- What is the Spread on Forex?

- Introduction

- Understanding Forex Spreads

- Types of Forex Spreads

- Factors Affecting Forex Spreads

- How to Choose the Right Forex Spread

- Forex Spread Table

- Conclusion

-

FAQ about Forex Spread

- What is the spread in forex?

- Why is there a spread?

- How is the spread determined?

- What is a good spread?

- How can I reduce the spread?

- What is the difference between a fixed spread and a variable spread?

- Which type of spread is better?

- How does the spread affect my trading?

- How can I avoid the spread?

What is the Spread on Forex?

Introduction

Hey there, readers! Ready to dive into the world of forex spreads? If you’re new to this thrilling financial arena, you may have stumbled upon this perplexing term. But worry not! We’ve got your back with a comprehensive guide that will shed light on the intricacies of forex spreads. Let’s dive right in!

Understanding Forex Spreads

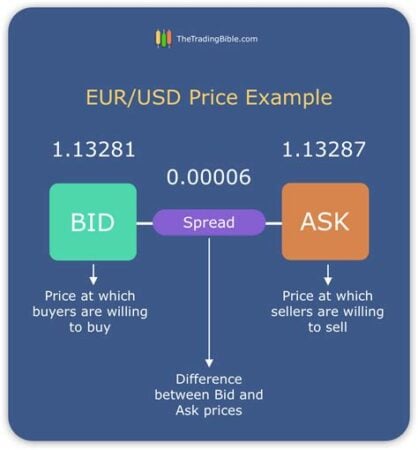

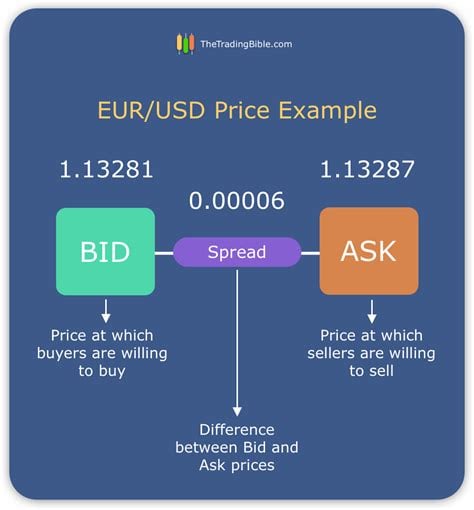

What Are Forex Spreads?

In the realm of forex trading, a spread refers to the difference between the bid price and the ask price of a currency pair. When you buy a currency pair, you’re purchasing it at the ask price. Conversely, when you sell, you’re doing so at the bid price. The spread represents the profit margin for the broker facilitating the trade.

Fixed vs. Variable Spreads

Forex brokers can offer two types of spreads: fixed and variable. Fixed spreads remain consistent regardless of market conditions, providing traders with stability and predictability. Variable spreads, on the other hand, fluctuate with market volatility, potentially offering tighter spreads during periods of high liquidity.

Types of Forex Spreads

Raw Spreads

Raw spreads are the purest form of forex spreads. They reflect the true bid-ask prices of currency pairs without any additional markup from the broker. Raw spreads are often found with ECN (Electronic Communication Network) brokers, which connect traders directly to other market participants.

Markup Spreads

Markup spreads are a type of variable spread where the broker adds a specific amount to the raw spread. This markup is typically a fixed amount and represents the broker’s profit margin. Markup spreads are commonly offered by retail forex brokers.

Factors Affecting Forex Spreads

Market Volatility

Market volatility significantly impacts forex spreads. During periods of high volatility, spreads tend to widen as liquidity decreases. Conversely, during calm market conditions, spreads often narrow due to increased liquidity.

Trading Volume

The volume of trading activity can also influence spreads. Higher trading volumes typically result in tighter spreads, while lower volumes lead to wider spreads. This is because increased trading activity attracts more market participants, which enhances liquidity.

How to Choose the Right Forex Spread

Consider Your Trading Style

Your trading style should guide your choice of forex spread. If you’re a scalper or day trader who relies on quick execution and tight spreads, you’ll want to look for brokers offering low variable spreads. Longer-term traders may prefer fixed spreads for consistency and predictability.

Compare Brokers

Don’t settle for the first broker you encounter. Take the time to compare different brokers and their spread offerings. Consider factors such as the type of spread, raw or markup, and the average spread size for the currency pairs you trade.

Forex Spread Table

| Broker | Spread Type | Average Spread |

|---|---|---|

| FXCM | Variable | 1.2 pips |

| XM | Fixed | 1.5 pips |

| InstaForex | Raw | 0.5 pips |

| Oanda | Markup | 2.0 pips |

| eToro | Fixed | 1.0 pips |

Conclusion

Alright, readers, we hope this article has illuminated the intricate world of forex spreads. Remember, understanding and managing spreads is crucial for navigating the forex market successfully. Take your time to research different brokers and spreads, and always choose the option that best aligns with your trading style and needs.

Feel free to check out our other informative articles on forex trading, where we delve into various aspects of this dynamic and exciting financial realm.

FAQ about Forex Spread

What is the spread in forex?

The spread is the difference between the buy and sell price of a currency pair. It is expressed in pips, which are the smallest unit of price movement.

Why is there a spread?

The spread is the profit that forex brokers make on each trade. It is a necessary cost of doing business, as brokers need to make a profit in order to stay in business.

How is the spread determined?

The spread is determined by a number of factors, including the liquidity of the currency pair, the time of day, and the broker’s own trading costs.

What is a good spread?

A good spread is one that is low and consistent. A low spread means that you will pay less in trading costs, and a consistent spread means that you can more easily predict your trading costs.

How can I reduce the spread?

There are a few things you can do to reduce the spread:

- Trade during high-liquidity periods.

- Trade with a broker that offers low spreads.

- Use a market order instead of a limit order.

What is the difference between a fixed spread and a variable spread?

A fixed spread is a spread that does not change, regardless of market conditions. A variable spread is a spread that can change, depending on market conditions.

Which type of spread is better?

Fixed spreads are better for traders who want to know exactly how much they will pay in trading costs. Variable spreads are better for traders who want to take advantage of market volatility.

How does the spread affect my trading?

The spread can affect your trading in a number of ways. It can increase your trading costs, reduce your profits, and make it more difficult to manage your risk.

How can I avoid the spread?

You cannot completely avoid the spread, but you can minimize its impact on your trading by following these tips:

- Trade with a broker that offers low spreads.

- Trade during high-liquidity periods.

- Use a market order instead of a limit order.

- Manage your risk carefully.