of birth. You will also need to provide the broker with a copy of your government-issued ID.

7. How do I fund my micro lot forex account?

You can fund your micro lot forex account using a variety of methods, such as:

- Bank wire transfer: This is a secure and reliable way to fund your account, but it can take several days for the funds to arrive.

- Credit/debit card: This is a convenient way to fund your account, but there may be fees associated with this method.

- E-wallet: This is a popular way to fund your account, as it is fast and secure.

8. How do I place a trade with a micro lot forex broker?

Placing a trade with a micro lot forex broker is a simple process. Typically, you will need to:

- Select the currency pair you want to trade.

- Choose the amount of currency you want to trade.

- Select the type of order you want to place (e.g., market order, limit order, stop order).

- Click the "Place Order" button.

9. How do I close a trade with a micro lot forex broker?

Closing a trade with a micro lot forex broker is a simple process. Typically, you will need to:

- Select the open trade you want to close.

- Click the "Close Trade" button.

- Confirm the closure of the trade.

10. What are some tips for trading with a micro lot forex broker?

Here are a few tips for trading with a micro lot forex broker:

- Start small: Don’t risk more money than you can afford to lose.

- Manage your risk: Use stop-loss orders to limit your losses.

- Trade with a plan: Develop a trading plan and stick to it.

- Be patient: Forex trading takes time and practice to master.