- Introduction

- How Margin Forex Works

- Benefits of Margin Forex

- Risks of Margin Forex

- Choosing Brokers for Margin Forex

- Margin Forex Trading Strategies

- Margin Forex Table Breakdown

- Conclusion

-

FAQ about Margin Forex

- What is margin forex?

- How does margin Forex work?

- What are the benefits of margin Forex?

- What are the risks of margin Forex?

- How to manage risk in margin Forex?

- Who should use margin Forex?

- What are the profit and loss calculations in margin Forex?

- Can I lose more than my initial investment?

- What is a stop-out level?

Introduction

Greetings, readers! Welcome to our in-depth exploration of margin forex, a powerful yet potentially risky tool that allows traders to amplify their profits with borrowed capital. Margin forex trading offers both opportunities and challenges, and understanding its nuances is crucial for successful execution. Join us as we delve into what margin forex is, how it works, and the factors traders should consider when using it.

What is Margin Forex?

Margin forex is a form of leveraged trading that enables traders to increase their exposure to the foreign exchange market. By using margin, traders can control a larger position size than their account balance allows, potentially magnifying their profits. However, it’s essential to note that margin trading also magnifies potential losses.

How Margin Forex Works

Borrowing from the Broker

When you trade margin forex, you essentially borrow funds from your broker to increase your trading power. The broker lends you a specific amount of capital, known as the margin, which you use to open and maintain a position. The amount of margin you can use is typically determined by a percentage of your account balance. For example, if you have an account balance of $10,000 and your broker offers a 50% margin, you can trade up to $20,000.

Maintaining Margin Levels

It’s crucial to maintain sufficient margin in your account to cover potential losses. Your broker will establish a minimum margin level that you must adhere to. If your account balance falls below the maintenance margin level, your broker may issue a margin call, requiring you to deposit additional funds or liquidate your position to avoid losses.

Benefits of Margin Forex

Increased Profit Potential

The primary benefit of margin forex is the potential for significantly increased profits. By leveraging your trading capital, you can control a larger position and increase your potential gains. However, it’s essential to remember that potential losses are also amplified.

Enhanced Flexibility

Margin forex provides traders with greater flexibility in their trading decisions. By using margin, you can access larger market opportunities that might not be available with limited capital. It also allows traders to hedge their positions more effectively.

Risks of Margin Forex

Magnified Losses

The most significant risk associated with margin forex is the potential for magnified losses. Since your trading size is larger, even small market movements can lead to substantial losses that exceed your initial investment.

Margin Calls

As mentioned earlier, your broker may issue a margin call if your account balance falls below the maintenance margin level. If you’re unable to meet the margin call, your broker may liquidate your position, potentially at a substantial loss.

Choosing Brokers for Margin Forex

Selecting a reliable and reputable broker is essential for successful margin forex trading. Consider the following factors when choosing a broker:

Regulatory Compliance

Ensure that the broker is regulated by a reputable financial authority, such as the National Futures Association (NFA) or the Financial Conduct Authority (FCA).

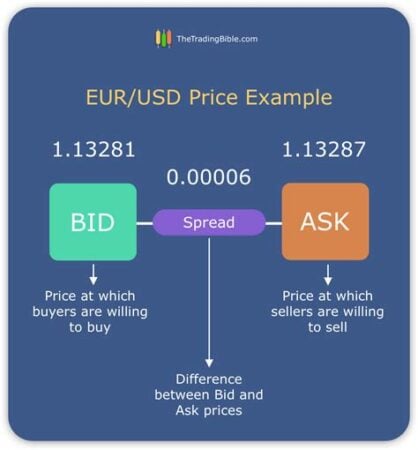

Trading Conditions

Compare different brokers’ trading conditions, including margin requirements, spreads, and commissions. Choose a broker that offers competitive terms that suit your trading style.

