What is Spread on Forex? A Beginner’s Guide to Forex Trading Fees

Introduction

Hey there, readers! Welcome to our comprehensive guide on the spread in forex trading. As you embark on your forex trading journey, it’s crucial to understand the role of spread in determining your profitability.

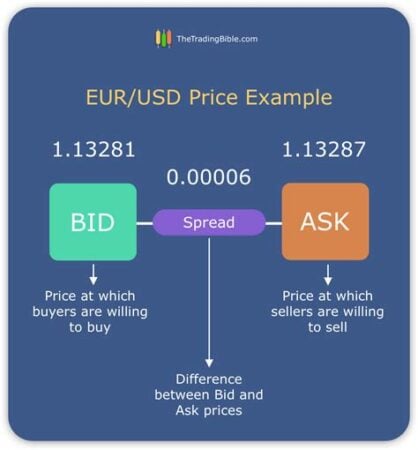

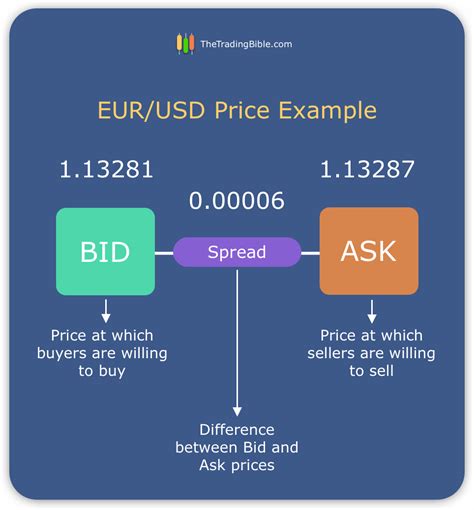

Forex trading involves buying and selling currencies on the foreign exchange market. When you place a trade, you might notice a difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy). This difference is known as the spread.

What is Forex Spread?

Forex spread is the cost of entering or exiting a forex trade. It represents the difference between the ask price and the bid price for a currency pair. The spread is expressed in pips, the smallest unit of price movement in forex trading.

Types of Forex Spreads

There are two main types of forex spreads:

-

Fixed Spread: A fixed spread remains constant regardless of market conditions. This type of spread is usually offered by market makers who provide liquidity for currency pairs.

-

Variable Spread: A variable spread can fluctuate depending on market volatility and liquidity. It is typically offered by ECN (Electronic Communication Network) brokers who connect traders directly to the interbank market.

How Forex Spread Affects Your Trading

The spread has a significant impact on your trading profitability. Here’s how:

-

Trading Costs: The spread is the primary cost of trading forex. It reduces your profits when you enter a trade and increases your losses when you exit.

-

Profitability: A wider spread can make it more challenging to achieve profitability. It limits your potential gains and increases your risk of losses.

-

Trading Strategy: Your trading strategy should take into account the spread. If you trade with a low-profit margin strategy, a wider spread can significantly impact your results.

Factors Affecting Forex Spread

Several factors can affect the spread in forex trading:

Market Volatility

High market volatility often leads to wider spreads as liquidity decreases and market makers demand a higher premium for providing liquidity.

Trading Volume

Currency pairs with higher trading volumes typically have narrower spreads due to increased competition among market participants.

Broker Type

Market maker brokers usually offer fixed spreads, while ECN brokers offer variable spreads. ECN spreads can be narrower during high-liquidity market conditions but may widen during periods of low liquidity.

Trading Platform

Different trading platforms may offer different spreads for the same currency pair. Compare spreads across platforms to find the best deal.

Table Breakdown of Forex Spreads

| Currency Pair | Typical Spread (Pips) |

|---|---|

| EUR/USD | 1-2 |

| GBP/USD | 1-3 |

| USD/JPY | 1-5 |

| AUD/USD | 1-4 |

| NZD/USD | 1-4 |

Conclusion

Understanding forex spread is essential for successful trading. Consider the spread when choosing a currency pair, selecting a broker, and developing your trading strategy. Remember, a wider spread increases your trading costs and reduces your profitability. By optimizing your spread, you can enhance your chances of success in the forex market.

Don’t forget to explore our other articles for more insights into forex trading. We cover a wide range of topics to help you become a knowledgeable and profitable trader.

FAQ about Forex Spread

What is Forex Spread?

Spread in Forex is the difference between the bid and ask prices of a currency pair, usually expressed in pips (points in percentage).

What is the Bid Price?

The bid price is the price at which a trader is willing to buy a currency pair.

What is the Ask Price?

The ask price is the price at which a trader is willing to sell a currency pair.

How are Spreads Calculated?

Spreads are calculated by subtracting the bid price from the ask price.

What Factors Affect Spread?

Factors affecting spread include market volatility, liquidity, and the broker’s markup.

Are Spreads Fixed or Variable?

Spreads can be fixed, where they remain constant, or variable, where they can fluctuate based on market conditions.

What is a Wide Spread?

A wide spread occurs when the difference between the bid and ask prices is large, resulting in higher trading costs.

What is a Narrow Spread?

A narrow spread occurs when the difference between the bid and ask prices is small, resulting in lower trading costs.

How Can I Minimize Spreads?

To minimize spreads, traders can consider choosing brokers with low markups, trading during high-liquidity periods, and using instruments with high average daily traded volume.

What is the Best Spread?

The best spread will vary depending on the broker, currency pair, and market conditions.