- Introduction

- What is Mirror Trade Forex?

- How to Choose a Mirror Trader

- Strategies for Mirror Trade Forex

- Mirror Trade Forex Providers

- Conclusion

-

FAQ about Mirror Trade Forex

- What is mirror trade forex?

- How does mirror trade forex work?

- What are the benefits of mirror trade forex?

- What are the risks of mirror trade forex?

- How do I choose a mirror trade forex provider?

- How do I get started with mirror trade forex?

- What are some of the best mirror trade forex platforms?

- Is mirror trade forex legal?

- Is mirror trade forex profitable?

Introduction

Hey readers,

Welcome to our comprehensive guide to mirror trade forex. In this article, we’ll dive deep into the world of mirror trading and help you understand how to profit from this unique approach to forex trading. Whether you’re a seasoned trader or just starting out, this guide will provide you with all the knowledge you need to navigate the mirror trade forex market successfully.

What is Mirror Trade Forex?

Mirror trade forex is a type of copy trading that allows you to follow and replicate the trades of experienced traders. By mirroring the trades of successful traders, you can potentially earn profits without the need for in-depth knowledge or experience in forex trading. This approach is particularly appealing to beginner traders who want to get started with forex without the usual learning curve.

Benefits of Mirror Trade Forex

- Simplified Trading: Mirror trade forex eliminates the need for complex technical analysis and trade execution. You can simply follow the trades of experienced traders and enjoy the potential rewards.

- Reduced Risk: By mirroring the trades of successful traders, you can spread your risk across multiple trades and reduce the impact of any individual losing trade.

- Suitability for Beginners: Mirror trade forex is an excellent option for beginner traders who want to gain experience and build their confidence before trading independently.

How to Choose a Mirror Trader

Choosing the right mirror trader is crucial to the success of your mirror trade forex strategy. Here are some factors to consider:

- Track Record: Look for traders with a proven track record of success. Consistent profitability is a key indicator of a skilled trader.

- Transparency: Choose traders who provide transparency about their trading strategies and results. This will help you make informed decisions and avoid potential scams.

- Risk Management: Select traders who employ sound risk management practices to minimize losses and maximize profits.

Matching Your Trading Style

It’s important to find a mirror trader whose trading style matches your risk tolerance and investment goals. If your risk appetite is low, you should choose traders who employ conservative strategies. Conversely, if you are willing to take on more risk, you may prefer traders with aggressive trading approaches.

Strategies for Mirror Trade Forex

Once you have chosen a mirror trader, you need to develop a strategy for managing your mirror trades. Here are some tips:

- Monitor Your Trades: Regularly monitor the performance of your mirror trades to ensure that they align with your expectations. If a trade is not performing as expected, consider adjusting your strategy or switching to a different mirror trader.

- Diversify Your Trades: Don’t rely solely on a single mirror trader. Diversify your trades by following multiple traders with different strategies to spread your risk and increase your chances of profitability.

- Use Stop-Loss Orders: Stop-loss orders are an essential risk management tool that automatically closes a trade if the price moves against you. This helps to limit your losses and prevent catastrophic losses.

Mirror Trade Forex Providers

There are various platforms that offer mirror trade forex services. These platforms provide a marketplace where traders can connect with mirror traders and follow their trades. Some reputable mirror trade forex providers include:

| Platform | Features |

|---|---|

| ZuluTrade | Global platform with access to thousands of mirror traders |

| eToro | Social trading platform with a large community of traders |

| FXTM | Multi-asset broker that offers mirror trading on forex pairs |

Conclusion

Mirror trade forex is a viable option for both beginner and experienced traders who want to profit from the forex market. By choosing the right mirror trader, developing a sound strategy, and managing your trades carefully, you can potentially earn consistent profits with minimal effort.

If you’re interested in learning more about mirror trade forex and other forex-related topics, be sure to check out our other articles on the website.

FAQ about Mirror Trade Forex

What is mirror trade forex?

Mirror trading is a type of copy trading that allows traders to automatically copy the trades of another trader.

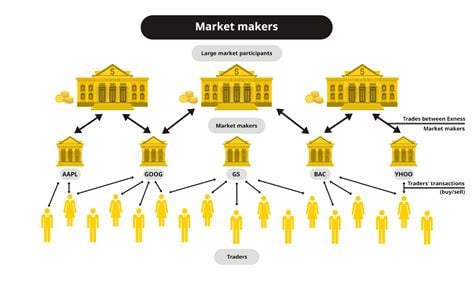

How does mirror trade forex work?

Mirror trading platforms connect traders to providers, who are experienced traders that share their trades. Traders can choose to copy the trades of any provider they wish.

What are the benefits of mirror trade forex?

- Less time consuming: Mirror trading saves traders time by automating the trading process.

- Easier to trade: Mirror trading makes it easier for traders to trade, even if they have less experience.

- Access to expert traders: Mirror trading gives traders access to the trades of experienced traders.

What are the risks of mirror trade forex?

- Losses: Traders can lose money if the provider they are copying makes losing trades.

- Scams: There are some mirror trading scams that can lead to traders losing money.

- Fees: Mirror trading platforms often charge fees for their services.

How do I choose a mirror trade forex provider?

Traders should consider the following when choosing a mirror trade forex provider:

- Track record: The provider’s track record should be analyzed to assess their profitability.

- Trading strategy: The provider’s trading strategy should be compatible with the trader’s own risk tolerance.

- Fees: The provider’s fees should be compared to other platforms.

How do I get started with mirror trade forex?

To get started with mirror trade forex, traders need to:

- Open an account with a mirror trading platform:

- Fund their account:

- Choose a provider to copy:

- Set their risk parameters:

What are some of the best mirror trade forex platforms?

Some popular mirror trade forex platforms include:

- ZuluTrade:

- eToro:

- Fxcopy:

Is mirror trade forex legal?

Mirror trade forex is legal in most countries. However, traders should check with their local regulations to ensure that it is legal in their country.

Is mirror trade forex profitable?

Mirror trade forex can be profitable, but there is no guarantee of success. Traders should only invest money that they can afford to lose.