Platform Usability

The trading platform you use should be easy to navigate and provide the necessary tools for effective forex trading. Check if the platform offers advanced features such as charting tools, technical analysis, and risk management capabilities.

Margin Forex Trading Strategies

Margin forex trading strategies vary widely depending on individual trading goals and risk tolerance. Here are a few common strategies:

Day Trading

Day traders aim to make multiple trades within a single trading day, typically closing all positions before the day ends. This strategy is suitable for traders with a high risk tolerance and a good understanding of the market.

Swing Trading

Swing traders hold positions for longer periods, ranging from several days to several weeks. They focus on identifying market trends and capitalizing on price swings. Swing trading requires patience and a keen eye for market patterns.

Scalping

Scalping involves making numerous small trades throughout the day, often taking advantage of small price fluctuations. This strategy demands quick execution and a deep understanding of how the market reacts to news and events.

Margin Forex Table Breakdown

| Term | Description |

|---|---|

| Margin | The amount of capital borrowed from the broker to increase trading power |

| Initial Margin | The minimum margin required to open a position |

| Maintenance Margin | The minimum margin level that must be maintained to avoid a margin call |

| Leverage | The ratio of borrowed capital to the trader’s own capital |

| Free Margin | The portion of your account balance that is not currently used as margin |

| Used Margin | The portion of your account balance that is being used to maintain open positions |

Conclusion

Margin forex trading offers traders both opportunities and risks. By understanding what margin forex is, how it works, and the factors to consider, you can make informed decisions about whether this trading method is right for you. Remember, successful margin forex trading requires a well-defined strategy, sound risk management practices, and a deep understanding of the financial markets.

We encourage you to explore our other articles for additional insights on forex trading and investment strategies. Thank you for reading, and best wishes in your trading endeavors!

FAQ about Margin Forex

What is margin forex?

Margin Forex, or Margin Trading in Forex, is a trading technique that allows traders to leverage their initial investment. It involves borrowing from a broker to increase their trading capital, enabling them to make larger trades with smaller amounts.

How does margin Forex work?

Brokers allow traders to use margin by providing them with a ratio (e.g., 1:50). This means that if a trader has $1,000 in their account, they can trade up to $50,000. The broker will provide the remaining $49,000 on margin.

What are the benefits of margin Forex?

- Increased potential profits: Margin trading allows traders to make larger trades with less capital, potentially increasing their profits.

- Leverage: Margin amplifies both profits and losses, providing leverage to traders.

- Access to larger markets: Margin trading enables traders to participate in larger markets with smaller investments.

What are the risks of margin Forex?

- Increased potential losses: Leverage can also magnify losses, leading to potential losses that exceed the initial investment.

- Margin calls: If market movements cause the trader’s account to fall too low, the broker may issue a margin call, requiring the trader to deposit more funds or close their positions.

- Emotional trading: Margin trading can lead to emotional trading, as traders may take unnecessary risks due to the increased potential profits.

How to manage risk in margin Forex?

- Use stop-loss orders: Stop-loss orders automatically close positions when prices reach a predetermined level, limiting potential losses.

- Monitor risk-to-reward ratios: Always calculate the potential reward in relation to the potential risk before entering a trade.

- Manage emotions: Margin trading requires discipline and emotional control to avoid excessive risk-taking.

Who should use margin Forex?

Margin Forex is suitable for experienced traders who understand the risks and have developed a sound trading plan. It is not recommended for beginners or those who are not comfortable with the potential losses.

What are the profit and loss calculations in margin Forex?

Profits and losses are calculated based on the initial investment, the margin ratio, and the price movements. If the trade moves in the trader’s favor, they keep the profit. If the trade moves against them, they may lose more than their initial investment.

Can I lose more than my initial investment?

Yes, margin trading allows for losses that exceed the initial investment. This is known as a "margin call."

What is a stop-out level?

A stop-out level is a predefined point at which the broker will automatically close all the trader’s open positions to prevent further losses.