- Introduction

- Market Access and Product Offerings

- Trading Platform and Tools

- Educational Resources and Support

- Account Types and Fees

- Conclusion

-

FAQ about Trade Forex Interactive Brokers

- What is Interactive Brokers?

- Is IBKR a good broker for forex trading?

- How do I open a forex trading account with IBKR?

- What is the minimum deposit to open a forex trading account with IBKR?

- What is the spread on forex trades with IBKR?

- What is the commission on forex trades with IBKR?

- What is the minimum lot size for forex trades with IBKR?

- What platforms does IBKR offer for forex trading?

- What are the benefits of trading forex with IBKR?

- Is IBKR regulated?

Introduction

Greetings, readers! Are you eager to delve into the world of forex trading with Interactive Brokers? Whether you’re a seasoned pro or just starting your journey, this article has got you covered. We’ll explore everything you need to know to trade forex effectively on Interactive Brokers’ platform.

Interactive Brokers is an industry leader in online trading, renowned for its advanced technology, low fees, and comprehensive product offerings. With its user-friendly interface and powerful trading tools, Interactive Brokers empowers traders to access global forex markets with ease.

Market Access and Product Offerings

Currency Pairs

Interactive Brokers offers a vast selection of currency pairs for trading, including major pairs like EUR/USD and GBP/USD, and minor and exotic pairs like AUD/NZD and USD/ZAR. This wide selection allows traders to diversify their portfolios and target specific market opportunities.

Leverage and Margin

Traders on Interactive Brokers can utilize leverage to amplify their trading potential, allowing them to trade positions larger than their account balance. However, it’s crucial to use leverage judiciously, as it can magnify both profits and losses. Additionally, Interactive Brokers provides margin accounts, which enable traders to borrow funds to increase their purchasing power.

Advanced Order Types

Interactive Brokers offers a comprehensive range of advanced order types to cater to various trading strategies. These include limit orders, stop orders, trailing stops, and conditional orders. By utilizing these advanced order types, traders can automate their trading decisions and manage risk effectively.

Trading Platform and Tools

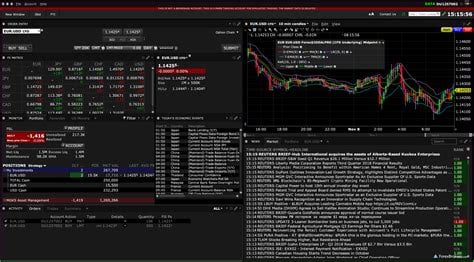

Trader Workstation

Interactive Brokers’ flagship trading platform, Trader Workstation (TWS), is renowned for its versatility and customizable features. TWS provides real-time market data, charting tools, and a sophisticated order management system. Traders can tailor the platform to their individual preferences, creating a workspace that optimizes their trading experience.

Mobile Trading

For traders on the go, Interactive Brokers’ mobile trading app offers a convenient way to access forex markets. The app provides essential trading functionality, such as real-time quotes, charting, and order placement, allowing traders to stay connected to the markets wherever they are.

MarketScan

MarketScan is an exclusive feature of Interactive Brokers that allows traders to track and analyze forex market depth. By displaying the number of bids and asks at different price levels, MarketScan provides valuable insights into market sentiment and liquidity.

Educational Resources and Support

Webinars and Training

Interactive Brokers offers a wealth of educational resources to enhance traders’ knowledge and skills. Regular webinars conducted by industry experts cover a wide range of forex trading topics, from beginner basics to advanced strategies.

Customer Support

Interactive Brokers’ dedicated customer support team is available 24/7 to assist traders with any queries or issues they may encounter. The team is highly knowledgeable and responsive, ensuring that traders receive prompt and effective support.

Community Forum

The Interactive Brokers community forum provides a platform for traders to connect, share ideas, and ask questions. This active community fosters a collaborative learning environment, allowing traders to benefit from the collective knowledge and experience of others.

Account Types and Fees

Tiered Account Structure

Interactive Brokers offers a tiered account structure with varying levels of fees and features. The Lite account is suitable for beginners with lower trading volumes, while the Individual and Professional accounts provide more advanced features and pricing benefits.

Trading Fees

Interactive Brokers’ trading fees are highly competitive, with low spreads and commissions. The fee structure varies depending on the account type and the traded currency pair. Traders should carefully consider the fees associated with their trading style to optimize their profitability.

Non-Trading Fees

In addition to trading fees, Interactive Brokers charges non-trading fees, such as account maintenance fees, inactivity fees, and wire transfer fees. Traders should be aware of these fees to avoid any unexpected expenses.

Conclusion

Congratulations, readers! You’ve now gained a comprehensive understanding of trading forex with Interactive Brokers. Whether you’re a novice or an experienced trader, Interactive Brokers provides the tools, resources, and support you need to navigate the forex markets successfully.

If you’re intrigued by other aspects of financial trading, we encourage you to explore our other articles on stocks, options, and bonds. Join us on this exciting journey as we unravel the intricacies of the financial markets together.

FAQ about Trade Forex Interactive Brokers

What is Interactive Brokers?

Interactive Brokers (IBKR) is a brokerage firm that offers trading services for stocks, options, bonds, futures, forex, and mutual funds.

Is IBKR a good broker for forex trading?

Yes, IBKR is one of the largest and most popular forex brokers in the world. It offers low spreads, fast execution, and reliable customer support.

How do I open a forex trading account with IBKR?

You can open an account online or by contacting IBKR customer support. You will need to provide personal information, such as your name, address, and occupation.

What is the minimum deposit to open a forex trading account with IBKR?

The minimum deposit amount varies depending on the account type and platform you choose. However, it is typically around $100.

What is the spread on forex trades with IBKR?

IBKR offers tight spreads on forex trades. The spread is the difference between the bid price and the ask price. The narrower the spread, the more profit you can make on trades.

What is the commission on forex trades with IBKR?

IBKR charges a commission on each forex trade. The commission is typically a few cents per lot.

What is the minimum lot size for forex trades with IBKR?

The minimum lot size for forex trades with IBKR is 1,000 units of the base currency.

What platforms does IBKR offer for forex trading?

IBKR offers several platforms for forex trading, including the Trader Workstation (TWS), Client Portal, and the IBKR Mobile app.

What are the benefits of trading forex with IBKR?

There are several benefits to trading forex with IBKR, including:

- Low spreads and commissions

- Fast execution

- Reliable customer support

- A wide range of trading platforms

Is IBKR regulated?

Yes, IBKR is regulated by the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).