- Introduction

- Understanding the Forex Spread

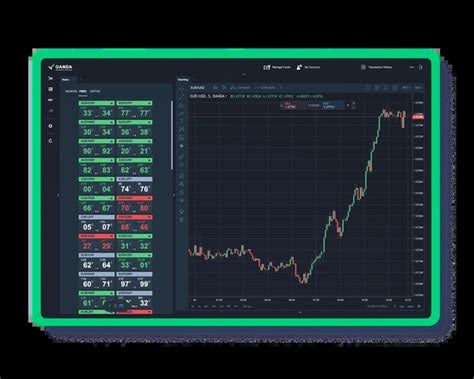

- OANDA’s Forex Spread

- Factors Affecting the OANDA Forex Spread

- OANDA’s Spread Table

- Conclusion

-

FAQ about OANDA Forex Spread

- What is the spread in forex trading?

- What is OANDA’s forex spread?

- How does OANDA’s forex spread compare to other brokers?

- What factors affect OANDA’s forex spread?

- What is the minimum spread OANDA offers?

- What is the average spread OANDA offers?

- How can I reduce the spread I pay?

- How does OANDA’s spread affect my profitability?

- What are the other trading costs I need to be aware of?

- How can I find the latest spread information for OANDA?

Introduction

Hey there, readers! Are you ready to dive into the world of currency trading and explore the OANDA Forex spread? Whether you’re a seasoned pro or just starting out, this comprehensive guide will give you all the insights you need about OANDA’s spread and how it can impact your trading success.

OANDA, a leading global provider of online trading services, is renowned for its competitive spreads and transparent pricing model. But what exactly is a spread, and why is it so important to traders? Let’s delve into the details!

Understanding the Forex Spread

What is a Forex Spread?

In Forex trading, the spread refers to the difference between the bid price (the price at which you can sell a currency pair) and the ask price (the price at which you can buy it). This difference represents the commission or fee charged by the broker for facilitating the trade.

Why is the Spread Important?

The spread is a crucial consideration for traders because it directly affects their profitability. A wider spread means higher trading costs, reducing your potential profits. Conversely, a narrower spread allows you to trade more efficiently and maximize your returns.

OANDA’s Forex Spread

Competitive Spreads

OANDA consistently offers highly competitive spreads across a wide range of currency pairs. This is due to its strong relationships with top liquidity providers and advanced trading technology that optimizes trade execution.

Transparent Pricing

OANDA is committed to transparency in pricing. The platform displays the spread in real-time, so traders can make informed decisions before entering a trade. The lack of hidden fees or markups ensures that traders can accurately assess their trading costs.

Factors Affecting the OANDA Forex Spread

Market Volatility

Market volatility is one of the primary factors influencing the OANDA Forex spread. During periods of high volatility, spreads tend to widen as liquidity decreases. This is because brokers need to compensate for increased risk by charging a higher spread.

Time of Day

Spreads are typically tighter during regular trading hours when liquidity is highest. Spreads may widen during weekends or market holidays when liquidity is reduced.

Currency Pair Traded

The spread will vary depending on the currency pair being traded. Major currency pairs, such as EUR/USD, typically have narrower spreads due to their high liquidity. Less popular or exotic currency pairs may have wider spreads due to lower trading volumes.

OANDA’s Spread Table

To provide a clear overview of its spreads, OANDA publishes a detailed spread table. This table lists the typical spreads for various currency pairs during different market conditions. Traders can use this information to plan their trading strategies and choose the most cost-effective instruments.

| Currency Pair | Market Volatility | Off-Peak Spread | Peak Spread |

|---|---|---|---|

| EUR/USD | Low | 0.9 pips | 1.2 pips |

| GBP/USD | Medium | 1.2 pips | 1.6 pips |

| USD/JPY | High | 1.5 pips | 2.2 pips |

| AUD/USD | Low | 1.1 pips | 1.4 pips |

| NZD/USD | Medium | 1.3 pips | 1.7 pips |

| EUR/GBP | Low | 1.0 pips | 1.3 pips |

| GBP/JPY | Medium | 1.4 pips | 1.8 pips |

| USD/CAD | High | 1.6 pips | 2.4 pips |

Conclusion

OANDA’s Forex spread is a crucial factor to consider when choosing a trading platform. The platform’s competitive spreads, transparent pricing, and responsive customer support make it an attractive option for traders of all levels.

Whether you’re looking to trade major currency pairs or explore exotic currencies, OANDA offers a wide range of trading instruments with competitive spreads. Be sure to check out our other articles on Forex trading to enhance your knowledge and make informed trading decisions. Thanks for reading!

FAQ about OANDA Forex Spread

What is the spread in forex trading?

- Answer: The spread is the difference between the bid price (the price at which you can sell a currency) and the ask price (the price at which you can buy a currency).

What is OANDA’s forex spread?

- Answer: OANDA’s forex spread is the difference between the bid and ask prices for a given currency pair. The spread is typically quoted in pips, which are the smallest increment of price movement for a currency pair.

How does OANDA’s forex spread compare to other brokers?

- Answer: OANDA’s forex spread is generally competitive with other brokers. However, the spread can vary depending on the currency pair you are trading and the market conditions.

What factors affect OANDA’s forex spread?

- Answer: Several factors can affect OANDA’s forex spread, including market liquidity, volatility, and the time of day.

What is the minimum spread OANDA offers?

- Answer: The minimum spread OANDA offers is 0.0 pips on select currency pairs under certain market conditions.

What is the average spread OANDA offers?

- Answer: The average spread OANDA offers will vary depending on the currency pair you are trading and the market conditions. However, OANDA typically offers spreads that are below the industry average.

How can I reduce the spread I pay?

- Answer: There are a few things you can do to reduce the spread you pay, including:

- Trading during times of high market liquidity

- Choosing currency pairs with narrow spreads

- Using an ECN (Electronic Communications Network) broker

How does OANDA’s spread affect my profitability?

- Answer: The spread can impact your profitability, as it represents the cost of entering and exiting a trade. A wider spread will reduce your profits, while a narrower spread will increase your profits.

What are the other trading costs I need to be aware of?

- Answer: In addition to the spread, you may incur other trading costs, such as commissions, rollover fees, and account fees. It is important to factor these costs into your trading strategy.

How can I find the latest spread information for OANDA?

- Answer: You can find the latest spread information for OANDA on the OANDA website or in the OANDA trading platform.