- Introduction

- What is Real Account Forex Trading?

- Advantages of Real Account Forex Trading

- Disadvantages of Real Account Forex Trading

- Choosing a Forex Broker

- Risk Management

- Next Steps

- Conclusion

-

FAQ about Real Account Forex

- What is a real account forex?

- How do I open a real account forex?

- What are the benefits of trading with a real account forex?

- What are the risks of trading with a real account forex?

- How much money do I need to start trading with a real account forex?

- What is the best way to learn how to trade forex?

- What are the most important things to consider when trading forex?

- How can I improve my forex trading skills?

- What is the best time to trade forex?

- What are the most common mistakes that forex traders make?

Introduction

Hey readers, welcome to our comprehensive guide on real account forex trading. If you’re new to the realm of forex, this article will provide you with everything you need to know to get started with a real account. We’ll cover the basics, provide tips, and explain the risks involved. So, grab a cup of coffee, sit back, and let’s dive into the world of real account forex!

What is Real Account Forex Trading?

Real account forex trading involves using your own actual funds to trade currencies in the foreign exchange market. Unlike demo trading, where you use virtual money, real account trading requires you to deposit real cash into your trading account. This means that you can potentially make real profits but also face real losses. Therefore, it’s crucial to understand the risks involved before you start trading with a real account.

Advantages of Real Account Forex Trading

1. Potential for Real Profits: The most significant advantage of real account trading is the chance to generate real profits. When you trade successfully, you can earn money in the form of currency gains.

2. Practical Experience: Real account trading provides you with a practical and valuable learning experience. You’ll gain a better understanding of market dynamics, risk management, and trading psychology.

Disadvantages of Real Account Forex Trading

1. Financial Risk: The primary disadvantage of real account trading is the risk of losing your money. Forex trading can be volatile, and losses can occur even for experienced traders.

2. Emotional Challenges: Trading with real money can be emotionally challenging. You may experience stress, anxiety, and regret, which can impact your trading decisions.

Choosing a Forex Broker

Selecting the right forex broker is essential for your success. Consider the following:

1. Regulation and Security:

Ensure your broker is regulated by a reputable authority to protect your funds and prevent fraud.

2. Trading Platform:

Choose a broker with a user-friendly and reliable trading platform that meets your needs.

3. Spreads and Commissions:

Compare the spreads and commissions offered by different brokers to minimize trading costs.

Risk Management

Managing risk is crucial in real account forex trading. Here are some tips:

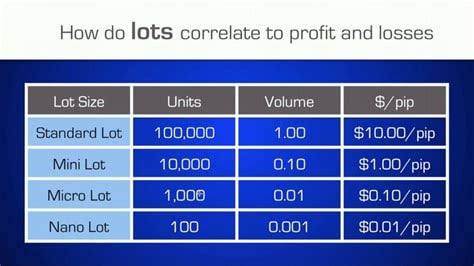

1. Leverage:

Use leverage cautiously. Leverage can magnify both your profits and losses.

2. Stop-Loss Orders:

Place stop-loss orders to limit potential losses.

3. Risk-Reward Ratio:

Consider the risk-reward ratio of your trades to ensure the potential profit outweighs the risk.

Next Steps

Now that you have a solid understanding of real account forex trading, it’s time to open a real account with your chosen broker. Here’s a step-by-step guide to get you started:

1. Open a Brokerage Account:

Visit the website of your chosen broker and complete the account opening process.

2. Fund Your Account:

Deposit funds into your trading account using a supported payment method.

3. Start Trading:

Once your account is funded, you can start trading currencies in the market.

4. Educate Yourself:

Continuously educate yourself about forex trading through books, articles, and online resources.

Conclusion

Real account forex trading can be an exciting and rewarding endeavor, but it’s essential to approach it with a well-informed mindset. By understanding the risks, choosing a reliable broker, and implementing risk management strategies, you can increase your chances of success in the foreign exchange market.

Thank you for reading! Don’t forget to check out our other articles on forex trading, investing, and personal finance.

FAQ about Real Account Forex

What is a real account forex?

A real account forex is a trading account that uses real money to trade currencies on the foreign exchange market.

How do I open a real account forex?

You can open a real account forex by contacting a forex broker and providing them with your personal information and financial details.

What are the benefits of trading with a real account forex?

Trading with a real account forex allows you to potentially earn real profits from your trades. It also gives you access to a wider range of trading tools and resources than you would have with a demo account.

What are the risks of trading with a real account forex?

Trading with a real account forex can be risky, as you can lose money on your trades. It is important to understand the risks involved before you start trading with real money.

How much money do I need to start trading with a real account forex?

The minimum amount of money you need to start trading with a real account forex varies depending on the broker you choose. Some brokers have a minimum deposit of $100, while others may require a higher minimum deposit.

What is the best way to learn how to trade forex?

The best way to learn how to trade forex is to practice trading with a demo account. This will allow you to learn the basics of trading without risking any real money.

What are the most important things to consider when trading forex?

The most important things to consider when trading forex are the current market conditions, the economic news, and the technical analysis.

How can I improve my forex trading skills?

You can improve your forex trading skills by practicing trading with a demo account, reading books and articles about forex trading, and attending forex trading webinars.

What is the best time to trade forex?

The best time to trade forex is during the overlap of the London and New York trading sessions. This is when the market is most active and there is the greatest opportunity for profit.

What are the most common mistakes that forex traders make?

The most common mistakes that forex traders make are trading with too much leverage, not managing their risk properly, and not following a trading plan.