- What is a Ship Mortgage?

- Types of Ship Mortgages

- Enforcement of Ship Mortgages

- Legal Framework for Ship Mortgages

- Key Considerations for Ship Mortgages

- Table: Comparison of Ship Mortgage Types

- Conclusion

-

FAQ about Ship Mortgages in Maritime Law

- What is a ship mortgage?

- Who can obtain a ship mortgage?

- What types of vessels can be mortgaged?

- What are the advantages of a ship mortgage?

- What are the disadvantages of a ship mortgage?

- How do I obtain a ship mortgage?

- What documents are required to obtain a ship mortgage?

- What are the costs associated with a ship mortgage?

- How can I protect my interest in a mortgaged vessel?

- What happens if I default on a ship mortgage?

What is a Ship Mortgage?

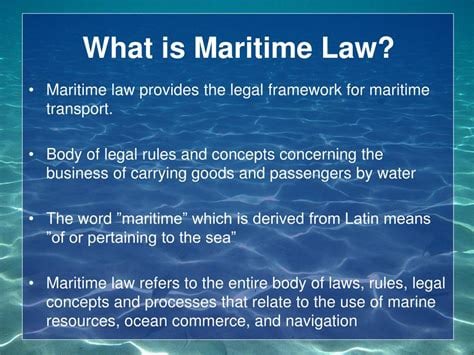

Ahoy there, readers! In the vast and ever-evolving realm of maritime law, ship mortgages play a pivotal role in financing and securing the interests of various parties involved in the shipping industry. A ship mortgage, in essence, is a legal contract that creates a security interest in a vessel, providing lenders with a way to secure their loans and investors with a means of mitigating risk.

Role of Ship Mortgages in Maritime Transactions

Ship mortgages are indispensable tools in maritime transactions, facilitating the acquisition, construction, and operation of vessels. They enable shipping companies and vessel owners to access capital and obtain financing for their ventures. By using ships as collateral, lenders are incentivized to provide loans, thereby fostering economic growth and innovation within the shipping sector.

Types of Ship Mortgages

Preferred Ship Mortgages

Preferred ship mortgages rank highest in priority among maritime liens and encumbrances, ensuring that lenders have a strong legal claim on the vessel in the event of default. These mortgages typically offer favorable terms and interest rates, making them a preferred choice for lenders and borrowers alike.

Conventional Ship Mortgages

Conventional ship mortgages, while not offering the same level of priority as preferred mortgages, still provide lenders with a valuable security interest in the vessel. They are often employed when the borrower has other assets or revenue streams that can serve as additional collateral.

Enforcement of Ship Mortgages

Foreclosure Proceedings

In the unfortunate event of a default, lenders may initiate foreclosure proceedings to seize and sell the mortgaged vessel. This process involves obtaining a court order and adhering to specific legal procedures to ensure a fair and orderly sale.

Admiralty Proceedings

In some jurisdictions, lenders may also pursue admiralty proceedings to enforce their ship mortgages. These proceedings allow lenders to seek remedies such as the arrest of the vessel or the appointment of a receiver to manage the vessel’s operations until the debt is satisfied.

Legal Framework for Ship Mortgages

International Conventions

The international maritime community has established various conventions to harmonize the laws governing ship mortgages. The International Convention on Maritime Liens and Mortgages, for instance, provides a uniform framework for the creation, perfection, and enforcement of ship mortgages.

National Laws

In addition to international conventions, each country has its own national laws governing ship mortgages. These laws may vary in terms of the requirements for creating and enforcing ship mortgages, as well as the rights and obligations of lenders and borrowers.

Key Considerations for Ship Mortgages

Due Diligence

Before entering into a ship mortgage agreement, both lenders and borrowers should conduct thorough due diligence to assess the risks involved. This includes verifying the title, ownership, and condition of the vessel, as well as the financial standing of the borrower.

Insurance

It is crucial for lenders to ensure that the mortgaged vessel is adequately insured against risks such as damage, loss, or theft. This protects the lender’s security interest in the event of an unfortunate incident.

Legal Counsel

Seeking legal counsel from experienced maritime attorneys is highly recommended to ensure that the ship mortgage agreement complies with all applicable laws and regulations. This helps avoid potential legal pitfalls and ensures the enforceability of the mortgage.

Table: Comparison of Ship Mortgage Types

| Mortgage Type | Priority | Enforcement |

|---|---|---|

| Preferred Ship Mortgage | Highest | Foreclosure or admiralty proceedings |

| Conventional Ship Mortgage | Lower | Foreclosure proceedings |

Conclusion

Ship mortgages are complex legal instruments that play a vital role in the maritime industry. They provide lenders with a means of securing their investment, while enabling borrowers to access capital for the acquisition and operation of vessels. Understanding the legal framework, types, and enforcement mechanisms of ship mortgages is essential for anyone involved in maritime transactions.

For further insights into related topics, be sure to check out our other articles on maritime law, vessel registration, and international shipping regulations.

FAQ about Ship Mortgages in Maritime Law

What is a ship mortgage?

A ship mortgage is a type of secured loan in which a vessel is used as collateral. The lender has a claim on the vessel if the borrower defaults on the loan.

Who can obtain a ship mortgage?

Individuals, companies, and other entities with a legal interest in a vessel can obtain a ship mortgage.

What types of vessels can be mortgaged?

Most types of vessels, including ships, barges, and fishing vessels, can be mortgaged.

What are the advantages of a ship mortgage?

Ship mortgages allow borrowers to access financing for vessel purchases, repairs, and upgrades. They also provide lenders with security for their investment.

What are the disadvantages of a ship mortgage?

If the borrower defaults on the loan, the lender has the right to seize and sell the vessel.

How do I obtain a ship mortgage?

Contact a lender that specializes in maritime finance. They will assess your creditworthiness, the value of the vessel, and other factors to determine the terms of the loan.

What documents are required to obtain a ship mortgage?

Typically, you will need to provide proof of ownership, a vessel appraisal, and a financial statement.

What are the costs associated with a ship mortgage?

Costs include closing fees, lender fees, and government recording fees.

How can I protect my interest in a mortgaged vessel?

Keep the loan current, maintain the vessel properly, and obtain insurance.

What happens if I default on a ship mortgage?

The lender can seize and sell the vessel to satisfy the debt.