Introduction

Hey there, readers! Welcome to our in-depth guide on "teading forex." In this article, we’ll dive into the exciting world of foreign exchange trading, providing you with all the essential information you need to get started.

Forex, short for foreign exchange, involves buying and selling currencies with the aim of making a profit. With a daily trading volume exceeding trillions of dollars, it’s one of the largest and most dynamic financial markets in the world.

Understanding the Basics of Teading Forex

Types of Forex Markets

There are two main types of forex markets:

- Spot Market: This is the most common market where currencies are bought and sold immediately for spot delivery.

- Futures Market: In this market, currencies are traded in standardized contracts for delivery at a future date.

Factors Affecting Forex Rates

Numerous factors can influence forex rates, including:

- Economic Data: News releases, such as GDP growth, inflation rates, and employment figures, can have a significant impact on currency values.

- Political Events: Political instability, elections, and changes in government policies can affect investor confidence and currency demand.

- Central Bank Policies: Monetary policies set by central banks, such as interest rate decisions, can influence currency values.

- Supply and Demand: Changes in the supply and demand for currencies can also affect their exchange rates.

Getting Started with Teading Forex

Choosing a Broker

The first step to teading forex is choosing a reputable broker. Look for a regulated broker with a good reputation, low trading fees, and a user-friendly platform.

Opening an Account

Once you’ve selected a broker, you’ll need to open a trading account. This typically involves providing personal information, verification of your identity, and depositing funds.

Understanding Leverage

Leverage allows traders to trade with more capital than they have in their account. While this can amplify profits, it can also increase losses, so it’s crucial to use leverage judiciously.

Developing a Trading Strategy

A well-defined trading strategy is essential for success in teading forex. Consider factors such as your risk tolerance, trading style, and market conditions.

Technical and Fundamental Analysis for Forex Teading

Technical Analysis

Technical analysis involves studying price charts and market data to identify patterns and trends. Traders use technical indicators, such as moving averages and support/resistance levels, to make trading decisions.

Fundamental Analysis

Fundamental analysis focuses on economic and financial factors that influence currency values. Traders analyze macroeconomic indicators, political events, and company news to assess the health of an economy and predict future currency movements.

Risk Management in Forex Teading

Managing risk is paramount in teading forex. Proper risk management techniques include:

- Setting Stop-Loss Orders: These orders automatically close a losing trade at a predetermined price, limiting potential losses.

- Using Take-Profit Orders: These orders close a winning trade at a specified profit target, ensuring profits are locked in.

- Controlling Leverage: As mentioned earlier, using excessive leverage can magnify losses.

- Diversify Your Trades: Spreading your trades across multiple currency pairs can reduce overall risk.

Table: Summary of Forex Trading

| Aspect | Summary |

|---|---|

| Market Type | Spot and Futures |

| Factors Affecting Rates | Economic Data, Political Events, Central Bank Policies, Supply and Demand |

| Leverage | Magnifies Profits/Losses |

| Risk Management | Stop-Loss Orders, Take-Profit Orders, Controlling Leverage, Diversification |

| Technical Analysis | Price Charts and Market Data |

| Fundamental Analysis | Economic and Financial Factors |

Conclusion

Trading forex can be a rewarding but challenging endeavor. By understanding the basics, choosing a reliable broker, developing a trading strategy, and implementing sound risk management practices, you can increase your chances of success.

Explore our other articles for more in-depth insights into various aspects of teading forex. Remember, knowledge is power in the financial markets, so continue educating yourself and refining your skills. Good luck, and may the pips be in your favor!

FAQ about Forex Trading

What is forex trading?

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies in the foreign exchange market. It is the largest financial market in the world, with a daily turnover of trillions of dollars.

How does forex trading work?

Forex trading involves buying and selling currency pairs. For example, if you believe that the Euro will rise in value against the US Dollar, you can buy EUR/USD. If the Euro does indeed rise in value, you will make a profit.

What are the benefits of forex trading?

Forex trading offers several benefits, including:

- High liquidity: The forex market is the most liquid financial market in the world, which means that it is easy to enter and exit positions.

- Volatility: The forex market is also very volatile, which means that there is the potential to make large profits.

- Leverage: Forex brokers offer leverage, which allows traders to trade with more money than they have in their accounts. This can amplify both profits and losses.

What are the risks of forex trading?

Forex trading also carries risks, including:

- Losses: Forex trading can result in losses, as the value of currencies can fluctuate rapidly.

- Margin calls: If your account balance falls below a certain level, your broker may issue a margin call, which requires you to deposit more funds or close out your positions.

- Leverage: Leverage can magnify both profits and losses, so it is important to use it carefully.

What is a pip?

A pip is the smallest unit of change in the value of a currency pair. Forex traders typically quote prices in pips, which makes it easier to compare different currency pairs.

What is a lot?

A lot is a standard unit of measurement in the forex market. One lot is typically equal to $100,000 of the base currency.

What is a spread?

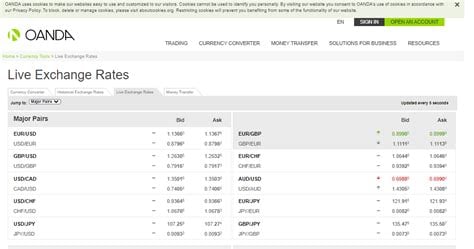

A spread is the difference between the bid price and the ask price of a currency pair. The spread is how forex brokers make money.

How do I get started with forex trading?

To get started with forex trading, you will need to open an account with a forex broker. Once you have opened an account, you can deposit funds and start trading.

What resources are available to help me learn about forex trading?

There are a number of resources available to help you learn about forex trading, including books, websites, and online courses. It is important to do your research and learn as much as you can about forex trading before you start trading with real money.