- Stock or Forex Trading: A Comprehensive Guide for Newcomers and Seasoned Traders

- Understanding Stock and Forex Trading

- Choosing the Right Trading Style for You

- Comparing Stock and Forex Trading

- Table Breakdown

- Conclusion

-

FAQ about Stock or Forex Trading

- 1. What is stock or forex trading?

- 2. How do I get started with stock or forex trading?

- 3. What are the risks involved in trading?

- 4. What is a stock exchange?

- 5. What is a forex broker?

- 6. What is a spread?

- 7. What is leverage?

- 8. What is a stop-loss order?

- 9. What is a technical indicator?

- 10. How do I develop a trading strategy?

Stock or Forex Trading: A Comprehensive Guide for Newcomers and Seasoned Traders

Introduction

Greetings, readers! Welcome to the realm of stock or forex trading, an exciting and potentially lucrative world where you can explore the intricacies of financial markets and make informed decisions to grow your wealth. Whether you’re a seasoned trader or an eager newcomer, this comprehensive guide will provide you with the essential knowledge and insights to navigate this dynamic industry.

In this article, we’ll delve into the intricacies of stock and forex trading, examining their unique characteristics, benefits, and potential risks. We’ll also explore the different types of trading strategies and provide practical advice to help you make informed decisions and maximize your chances of success.

Understanding Stock and Forex Trading

Stock Trading

Stock trading involves buying and selling shares of publicly traded companies. When you purchase a company’s stock, you become a part-owner of that business and are entitled to a proportionate share of its profits. Stock trading can offer the potential for significant returns, but it also comes with its fair share of risks.

Forex Trading

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies. As the largest and most liquid financial market in the world, forex trading provides traders with the opportunity to profit from currency fluctuations. Forex trading can offer high potential returns, but it also requires traders to have a thorough understanding of macroeconomic factors and geopolitical events that can impact currency prices.

Choosing the Right Trading Style for You

Day Trading

Day trading involves buying and selling stocks or currencies within the same trading day. Day traders aim to profit from short-term fluctuations in prices, often making multiple trades throughout the day. Day trading requires a high level of trading knowledge, discipline, and risk tolerance.

Position Trading

Position trading involves holding stocks or currencies for a longer period, often ranging from weeks to months or even years. Position traders aim to capitalize on long-term trends and fluctuations in the market. Position trading requires patience, a deep understanding of market fundamentals, and a willingness to ride out short-term price fluctuations.

Scalping

Scalping involves making numerous small trades in a short period of time, often within minutes or seconds. Scalpers aim to profit from very small price movements and rely on high-frequency trading strategies to generate consistent returns. Scalping requires a deep understanding of technical analysis, risk management, and ultra-fast trading platforms.

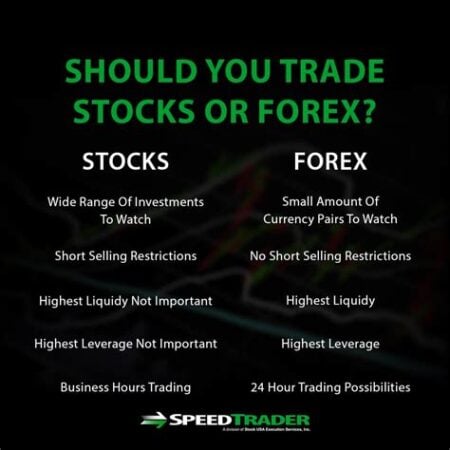

Comparing Stock and Forex Trading

| Feature | Stock Trading | Forex Trading |

|---|---|---|

| Underlying Asset | Shares of companies | Currencies |

| Market Size | Smaller than forex | Larger than stock |

| Liquidity | Varies depending on the stock | High |

| Volatility | Varies depending on the stock | Relatively low |

| Trading Times | Typically during stock exchange hours | 24 hours a day, 5 days a week |

| Returns | Potential for high returns | Potential for high returns |

| Risks | High | Moderate |

| Entry Barriers | Relatively low | Relatively low |

Table Breakdown

The table above provides a breakdown of the key differences between stock and forex trading. As you can see, there are several factors to consider when choosing which type of trading is right for you, including your trading style, risk tolerance, and available capital.

Conclusion

Stock or forex trading can be a rewarding and lucrative endeavor, but it also requires traders to have a clear understanding of the markets and to manage their risks carefully. Whether you’re a seasoned trader looking to expand your knowledge or a newcomer eager to break into the financial world, we encourage you to delve deeper into the resources provided in this article and to explore the wealth of information available online.

To learn more about specific aspects of stock or forex trading, we приглашаю вас to check out the following articles:

FAQ about Stock or Forex Trading

1. What is stock or forex trading?

Stock trading involves buying and selling shares of companies, while forex trading involves buying and selling currencies.

2. How do I get started with stock or forex trading?

Open an account with a licensed broker, fund it, and research potential markets before placing trades.

3. What are the risks involved in trading?

Trading involves the risk of losing money, as market prices can fluctuate unpredictably.

4. What is a stock exchange?

A marketplace where buyers and sellers come together to trade stocks.

5. What is a forex broker?

An intermediary that provides access to the foreign exchange market for trading.

6. What is a spread?

The difference between the buy and sell prices of a currency pair or stock.

7. What is leverage?

Borrowed capital that allows traders to control larger positions than their account balance permits.

8. What is a stop-loss order?

An order that triggers a trade closure at a predetermined price to limit losses.

9. What is a technical indicator?

A tool used to analyze market data and identify potential trading opportunities.

10. How do I develop a trading strategy?

Research, backtest, and refine a set of rules and guidelines for making trading decisions.